On Wednesday (30 November 2022), the New York Times held its annual DealBook Summit in New York City, an an event which was hosted by Andrew Ross Sorkin, Times columnist and DealBook founder and editor at large.

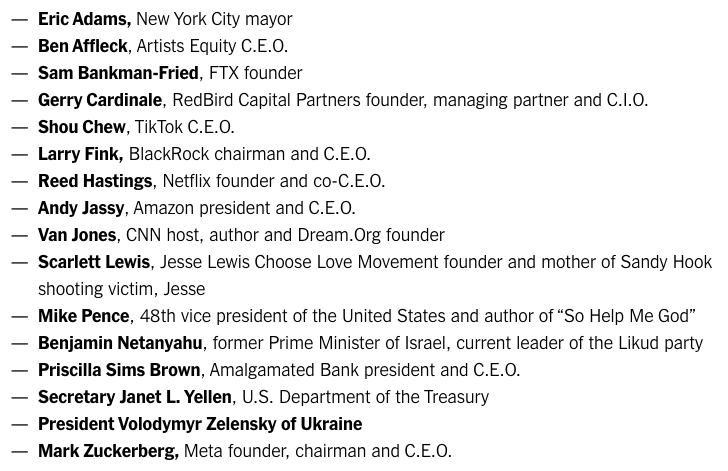

Here were the main speakers/interviewees:

Of course, the interviewee that most people were most excited about hearing from was Sam Bankerman-Fried (aka “SBF”), the disgraced co-founder and former CEO of bankrupt crypto exchange FTX.

Based on the full transcript of Andrew Ross Sorkin’s interview with SBF published by CoinDesk earlier today, SBF said:

“Clearly, I made a lot of mistakes or things I would give anything to be able to do over again. I didn’t ever try to commit fraud on anyone… I didn’t knowingly commingle funds. And again, one piece of this you have the margin trading you have you know, customers borrowing from each other, Alameda is one of those. I was frankly surprised by how big Alameda’s position was, which points to another failure of oversight on my part. And a failure to appoint someone to be chiefly in charge of that. But I wasn’t trying to commingle funds…

“The time that I really knew there was a problem was Nov. 6. Nov. 6 was the date that the tweet about FTT came out. By late on Nov. 6, we were putting together all of the data, putting together all the information that obviously should have been put together way earlier, that obviously should have been part of the dashboards I was always looking at…

“We were spending an enormous amount of our energy on compliance. We’re spending an enormous amount of energy on regulation on licensure. We’re getting licensed in dozens of jurisdictions…

“Everything I have, I’m disclosing and you know, I’m down to…I have one working credit card left. I think it might be $100,000 or something like that in that bank account. And, I mean, everything that I had, even all the loans I had were, you know, those are all things I was reinvesting in the businesses…I put everything I had into FTX.“

Here are a few reactions to this interview from the crypto community on Twitter: