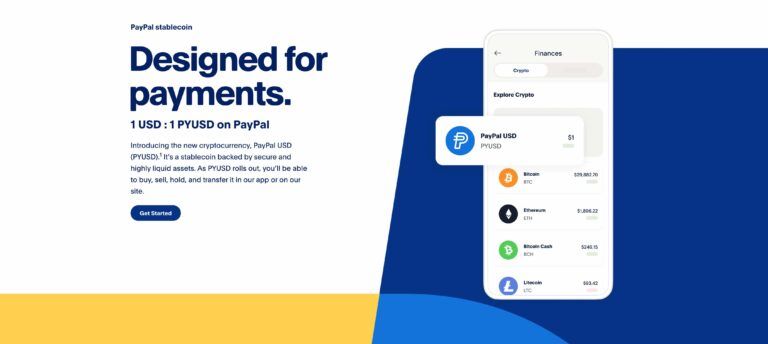

Stablecoins have emerged as a bridge between traditional finance and the decentralized world of cryptocurrencies. Among the latest entrants in this space is PYUSD, a product of the global online payments giant PayPal.

Launched on 7 August 2023, PYUSD is the result of a strategic collaboration between PayPal and Paxos Trust Limited. This partnership signifies PayPal’s commitment to integrating the benefits of the crypto world into its vast financial ecosystem.

Built on the Ethereum platform, PYUSD adopts the ERC-20 token standard, ensuring its compatibility with a myriad of digital services, platforms, and decentralized finance (DeFi) protocols. Its value is anchored to the U.S. dollar, providing users with the stability of fiat currency while reaping the benefits of digital assets. Paxos Trust Limited, a company regulated by New York authorities, plays a pivotal role in maintaining this peg, ensuring that for every PYUSD token, there’s a U.S. dollar backing it. This backing isn’t just in fiat; it’s a combination of U.S. dollar deposits and short-term U.S. Treasuries, adding layers of security and trust to the token.

For users, the process of acquiring PYUSD is streamlined and user-friendly. With a verified PayPal account, users can effortlessly exchange their balances for PYUSD, making the transition from fiat to crypto smoother than ever. And this is just the beginning. As PYUSD continues to integrate into the digital ecosystem, users can anticipate its availability on platforms like Venmo and other major digital wallets and services.

PayPal’s PYUSD stablecoin allows users to buy and sell PayPal USD via the app or website, convert it to other supported cryptocurrencies, and make purchases at numerous online stores using PayPal USD. Additionally, users can send PYUSD to friends within the US without incurring fees and can also transfer it to Ethereum wallet addresses that accept PYUSD seamlessly.

Platforms like Huobi and BitMart have already listed the stablecoin, facilitating its trade and increasing its accessibility to crypto enthusiasts worldwide. Given PayPal’s significant holdings in various cryptocurrencies, PYUSD is set to play a central role in its digital asset strategy, further solidifying its position in the market.

Stablecoins, like PYUSD, are designed to maintain a consistent value over time, typically pegged to a reference asset such as the U.S. dollar. Their primary appeal lies in their ability to offer broad, inclusive access to the financial system while enabling swift and efficient money movement. Furthermore, their programmable nature makes them invaluable to developers, allowing them to be seamlessly integrated into public blockchains. This programmability bridges the gap between the traditional economy and the emerging Web3, offering a digital currency that can be woven into both realms.

Transparency is at the heart of PYUSD’s operations. To ensure users have the utmost confidence in the stablecoin, Paxos Trust Limited will release a proof-of-reserves statement in September 2023. This statement will provide insights into the stablecoin’s financial backing, ensuring that every PYUSD in circulation is adequately backed by tangible assets.

But what truly sets PYUSD apart is its potential to revolutionize online transactions. With PYUSD, online shopping, remittances, and peer-to-peer payments can achieve unprecedented speeds, eliminating the need for traditional transaction mechanisms. Its foundation on Ethereum also opens doors to collaborations with various DeFi platforms, expanding its utility beyond just a stablecoin.

While PYUSD offers a plethora of benefits, it’s essential to acknowledge potential challenges. Its centralized nature, with significant control under Paxos Trust, might be a point of contention for purists who advocate for complete decentralization. Moreover, in a market teeming with established stablecoins, PYUSD will need to carve its niche, offering unique benefits that set it apart.