Leading US-based cryptocurrency exchange Coinbase has announced the addition of trading support for Arbitrum ($ARB), the governance token of the Ethereum layer-2 (L2) scaling solution, and a direct competitor to Polygon ($MATIC).

According to Offchain Labs, the startup developing this popular Ethereum L2 scaling solution, Arbitrum is an “optimistic rollup” that offers the following benefits:

- “Trustless security: security rooted in Ethereum, with any one party able to ensure correct Layer 2 results

- Compatibility with Ethereum: able to run unmodified EVM contracts and unmodified Ethereum transactions

- Scalability: moving contracts’ computation and storage off of the main Ethereum chain, allowing much higher throughput

- Minimum cost: designed and engineered to minimize the L1 gas footprint of the system, minimizing per-transaction cost.“

Arbitrum’s developers’ documentation goes on to explain what the term “optimistic rollup” means:

“Arbitrum is a rollup, which means that the inputs to the chain — the messages that are put into the inbox — are all recorded on the Ethereum chain as calldata. Because of this, everyone has the information they would need to determine the current correct state of the chain — they have the full history of the inbox, and the results are uniquely determined by the inbox history, so they can reconstruct the state of the chain based only on public information, if needed.

“This also allows anyone to be a full participant in the Arbitrum protocol, to run an Arbitrum node or participate as a validator. Nothing about the history or state of the chain is a secret.

“Arbitrum is optimistic, which means that Arbitrum advances the state of its chain by letting any party (a “validator”) post a rollup block that that party claims is correct, and then giving everyone else a chance to challenge that claim. If the challenge period (roughly a week) passes and nobody has challenged the claimed rollup block, Arbitrum confirms the rollup block as correct. If somebody challenges the claim during the challenge period, then Arbitrum uses an efficient dispute resolution protocol (detailed below) to identify which party is lying. The liar will forfeit a deposit, and the truth-teller will take part of that deposit as a reward for their efforts (some of the deposit is burned, guaranteeing that the liar is punished even if there’s some collusion going on).

“Because a party who tries to cheat will lose a deposit, attempts to cheat should be very rare, and the normal case will be a single party posting a correct rollup block, and nobody challenging it.“

Coinbase has made $ARB trading available on both its iOS and Android applications, albeit with an experimental label. In a bid to ensure transparency and aid customers in making informed decisions, Coinbase has implemented an “Experimental” asset label for specific tradable assets that are either new to the platform or possess lower trading volume compared to the broader crypto marketplace. While the label does not impose any trading restrictions, customers are urged to exercise caution due to the associated risks, such as price fluctuations and canceled orders stemming from lower volume and availability.

Before Coinbase’s announcement, four major crypto exchanges—MEXC, Huobi, Bitrue, and Bybit—revealed plans to list ARB by March 23, coinciding with Arbitrum’s first airdrop. The airdrop proceeded as scheduled, with the Arbitrum foundation distributing 12.5% of its token supply to eligible users.

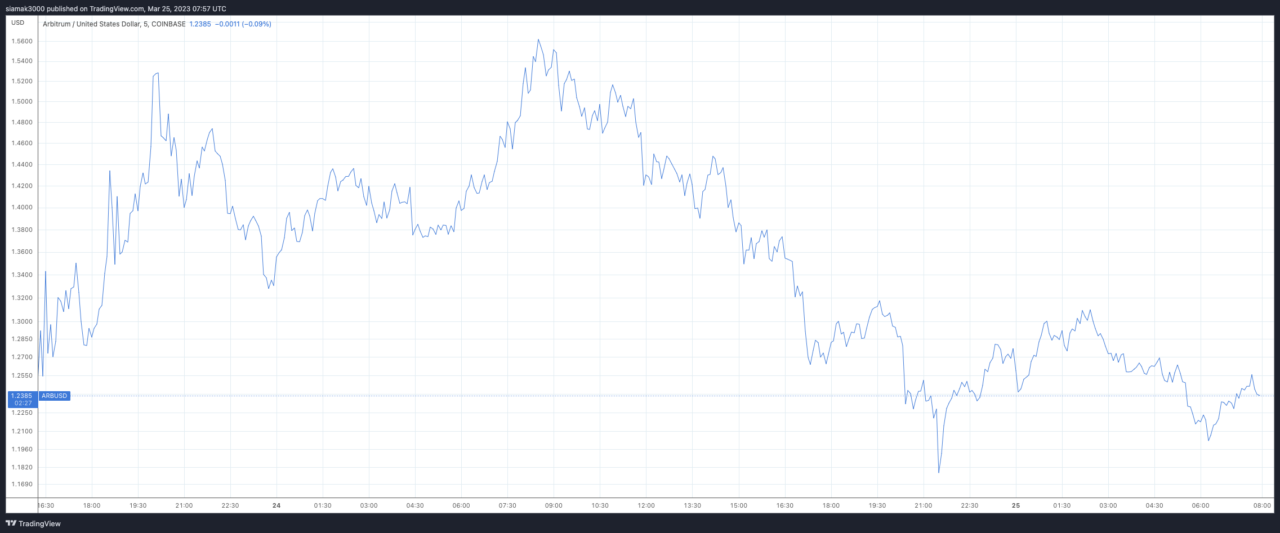

According to data from TradingView, on Coinbase, currently (as of 7:57 a.m. UTC on March 25), $ARB is trading at around $1.2385:

Image Credit

Featured Image via Pixabay