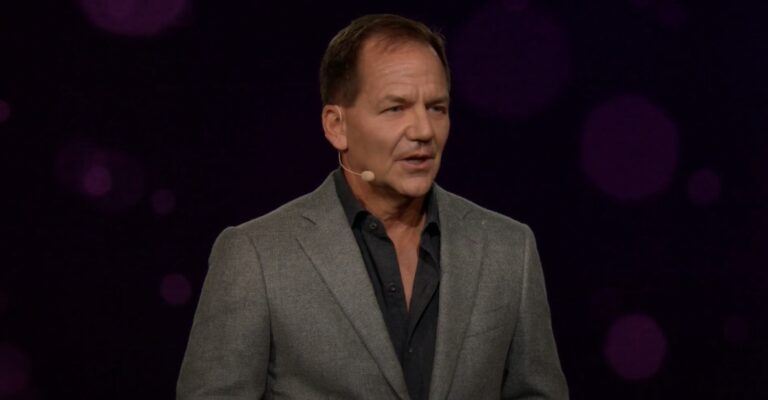

On Monday (October 10), legendary billionaire macro investor Paul Tudor Jones II (aka “PTJ”) shared his latest thoughts on crypto during an interview with CNBC.

As you may remember, in May 2020, PTJ made some very bullish comments about Bitcoin (as an inflation hedge) in the investment letter (“Market Outlook — Macro Perspective”) sent out to clients of the $22 billion macro hedge fund “BVI Global Fund”, which is managed by his asset management firm Tudor Investment.

Bloomberg was the first to report (on 7 May 2020) that according to this investment letter, the offering memoranda for the Tudor BVI Global Fund had been updated to disclose that Tudor Investment Corporation “may trade Bitcoin futures” for the fund and that the “initial maximum exposure guideline for purchasing Bitcoin futures” had been set to “a low single digit exposure.”

PTJ made his most recent comments about crypto during an interview with Andrew Ross Sorkin on CNBC’s “Squawk Box”.

When asked about his current thoughts on Bitcoin, he replied:

“I’ve still got a very minor allocation. I’ve always had a small allocation to it. I think, you know, if you think about every decade, the 70s were the decade of inflation, the 80s was a decade of kind of boom, bust, huge swings, and dollar volatility, the 90s was equitization, the dot com bubble, the aughts was the mortgage bubble and the great financial crisis, the teens were the peak of globalisation and probably the peak of central bank experimentation with monetary policy.

“The 20s, I’m afraid, are going to be that period where we really focus on debt dynamics, country by country, fiscal deficits, and the need to run, certainly, fiscal policy in a way that gives people confidence in the long run value of the currency.

“And the problem that we’ve had really for the last 12 years is that we’ve done this massive experimentation with monetary policy, where we suppressed yields. And we did this massive experimentation of fiscal side during the pandemic, and so my guess is the 20s are gonna be just the opposite of both. We’re already seeing that right now from the central bank…

“Whoever is the president in 2024 is going to be dealing with debt dynamics that are so dire… we’re gonna have to have fiscal retrenchment, and that fiscal retrenchment means that if we don’t have fiscal retrenchment, then everything that we spent, if you think about the teens, which was all about suppressing yields, right?

“I think the 20s will be just the opposite. I mean, higher term premiums in bond markets, and higher term premiums in stock markets. They’ll be just the opposite of what we experienced the last decade. So, in a time when there’s too much money, which is why we have inflation, and too much fiscal spirit spending, something like crypto, specifically Bitcoin and Ethereum, where there’s a finite amount of that, that will have value, at some point, someday.“

At this point Sorkin interjected to ask if that value will be a much higher number than today, and PTJ replied:

“I think so, yeah.“

On 28 September 2022, PTJ’s friend, billionaire investor Stanley Druckenmiller, talked about crypto while he was being interviewed at CNBC’s Delivering Alpha conference.

As you may remember, on that day, the Bank of England (which is UK’s central bank) announced that “in line with its financial stability objective” it “stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses and to achieve this “the Bank will carry out temporary purchases of long-dated UK government bonds from 28 September.”

According to a report by The Daily Hodl, Druckenmiller said:

“I still think… if the Bank of England, what they did is followed by stuff like that by other central banks in the next two or three years, if things get really bad… I could see cryptocurrency having a big role in a Renaissance because people just aren’t going to trust the central banks.“

Apparently, he did however point out that he does not hold any crypto at the moment since it is difficult for him “to own anything like that with central banks tightening.”