As the allure of Bitcoin begins to fade, an ancient asset is captivating the attention of modern investors.

On April 24, The Wall Street Journal published an article titled “‘How to Buy Gold’ Hits a Google Record as Crypto Investors Chase World’s Oldest Asset” by Markets Reporter Hardika Singh. According to the report, some cryptocurrency investors, after experiencing the volatile nature of digital assets, are turning to gold for its stability.

Mitch Day, a 27-year-old Kelowna, British Columbia, college student, was once a genuine cryptocurrency enthusiast. However, as Singh reports, Day now recognizes gold as a more reliable store of value during uncertain times. This sentiment has been echoed by other investors who have experienced significant losses in various cryptocurrencies.

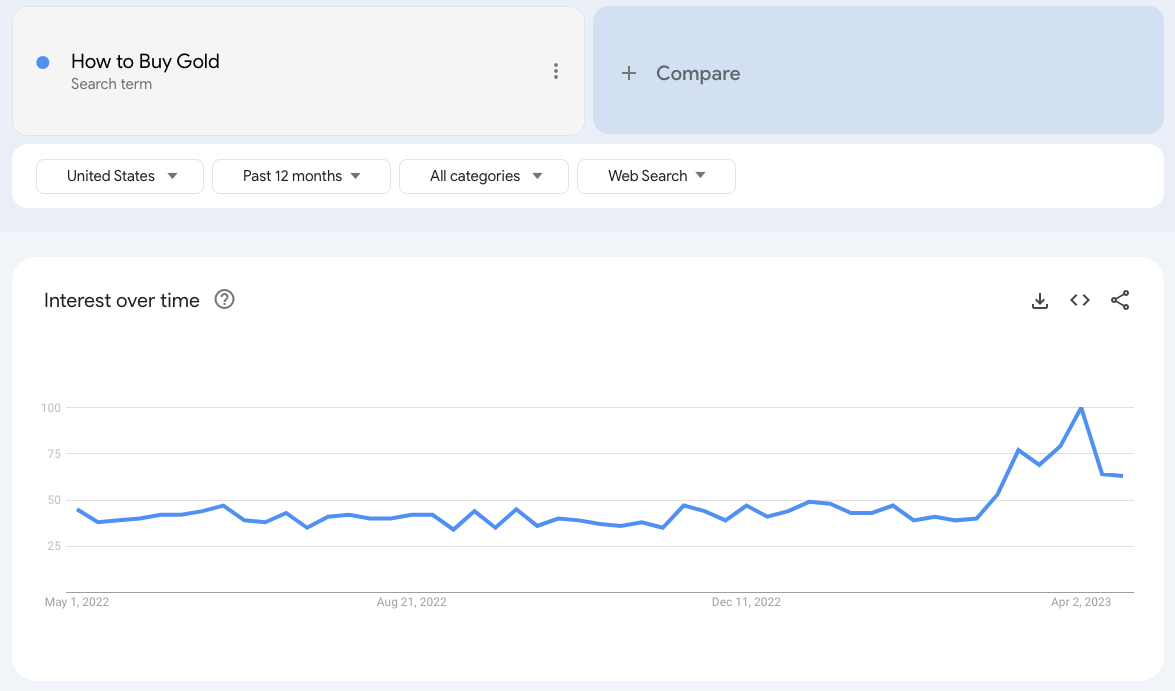

As cited in the article, searches for “crypto” and “gold” reached their highest levels since 2018, while Google searches for “how to buy gold” hit an all-time high this month, according to data from Hootsuite and Google Trends, respectively.

The SPDR Gold Shares ETF, the largest ETF backed by physical gold, has increased by about 20% in the past six months, as reported by Singh.

Singh notes that Bitcoin has lost approximately 50% of its value since late 2021, and the collapse of the cryptocurrency exchange FTX further dampened enthusiasm. In contrast, gold prices remained relatively stable last year, even as stocks and bonds experienced double-digit losses. Turmoil in the banking sector has recently pushed gold-futures prices above $2,000 per troy ounce for the first time in a year, near record highs.

Per the data cited in the article, the total market value of all cryptocurrencies is currently around $1.2 trillion. Gold, one of the world’s oldest assets, has an estimated total value of $14.5 trillion, based on data from the World Gold Council.

Singh shares the story of Rob Saudelli from Chilliwack, British Columbia, who has become disillusioned with cryptocurrencies and is now diversifying his portfolios with gold and silver. Saudelli’s portfolio, which once contained about 10% Bitcoin and Ethereum, has apparently now dropped to 5%. In comparison, gold and silver account for 10% and 14% of his holdings, respectively.

Daniel Fisher, CEO of Physical Gold Ltd., a precious metals dealer in London, told Singh that the decline in cryptocurrencies and stock-market turbulence has led to increased sales of gold and silver coins in recent months.

Luis Sousa, a 29-year-old veterinarian from Cardiff, Wales, started reducing his cryptocurrency holdings in late 2021 and began adding gold Britannia coins in early 2022, as reported in the WSJ article. He believes that even during the worst market conditions, gold will outperform Bitcoin.

According to Singh’s account, Mitch Day acknowledges that gold won’t provide the same exponential gains as cryptocurrencies, but he values it for preserving wealth.