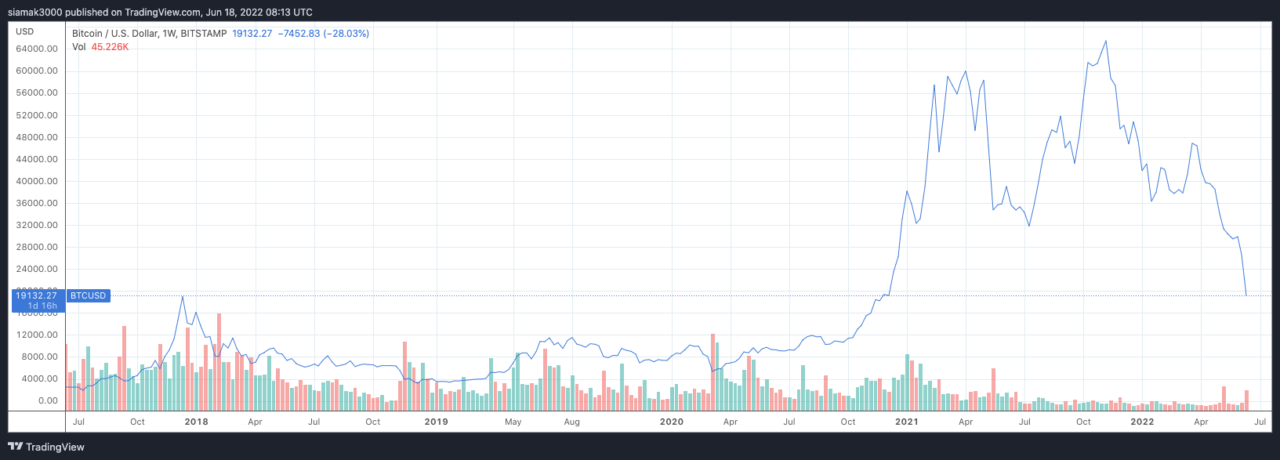

On Saturday (June 18), as the price of Bitcoin ($BTC) went below the $20K level for the first time since December 2020, macro-economist, trader, strategic advisor, and popular crypto analyst on Twitter Alex Krüger explained why this price level is so significant.

According to data by TradingView, on crypto exchange Bitstamp, the $BTC price dropped below $20K around 6:51 a.m. UTC, and currently (as of 8:16 a.m. UTC), Bitcoin is trading around $18,900, down 10.54% in the past 24-hour period.

Krüger said for $BTC to be seen as an “investable asset class”, it is crucial for Bitcoin to get back above the $20K level, and another popular crypto analyst agreed with him.

It is important to note that yesterday Krüger had warned that the $BTC chart is “so broken it’s one for the history books.”

Charles Edwards, Co-Founder of digital asset management firm Capriole Investments, pointed out earlier today that Bitcoin’s price is now below its mining cost.

Arthur Hayes, Co-Founder of 100x (the owner and operator of crypto exchange BitMEX), blames the Bitcoin price crash mostly on the quantitative tightening by the Federal Reserve.

On June 15, Federal Reserve Chair Jerome Powell said at the press conference following the conclusion of a two-day meeting of the Federal Open Market Committee (FOMC):

“From the standpoint of our Congressional mandate to promote maximum employment and price stability, the current picture is plain to see: The labor market is extremely tight, and inflation is much too high. Against this backdrop, today the Federal Open Market Committee raised its policy interest rate by 3/4 percentage point and anticipates that ongoing increases in the that rate will be appropriate. In addition, we are continuing the process of significantly reducing the size of our balance sheet.“

Although the Fed’s quantitative tightening is probably the most important factor affecting the crypto market, the recent troubles of Terraform Labs, Celsius Network, and Three Arrows Capital have also played a big part in undermining confidence in the market.

Interestingly, yesterday, Barry Silbert, who is the founder and CEO of its Digital Currency Group (DCG), which is the parent company of crypto investment firm Grayscale Investments, tweeted that they were buying $BTC.

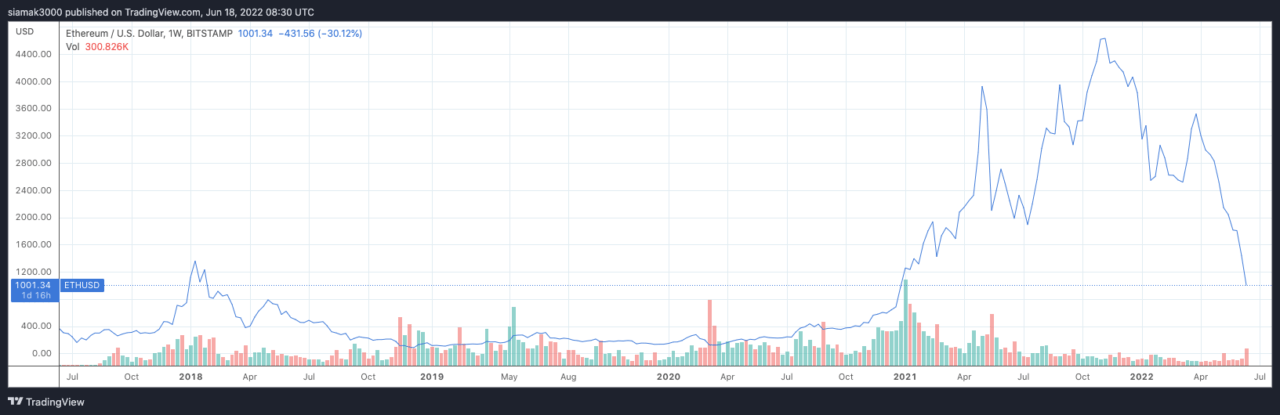

Meanwhile, today, the price of Ethereum ($ETH) fell below the $1000 level — for the first time since December 2020 — at around 7:17 a.m. UTC, and it is currently (as of 8:30 a.m. UTC) trading at $997.75.

Image Credit

Featured Image by “madartzgraphics” via Pixabay.com