In MicroStrategy Incorporated’s Q4 2022 Earnings Call, Michael Saylor, the Executive Chairman of the company, discussed the firm’s performance and their corporate strategy.

According to the transcript provided by Yahoo Finance, Saylor highlighted that since the company’s major strategic decision in the summer of 2020 to acquire $250 million worth of Bitcoin, the company’s stock (NASDAQ: MSTR) has risen 117% and outperformed Bitcoin, which has risen 98% in the same time period. When compared to other major asset classes and indexes, such as the S&P 500 and NASDAQ, Bitcoin has been the strongest performer, outpacing them by a factor of five to ten times.

Saylor also compared the performance of big tech stocks to that of Bitcoin. He noted that while big tech companies like Google, Apple, and Microsoft have performed well, they have still underperformed Bitcoin by a factor of three to five times. On the other hand, stocks like Netflix, Amazon, and Meta group have all declined by 25%, 33%, and 42% respectively. Saylor pointed out that in the summer of 2020, investors faced a difficult challenge in determining where to invest their money with interest rates at zero and a substantial bounce in risk assets. In this context, Bitcoin emerged as the clear outperformer.

“We measure our success based upon the creation of shareholder value. And if we look at the performance of the company stock since August 10 2020 to the close of business (4 pm Eastern Time) on February 1, you can see the MicroStrategy stock is up 117%,” said Saylor.

“In the summer of 2020, investors were faced with a very, very difficult challenge, because it’s just not easy to figure out what to invest in when interest rates went to zero and when we’d already had a substantial bounce in risk assets. And you can see of all these choices, Bitcoin, clearly would have outperformed them all,” added Saylor.

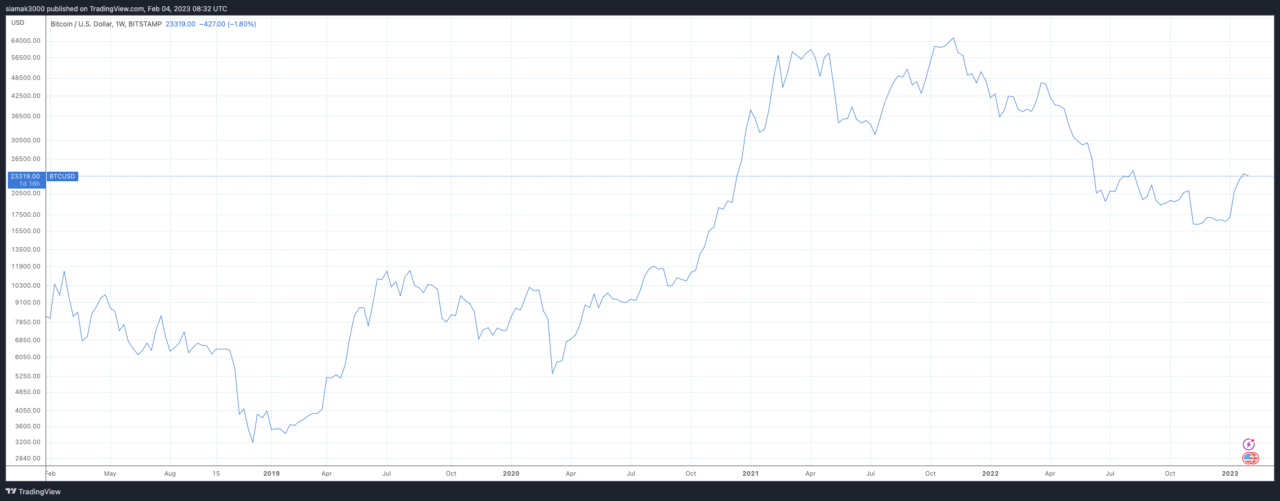

According to data from TradingView, in the year-to-date period, the Bitcoin price has gone from $16,521 to $23,318, which is a gain of 41.14% (vs USD).