On Monday (June 27), crypto analyst Will Clemente, who is Lead Insights Analyst at Blockware Solutions, took a closer look at the Bitcoin price, and concluded that it was “incredibly cheap” at current price levels.

Clemente, who was using data from blockchain data and intelligence platform Glassnode, was basing his claim on the fact that the Mayer Multiple is currently around 0.6. The Mayer Multiple, which was created by Trace Mayer “as a way to analyse the price of Bitcoin in a historical context” is “the multiple of the current Bitcoin price over the 200-day moving average.” In other words, Bitcoin is currently trading at a 40% discount to its 200-day simple moving average (SMA).

According to the June 27 issue of Glassnode’s “The Week Onchain Newsletter”, “almost all macro indicators for Bitcoin are at all-time lows, signalling potential floor formation,” with many “even trading at levels with single digit percentage points of prior history at similar levels.”

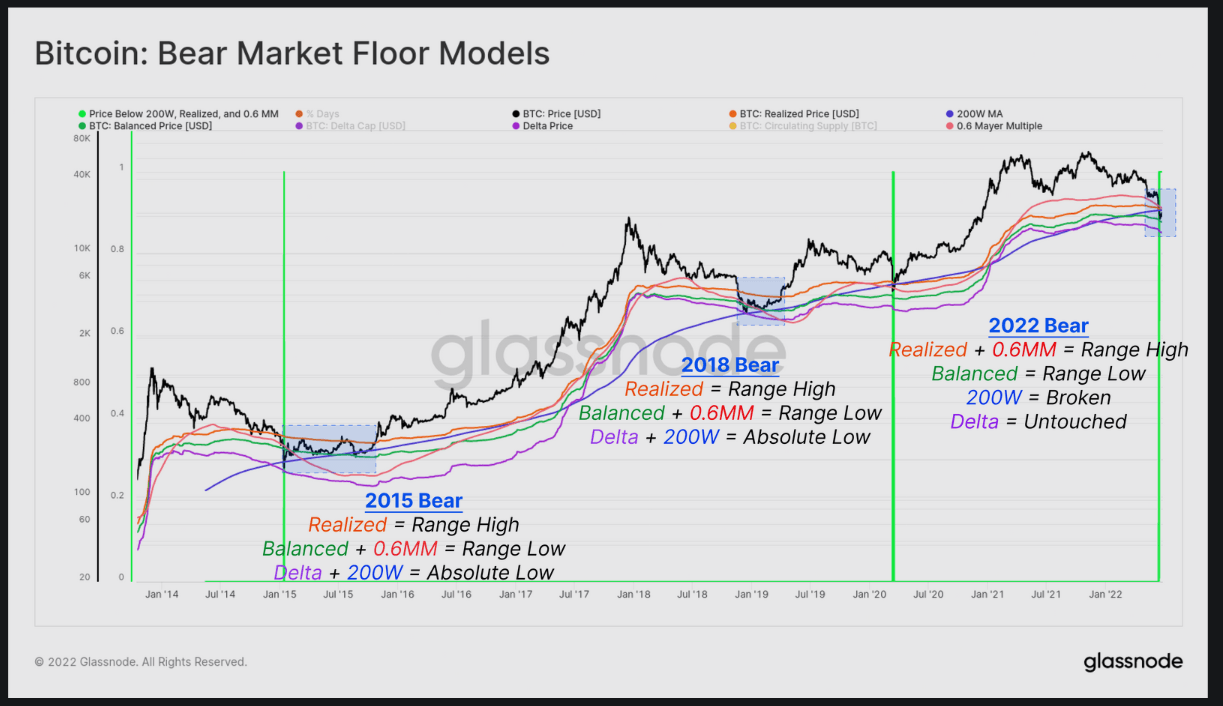

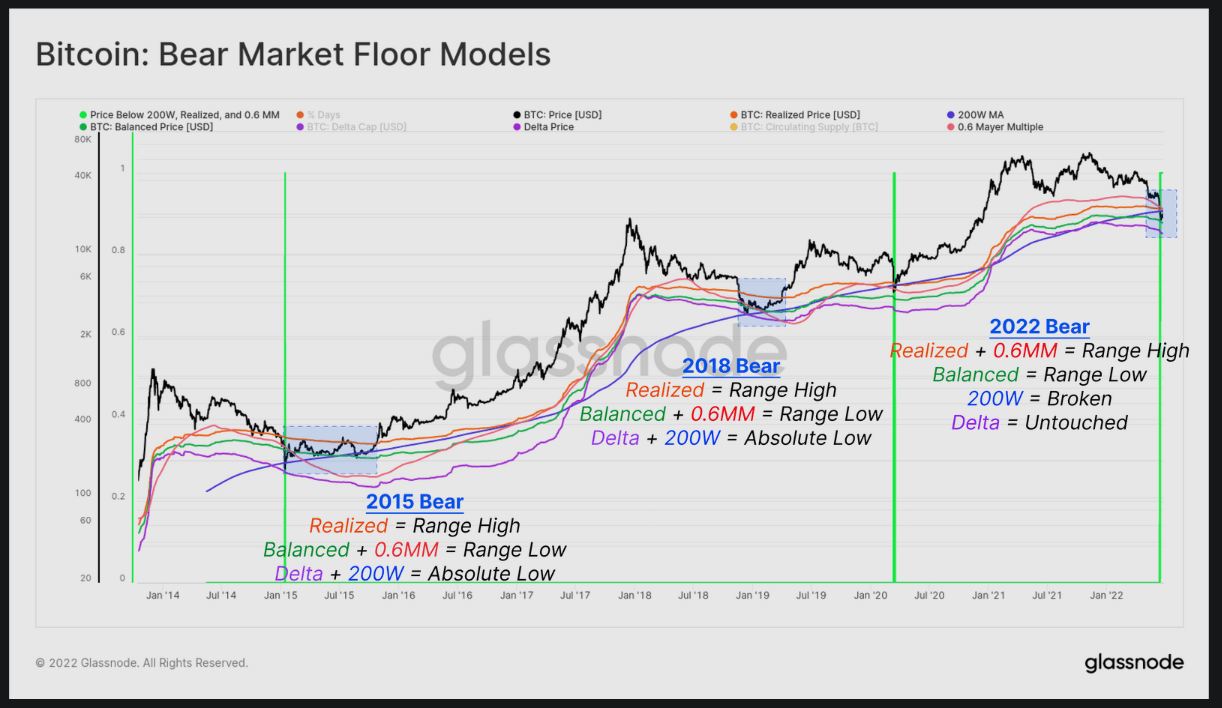

Glassnode had five things to say about the chart shown above:

- “Mayer Multiple of 0.6 ($23,380) price trading at a 40% discount to the 200-day moving average, with just 3.4% of trading days closing at or below this level.“

- “Realized Price ($22,500) being the aggregate cost basis of the coin supply, typically provides resistance during bottom formation. 14% of all trading days have closed below.“

- “200 Week Moving Average ($22,390) which has historically provided support during final bear market capitulation phase, and only 1% of days have closed below it.“

- “Balance Price ($17,980) which accounts for the destruction of coin-days, and reflects a market price that matches the value paid for coins, minus the value ultimately realized. Just 3% of trading days have closed below this model.“

- “Delta Price ($15,750) which is the difference between the Realized Price, and the all-time-average price. This level never been breached on a closing basis, and has provided ultimate final support in bears.“

Glassnode then noted that “in the current market, spot prices ($21,300) are trading below the Realized Price, the 0.6 Mayer Multiple band, and the 200 Week MA, and recently broke below Balanced Price during the 18-June flush out to $17,600.”

It also pointed out that “only 13 out of 4,360 trading days (0.2%) have ever seen similar circumstances, occurring in just two prior events, Jan 2015 and March 2020.”

Image Credit

Featured Image by “Donbrandon” via Pixabay.com