Jurrien Timmer, Director of Global Macro at Fidelity Investments, recently shared his insights on Twitter about Bitcoin’s potential role in a traditional 60/40 investment portfolio. He discussed the current state of Bitcoin and its correlation with other assets, providing a comprehensive analysis of its place in portfolio diversification.

Timmer started by noting that Bitcoin’s price, currently at $28k, is primarily a function of its adoption curve and its limited supply. He emphasized the importance of considering both the growth of the network and the level and direction of real rates when attempting to model Bitcoin’s value.

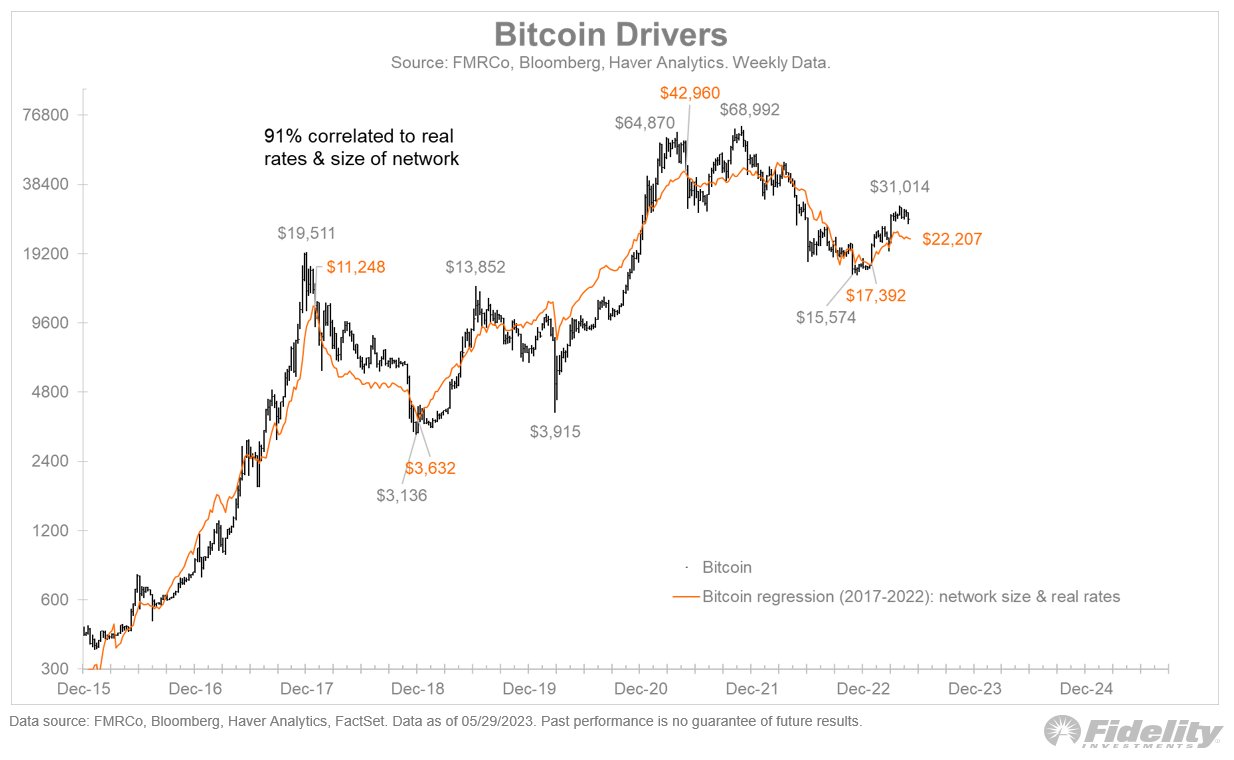

He presented a chart showing a regression of both the network and real rates, pointing out that since 2017, these two variables have a correlation of 91%. This suggests that Bitcoin’s network growth and the macro landscape, reflected by real rates, explain a significant portion of its price movement.

Timmer acknowledged that Bitcoin’s adoption curve has flattened since the crypto winter began in 2021. He also noted that monetary policy has affected real rates, impacting Bitcoin’s use case. Despite this, he believes that Bitcoin still has potential as digital gold, albeit more modest than it appeared a few years ago.

To consider Bitcoin as part of a 60/40 portfolio, Timmer suggested looking at the same attributes as for traditional asset classes: Sharpe Ratios, correlation, and volatility. He noted that Bitcoin’s Sharpe Ratio is competitive against other 60/40 building blocks, but its annualized volatility of 64% remains a hurdle. Its correlation to equities has declined in recent months but remains positive at +35%.

In conclusion, Timmer suggested that Bitcoin could potentially still have a place in a 60/40 portfolio, even though its growth curve seems more mature than previously thought and is more affected by real rates. Given the positive correlation and high volume, he advised that less is likely more when it comes to Bitcoin’s allocation in a portfolio.

Featured Image Credit: Photo / illustration by “petre_barlea” via Pixabay