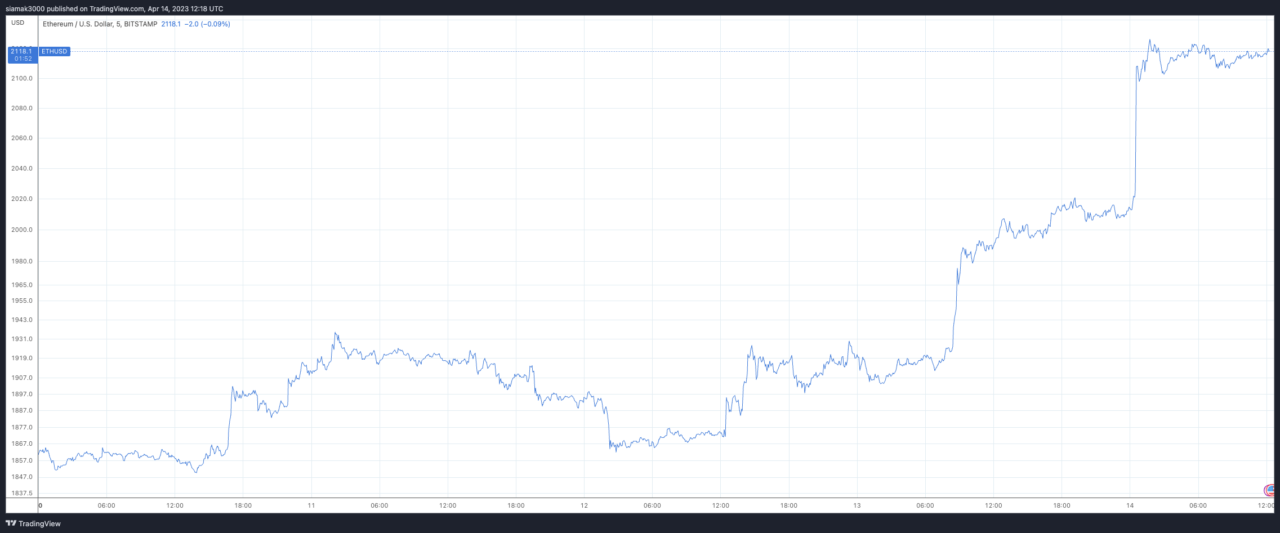

On April 13, crypto analytics firm Santiment took a closer look at Ethereum’s price moving above $2,000 for the first time in eight months.

This increase coincided with Bitcoin’s price crossing $30,000 after a 10-month gap. Traders are now wondering if Ethereum’s growth is just a temporary event or the beginning of a longer upward trend that could bring it closer to its all-time high in November 2021.

According to Santiment’s analysis, average trading returns are important to watch. The firm suggests that when the Market Value to Realized Value (MVRV) is 15% or higher over 30 days, it could be a warning sign of a possible price drop. Currently, Ethereum’s 30-day MVRV is 9.95%, which means there’s an increased chance of a price drop, but it’s not at a critical level yet. However, the 365-day MVRV is at +29%, the highest it’s been since December 27, 2021, which is more concerning for long-term traders.

Santiment’s blog post also highlights the significance of funding rates for contracts on the Deribit exchange. Recently, the exchange has seen big swings between people betting on price increases (longs) and those betting on price drops (shorts). As the funding rates became balanced, Ethereum’s price started to rise along with Bitcoin’s.

The post further examines Ethereum’s profit vs. loss transaction ratio, which is currently at its highest since January 20. Santiment interprets this as a short-term bearish signal, as heavy profit-taking can temporarily push prices down.

Lastly, Santiment analyzes the behavior of different tiers of Ethereum holders during this phase of market cap growth. The blog post reveals that three of the four tiers show signs of decline over the past month, which is a slightly disappointing outlook.

Although there seem to be a few more indicators pointing to bearishness at the moment, Santiment’s blog post suggests that the overall 2023 outlook for Ethereum could still be optimistic. Ethereum is just seven months past its successful merge, and there are plenty of reasons to be excited about the second-largest cryptocurrency by market cap. However, traders should be prepared for some price fluctuations around the $2,000 level as bulls and bears battle it out.