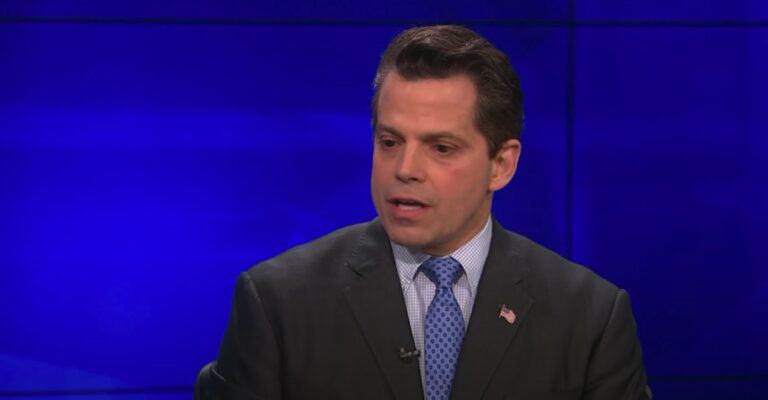

Recently, former White House Director of Communications Anthony Scaramucci, who is the founder and managing partner of global alternative investment firm SkyBridge Capital, shared his thoughts on the partnership between BlackRock and Coinbase.

SkyBridge Capital is “an SEC-registered investment adviser and global alternative investment manager that invests in hedge funds, digital assets, private equity, and real estate.”

On 4 January 2021, Skybridge announced “the launch of the SkyBridge Bitcoin Fund LP, which provides mass-affluent investors with an institutional-grade vehicle to gain exposure to Bitcoin.”

The press release went on to say:

“Additionally, on behalf of its flagship funds, SkyBridge initiated a position, valued at approximately $310 million at the time of this release, in funds investing in Bitcoin during November and December 2020.“

According to a report by Cointelegraph published on 25 April 2022, SkyBridge Capital “also has money deployed in other hedge funds, late-stage private tech companies and real estate.” SkyBridge has also been trying to get a physical Bitcoin ETF approved by the U.S. SEC.

Last Monday (August 22), Scaramucci explained — during an interview with CNBC — why the partnership between BlackRock and Coinbase, which was announced on August 4, so significant.

BlackRock, which was founded in 1988, started with just eight people working in one room. It made its Initial Public Offering on the New York Stock Exchange on 1 October 1999 at $14 a share. In 2006, BlackRock acquired Merrill Lynch Investment Management. Then in 2009, it acquired Barclay’s Global Investors (BGI), “becoming the world’s largest asset manager, with employees in 24 countries.” As of the end of Q2 2022, BlackRock had $8.48 trillion in assets under management (AUM).

On August 4, Coinbase’s Brett Tejpaul (who is Head of Coinbase Institutional) and Greg Tusar (who is Head of Institutional Product) published a blog post, in which they stated that “Coinbase and BlackRock to create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin.”

The blog post went on to say that “Coinbase is partnering with BlackRock, the world’s largest asset manager, to provide institutional clients of Aladdin®, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime.” Apparently, Coinbase Prime will “provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.”

As reported by The Daily Hodl, Scaramucci told CNBC:

“People are not paying close enough attention to what BlackRock is doing. If Larry Fink and his team are setting up a product related to Bitcoin, that is telling you that there is institutional demand out there. Whether they have a positive or negative opinion on Bitcoin, it doesn’t matter.

“There’s an expression back at [investment bank] Goldman Sachs in the early ’90s: ‘feed the ducks’. If the ducks want Bitcoin, set up a product and feed the ducks. And so I think this is a huge thing that’s just not being expounded upon as much as it should be.“