In the early hours of Thursday (UTC time), Bitcoin fell below $26,000, partly due to fiat-backed stablecoin Tether ($USDT) temporarily losing its peg. However, currently, $USDT is looking healthier and so does Bitcoin.

According to data by TradingView, on crypto exchange Bitstamp, the Bitcoin price fell to around $25,499 — which is the lowest it has been since December 2020 — at 7:17 a.m. UTC (on May 12). Currently (as of 9:58 a.m. UTC on May 12), Bitcoin is trading around $27,510.

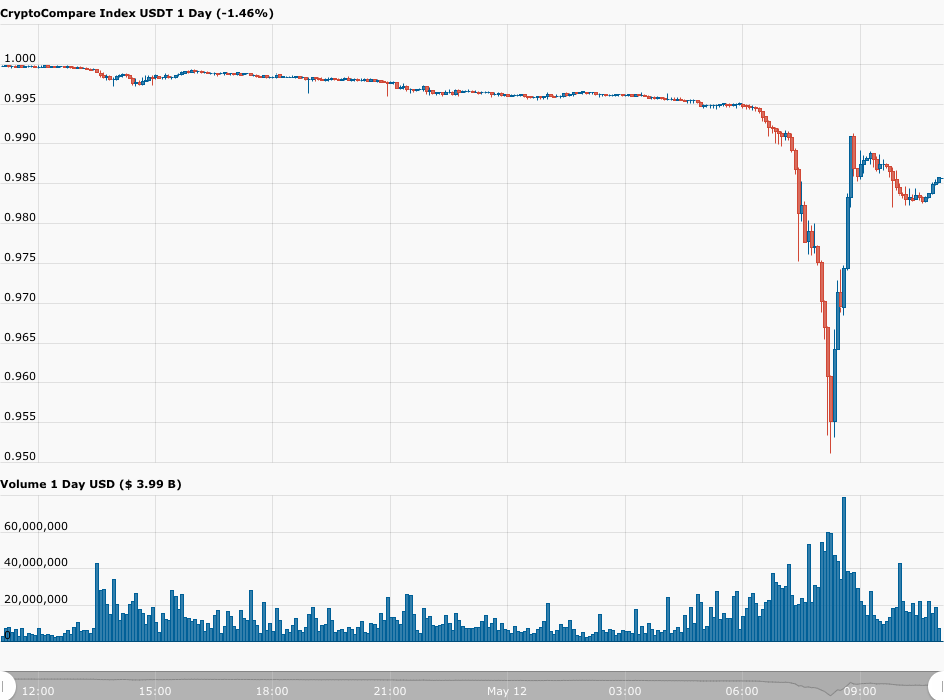

One of the main main reasons for this drop appears to be a temporary de-pegging of $USDT. As you can see from the chart below by CryptoCompare, around 7:15 a.m. UTC (on May 12), the weighted average price of $USDT across multiple top-tier exchanges fell to as low as $0.9511.

Paolo Ardoino, CTO at Bitfinex and Tether, told crypto news outlet The Block in a statement:

“Tether continues to process redemptions normally amid some expected market panic following yesterday’s market. In spite of that, Tether has not and will not refuse redemptions to any of its verified customers, which has always been its practise. In the last 24 hours alone, Tether has honoured over 300m USDt redemptions and is already processing another 1bn so far today without issue…

“On Bitfinex the Tether peg is > 1$ while on Kraken it is slightly lower than 1$. This has resulted in arbitrageurs buying USDt cheap on Kraken and selling it on Bitfinex for profit. While other market makers have bought USDt < 1$ on Kraken and directly redeemed it for 1$, still enjoying the profit.“

Late yesterday, this is what legendary veteran trader Peter L. Brandt, who is one of the world’ most respected classical chartists, had to say about Bitcoin’s latest price action.

And a few hours later, when $BTC was trading around $27,344, he added:

Dan Held, who is currently Director of Growth Marketing at Kraken, seems to believe that we are very close to seeing the botttom:

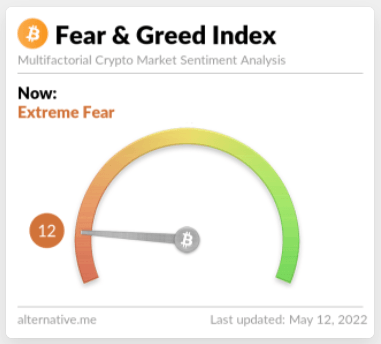

The famous “Crypto Fear & Greed Index” says market sentiment indicates “Extreme Fear” at the moment:

And finally, Michael J. Saylor, Co-Founder, Chairman, and CEO of Nasdaq-listed business intelligence company MicroStrategy Inc. (NASDAQ: MSTR), seems to be as bullish as ever on Bitcoin:

To make sure you receive a FREE newsletter every Friday that features highlights from that week’s most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “Angelo_Giordano” via Pixabay.com