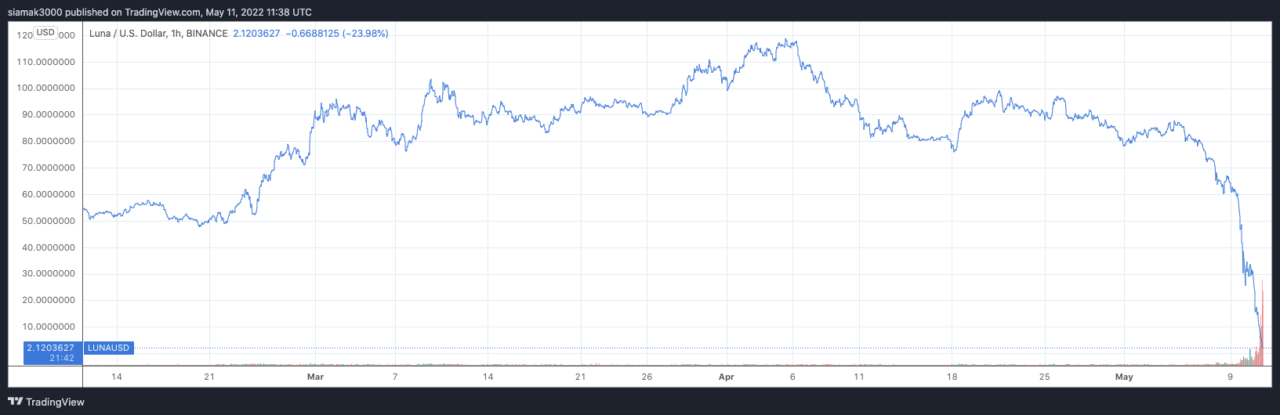

On Wednesday (May 11), $LUNA, which is the native staking and governance token of Terra protocol, is trading below $10, which is a huge fall from the all-time high of $119.18, which was set just over five weeks ago.

What Is Terra ($LUNA)?

The official Terra documentation has this to say about the Terra Protocol:

“The Terra protocol is the leading decentralized and open-source public blockchain protocol for algorithmic stablecoins. Using a combination of open market arbitrage incentives and decentralized Oracle voting, the Terra protocol creates stablecoins that consistently track the price of any fiat currency.

“Users can spend, save, trade, or exchange Terra stablecoins instantly, all on the Terra blockchain. Luna provides its holders with staking rewards and governance power. The Terra ecosystem is a quickly expanding network of decentralized applications, creating a stable demand for Terra and increasing the price of Luna.“

As for the protocol’s two main tokens, it says:

- Terra: “Stablecoins that track the price of fiat currencies. Users mint new Terra by burning Luna. Stablecoins are named for their fiat counterparts. For example, the base Terra stablecoin tracks the price of the IMF’s SDR, named TerraSDR, or SDT. Other stablecoin denominations include TerraUSD or UST, and TerraKRW or KRT. All Terra denominations exist in the same pool.“

- Luna: “The Terra protocol’s native staking token that absorbs the price volatility of Terra. Luna is used for governance and in mining. Users stake Luna to validators who record and verify transactions on the blockchain in exchange for rewards from transaction fees. The more Terra is used, the more Luna is worth.“

And this is Binance Academy’s brief explanation of what Terra is:

“Terra is a blockchain network built using Cosmos SDK specializing in stablecoin creation. Rather than use fiat or over-collateralized crypto as reserves, each Terra stablecoin is convertible into the network’s native token, LUNA. LUNA allows holders to pay network fees, participate in governance, stake in the Tendermint Delegated Proof of Stake consensus mechanism, and peg stablecoins.

“To peg a stablecoin like TerraUSD (UST), a USD value of LUNA is convertible at a 1:1 ratio with UST tokens. If UST’s price is, for example, at $0.98, arbitrageurs swap 1 UST for $1 of USD and make 2 cents. This mechanism increases UST demand and also reduces its supply as the UST is burned. The stablecoin then returns to its peg.

“When UST is above $1, say at $1.02, arbitrageurs convert $1 of LUNA into 1 UST and make 2 cents. The supply of UST increases, and demand for UST also decreases, bringing the price back to peg. Apart from reducing stablecoin volatility, validators and delegators stake LUNA for rewards. These two actors play an essential part in keeping the network secure and confirming transactions.

“You can purchase LUNA via Binance and then store it, stake it, and participate in governance with Terra Station, the official wallet and dashboard for the Terra blockchain network.“

Why Did TerraUSD ($UST) Lose Its Dollar Peg?

On Monday (May 9), Jonathan Wu, who works at Aztec Network, posted an excellent thread on $UST’s de-peggging from the dollar:

And yesterday (May 10), popular pseudonymous crypto analyst “Onchain Wizard” posted a great thread on his theory of how $UST was attacked:

Price Action of $LUNA, $UST, and $ANC

Since the start of the bank run on May 8, $LUNA, $UST, and $ANC have all suffered huge losses, and are currently (as of 11:20 UTC on May 11), down 98.3%, 62%, and 97.7% from their all-time highs.

What Terraform Labs CEO Has to Say About This Situation

So, what does Do Kwon, Co-founder and CEO of Terraform Labs — as well as a director at Luna Foundation Guard (LFG), have to say to remaining Terra fans (aka “LUNAtics”)?

These are two of his tweets from yesterday:

And then around one hour ago (i.e. at 11:10 UTC on May 11), he posted a Twitter thread (addressed to the Terra community), in which he said:

- “A review of the current situation: UST is currently trading at 50 cents, a significant deviation from its intended peg at $1.“

- “The price stabilization mechanism is absorbing UST supply (over 10% of total supply), but the cost of absorbing so much stablecoins at the same time has stretched out the on-chain swap spread to 40%, and Luna price has diminished dramatically absorbing the arbs.“

- “Before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it.“

Next, he gave an example of a remedial measure that could “aid the peg mechanism to absorb supply.”

And finally, he said:

- “With the current on-chain spread, peg pressure, and UST burn rate, the supply overhang of UST (i.e., bad debt) should continue to decrease until parity is reached and spreads begin healing.“

- “Naturally, this is at a high cost to UST and LUNA holders, but we will continue to explore various options to bring in more exogenous capital to the ecosystem & reduce supply overhang on UST.“

- “As we begin to rebuild UST, we will adjust its mechanism to be collateralized.“

What Dr. Clements Said About Terra ($LUNA) and Stablecoin TerraUSD ($UST) in April 2022

On April 20, Dr. Ryan Clements, who is an assistant professor at University of Calgary’s Faculty of Law, explained why he remains wary of decentralized algorithmic stablecoin TerraUSD ($USDT).

As Chair in Business Law and Regulation at the University of Calgary’s Faculty of Law, Dr. Clements’ academic research interests include “Securities, Financial Market Regulation, Financial Technology (Fintech), Systemic Risk & Financial Crises, Financial Product Innovation, Investment Funds, Crypto-Assets.”

In October 2021, Dr. Clements published a research paper titled “Built to Fail: The Inherent Fragility of Algorithmic Stablecoins”, in which he argued that purely algorithmic stablecoins (i.e. those not backed by any kind of collateral) are inherently fragile:

“… algorithmic stablecoins are fundamentally flawed because they rely on three factors which history has shown to be impossible to control. First, they require a support level of demand for operational stability. Second, they rely on independent actors with market incentives to perform price-stabilizing arbitrage. Finally, they require reliable price information at all times. None of these factors are certain, and all of them have proven to be historically tenuous in the context of financial crises or periods of extreme volatility.“

On April 20, Dr. Clements was interviewed on CoinDesk TV.

First, he was asked to talk about the relationship between $LUNA and $UST.

Dr. Clements replied:

“When I first started researching and writing in this area, TerraUSD was a purely algorithmic stablecoin, meaning it was a token that purported to maintain a stable peg, and it held that stable peg, similar to other stable coins, without any intrinsic backing or without any assets or without any collatera, but by creating economic incentives to use the stablecoin and creating arbitrage opportunities with another token called $LUNA where as the stablecoin lost its peg — whether it was increasing in value above a dollar or below — there was an opportunity to be able to mint or burn $LUNA, in an arbitrage dynamic to be able to maintain this peg.

“Now, over time, the Luna Foundation Guard in the Terra ecosystem has looked to supplant that or to add to that with a Bitcoin and $AVAX reserve in the event that the economic incentives and the arbitrage mechanism and the supply modifications of this $LUNA-$UST relationship break down. They now have a reserve that they can look to to add to the peg, and so effectively, it’s a different version of a stablecoin that uses economic incentives and arbitrage in order to maintain a stable value.“

Next, he talked about the risks of looking at $UST as money:

“If I look at TerraUSD and I think ‘okay, this is money, this is substitute for money’, I have to be cognisant of what the risks to that money are. With respect to using TerraUSD as a substitute for money, I am susceptible to the risks within the Terra ecosystem, and I’m susceptible to the volatility risk of the reserves and the sufficiency of the reserves that it’s now currently compiling.

“If you look at the Terra ecosystem, two-thirds of the demand for $UST is coming from the Anchor protocol. Lending demand on on the Anchor protocol significantly is higher than borrowing demand on the Anchor protocol. As a result, the Terra Foundation is having to inject reserves to top up depleting reserves on that protocol. So, I look across the Terra ecosystem and I think ‘what are some things that could lead to instability, that could potentially cause this to become de-pegged’, and there’s quite a few.

“There might be another borrowing protocol that’s more popular, that takes liquidity out of Anchor and moves it to another. Staking demand may decrease in Terra, the reserves may not be sufficient to defend the peg. The use cases of Terra may not be utilized… There might be a run on $LUNA…

“My argument is not that it can’t be stable. My argument is that in order for it to be stable there are a number of assumptions that have to hold. We need sufficient demand in this ecosystem. We need this ecosystem to be able to add to the reserves, and I’ll point out that the reserves were not something that that were originally in the ecosystem design; the reserves are something that have come after.

“I look at this, and I think the fact that Terra is adding to these reserves or acknowledging the need for reserves suggest to me that they don’t think the ecosystem in and of itself is sufficient to be able to keep this peg… And so, I look at it, and I think ‘okay, in order to maintain this peg, these assumptions have to hold’, and I think Anchor right now, with a very high APYs on anchor, and the fact that Terra Foundation is having to inject liquidity into Anchor in order to maintain those yields looks vulnerable to me over time.“

Dr. Clements also had other concerns about LFG’s Bitcoin reserves for $UST:

“Even with the Bitcoin reserves, the question will be one of scale. Can the reserves continue to match the market cap of $UST? Because if it can’t, then we rely on this kind of acceptance assumption, that there’s enough use, that there’s enough demand, and there’s enough outside money continually coming in to maintain this and to ward off any de-pegging.

“It’s possible. You know, Matt Levine wrote yesterday where it is possible that you could move from what he described as Ponzi to acceptance to stability. It’s possible. My point is if we’re in that process, we need to be aware, and I actually think that it would be healthy and add some trust to be able to have some more clear disclosures and maybe some operational controls and some stability in this.

“I don’t think we need to look at regulation necessarily as mutually exclusive, but for wanting to use this as a form of money, it could be helpful to have some understanding of where the vulnerabilities are and where the control mechanisms are, and particularly on this concentration side, I think.“

What Nic Carter Said About Algorithmic Stablecoins in April 2022

Here is how Nic Carter, who is a general partner at Castle Island Ventures, as well as Co-Founder and Chairman of Coin Metrics, expressed his dislike of algorithmic stablecoins on Twitter on April 21:

“of all the bad ideas the crypto industry has come up with algo stables are among the worst…

“no one in their right mind would, given the free choice, hold an algostable with 100x the default risk of USDC/T. unsustainable subsidized yields are not a sufficient long term incentive…

“‘but algostables are decentralized’ — no they’re not. they are all actively managed. they have organizations holding reserves, managing pegs, doing open market operations. insane thing to claim. if you want more decentralized stables then use overcollateralized crypto backed ones…

“and when these things inevitably fail, regulators will use the failure as a stick to bash the rest of the industry with, most likely causing reprisals against useful and functional stablecoins…

“would be nice if the smartest minds of my generation weren’t occupied by developing ever more sophisticated mental gymnastics to justify obvious ponzis“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “Angelo_Giordano” via Pixabay.com