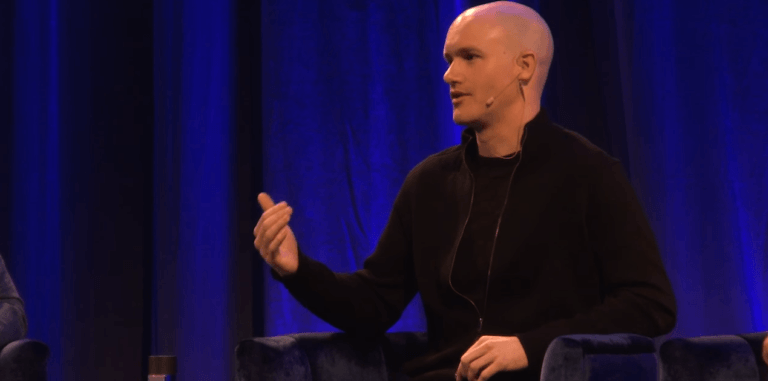

On Wednesday (February 8), Coinbase Co-Founder and CEO Brian Armstrong expressed his worries about rumors of the U.S. Securities and Exchange Commission (SEC) considering a ban on crypto staking for retail investors. Armstrong believes that such a ban would have a negative impact on the growth of the crypto industry in the U.S.

Crypto staking, a recent innovation in the world of digital currencies, allows users to “participate directly in running open crypto networks.” According to Armstrong, it brings about many benefits, including scalability, security, and energy efficiency. Armstrong stressed that staking is not a security.

The Coinbase CEO emphasized the importance of encouraging new technologies to grow in the U.S. He believes that it is crucial to the national security that the country builds out its capabilities in the field of financial services and Web3. Armstrong criticized the enforcement-based approach to regulation, stating that it encourages companies to operate offshore, as seen with FTX.

Armstrong hopes that the crypto industry and the regulators can come to an agreement on clear rules for the sector, which will protect consumers while promoting innovation and national security interests in the U.S.

IOG Co-Founder and CEO Charles Hoskinson was quick to respond to Armstrong’s comments by sharing his thoughts on the current state of Ethereum staking, calling it problematic and comparing it to regulated products.

Hoskinson argues that the temporary transfer of assets to others for staking is not the solution for a sustainable Proof-of-Stake (PoS) protocol. Instead, he believes in the importance of non-custodial liquid staking, which operates similarly to mining pools.

Hoskinson is concerned that due to a misunderstanding of the nature of PoS protocols, the industry might suffer from poor protocol design and centralization. He emphasizes the need for a decentralized environment where control is held by the many, not just a few. The IOG CEO believes that locking funds and poor protocol design are detrimental to the crypto industry as a whole.

Hoskinson lamented that all PoS protocols are often wrongly compared, likening the comparison to comparing a modern nuclear reactor to the Three Mile Island nuclear facility. He emphasizes the need to educate and properly understand the facts and operation design of these protocols.

On 15 September 2022, the day that Ethereum completed its Merge upgrade, i.e. its transition from PoW to PoS, Michael Saylor, the Executive Chairman of business intelligence software company MicroStrategy Inc. (NASDAQ: MSTR), implied that $ETH could get classified as a security (rather than a commodity) by the SEC.

Saylor, who is a Bitcoin maxi (i.e. believes that — with the exception of fiat-backed stablecoins such as Tether ($USDT) — Bitcoin is the only legitimate cryptocurrency), sent out a tweet in response to comments by SEC Chair Gary Gensler’s most recent comment on PoS cryptocurrencies that suggested he expects the SEC to eventually declare that $ETH is a security (unlike $BTC which they have publicly called a commodity and therefore not subject to U.S. securities laws).

The Wall Street Journal (WSJ) report that Saylor was referring to in his tweet says that “Ethereum’s big software update on Thursday may have turned the second-largest cryptocurrency into a security” in the eyes of the SEC.

According to the WSJ report, although Gensler did not specifically mention Ethereum, he did say that the native assets of PoS blockchains could pass the Howey Test since it was possible to view staking as an “investment contract” because “the investing public is anticipating profits based on the efforts of others.”