The information in this article is based on a recently released guide — titled “Crypto Travel Rule in United Kingdom by the Financial Conduct Authority (FCA)” — from RegTech startup Notabene.

The United Kingdom has proactively engaged with the crypto industry, partnering with experts and regulators to establish an evidence-based regulatory framework. The Financial Conduct Authority (FCA) has clarified that cryptocurrency is legal in the country and has issued guidelines outlining the types of cryptoassets that fall under its purview.

Since January 10, 2020, businesses involved in cryptoasset activities have been required to register with the FCA and comply with anti-money laundering (AML) regulations. MLTFR 2022 further extended these obligations to include the Financial Action Task Force (FATF) Travel Rule requirements for Virtual Asset Service Providers (VASPs) in the UK.

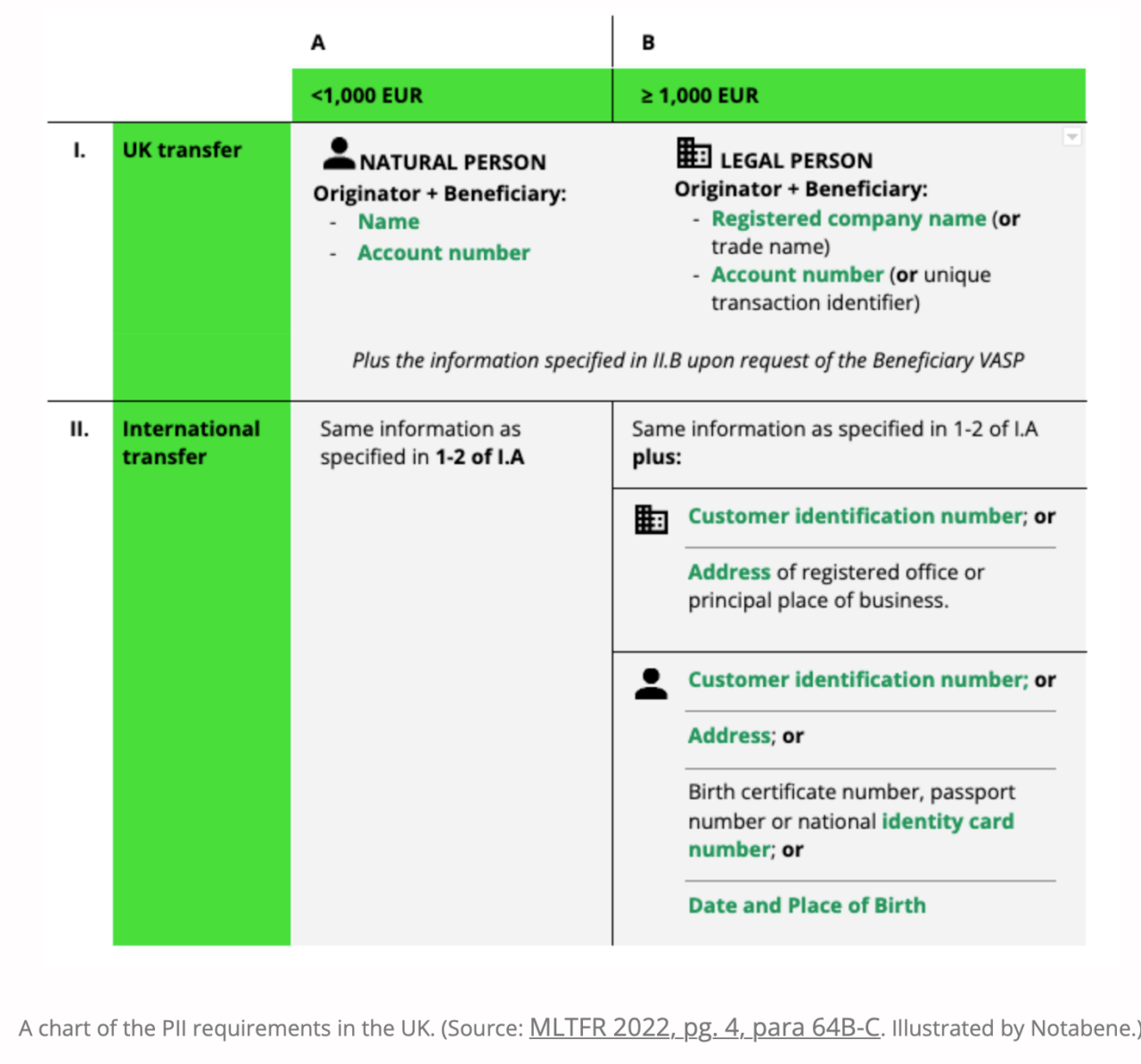

As of September 1, 2023, the FATF Travel Rule is now in effect in the UK. The UK government had granted a 12-month grace period for VASPs to comply, starting from July 21, 2022. The rule mandates that UK VASPs must transfer specific information for all transactions, irrespective of the amount. For transactions that involve at least one counterparty outside the UK and exceed 1,000 euros in cryptoassets, a broader set of data is required. The rule also specifies the types of personally identifiable information (PII) that must accompany inter-cryptoasset business transfers. UK-based transfers require less PII than international ones, and the Beneficiary VASP can request additional information within three working days.

Transactions with self-hosted wallets do not require the transmission of information. However, VASPs may request missing information based on a risk assessment that considers the customer relationship, the purpose and value of the transfer, and the frequency of transactions. Beneficiary VASPs have specific obligations upon receiving an inter-cryptoasset business transfer. They must confirm that all required information has been received and match it against their customer due diligence records. In case of discrepancies or missing information, they can take several steps, including withholding or returning funds. They are also obligated to report to the FCA any repeated failures by other VASPs to provide required information and the steps taken in response.

Featured Image Credit: Photo / illustration by derwiki via Pixabay