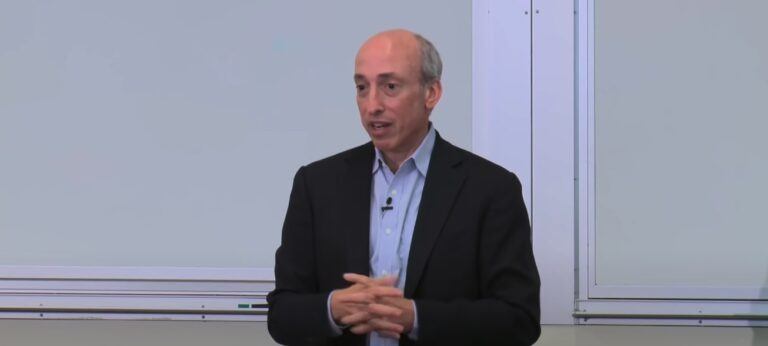

During an interview on CNBC interview on June 6, 2023, U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler expressed his views on the current state of digital currencies and the need for cryptocurrency exchanges to adhere to U.S. securities laws.

Gensler emphasized that the world already has digital currencies, such as the U.S. dollar, euro, and yen. He questioned the necessity and underlying value of new tokens, stating that the investment world is already digital:

“Look, we don’t need more digital currency. We already have digital currency. It’s called the U.S. dollar. It’s called the euro, or it’s called the yen; they’re all digital right now. We already have digital investments.“

He argued that the focus should be on full, fair, and truthful disclosures, which are the bedrock of securities laws.

The SEC Chair also expressed concerns about the operations of cryptocurrency trading platforms. He noted that these platforms often combine functions that are usually separate in traditional finance:

“These trading platforms, they call themselves exchanges, are commingling a number of functions. In traditional finance, we don’t see the New York Stock Exchange also operating a hedge fund making markets.“

Gensler highlighted the case of Binance, which the SEC alleges has a sister organization involved in wash trading and lacks controls on its platform. He described this as a “web of deception and conflicts,” with the platform’s founder, Changpeng Zhao, allegedly trying to evade U.S. law.

Addressing the SEC’s lawsuit against Coinbase, Gensler noted that the platform allows trading of a staggering 16,000 different tokens. He emphasized that the SEC’s goal is not to stifle innovation but to ensure that these platforms comply with U.S. securities laws to protect the investing public.

Gensler also touched on the timeline of enforcement actions, explaining that these processes take time as the SEC follows the facts and the law. He expressed pride in the investigative teams at the SEC who work diligently to build cases.

When asked about the SEC’s Binance US complaint seeking emergency relief like an asset freeze and the appointment of a receiver, Gensler stated that the SEC has concerns about platforms that try to evade U.S. law and where customer funds are potentially at risk.