British cryptographer and cypherpunk Dr. Adam Back, who is Co-Founder and CEO of blockchain technology company Blockstream, recently explained why he believes that Bitcoin’s market cap (currently around $472 billion) could reach $200 trillion in just nine years.

Blockstream is a renowned blockchain technology firm founded by Bitcoin developers Adam Back and Pieter Wuille back in 2014. The company has a strong focus on developing innovative solutions that aim to scale and secure blockchain networks, particularly Bitcoin.

The firm is known for pioneering several proprietary technologies, including the Liquid Network, a federated sidechain that facilitates faster and more private transactions on the Bitcoin network. Blockstream has also created the Blockstream Satellite, a satellite network that transmits Bitcoin data globally, enabling users to access the network without internet connectivity.

Last Sunday (12 February 2023), the Blockstream CEO shared his long-term price prediction for Bitcoin via a Twitter thread.

Back was intrigued by the “bitcoin 2x’s per year on average” claim early this year, which he confirmed to be true. He expects that if the trend continues, Bitcoin’s price will reach $10 million and have a market cap of $200 trillion by the end of the next two halvings, which is expected to occur in about nine years. This is a Hal Finney 2009 Bitcoin market cap prediction number that, if achieved, will displace a significant part of the store of value premiums in bonds, real estate, gold, and 60:40 stock portfolios.

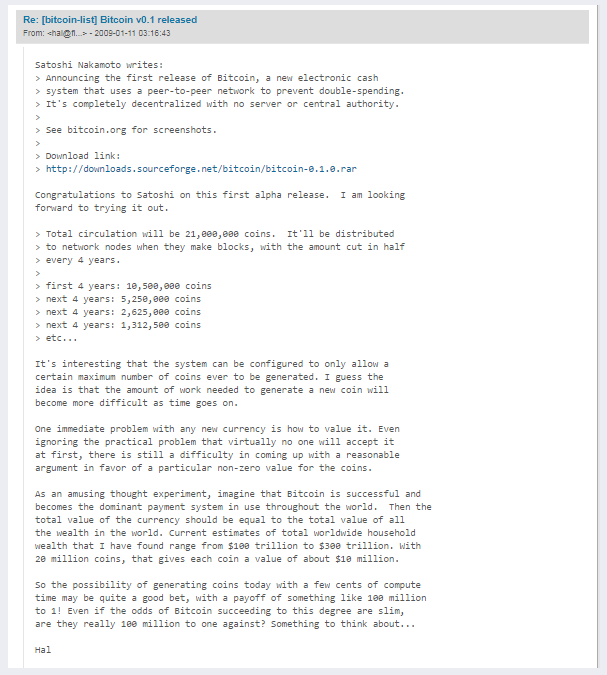

This conversation from back in January 2009 between Satoshi Nakamoto and Hal Finney in a Bitcoin forum is what Back is referring to when he mentions Hal Finney’s long-term price prediction for BTC:

Back is uncertain about adoption slowing down or a decrease in volatility, but he thinks there are other factors to consider. For instance, he believes that the new cycle of people who learn to HODL and make it their mission to buy and cold store as much Bitcoin as possible may create volatility. He also thinks that adoption could have hyperbitcoinization spurts, causing rapid viral adoption, leading to people protecting their savings via Bitcoin.

Back is optimistic about the future of Bitcoin, noting that the market for Bitcoin-native financialization is immature and almost untouched. He believes that Bitcoin-structured products, such as mortgages backed by real estate with interest guaranteed by BTC, will make Bitcoin easier to use for more people and match risk profiles. However, he also emphasized the need to scale tech to accommodate the next billion users, which probably means sidechains / drivechains as a tradeoff, more lightning optimization, and other layer two solutions like Liquid Network and Fedimint.

Image Credit

Featured Image via Pixabay