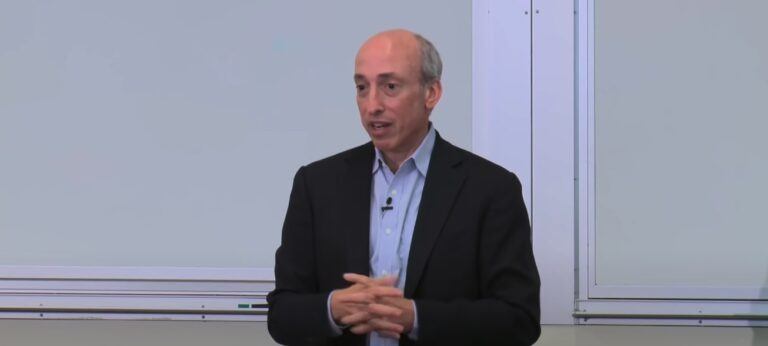

On Monday (April 4), Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), expressed his concerns about the crypto market during a keynote speech for the annual conference of Penn Law Capital Markets Association of the University of Pennsylvania Carey Law School.

Gensler was nominated by President Joe Biden to Chair the U.S. SEC on 3 February 2021, confirmed by the U.S. Senate on 14 April 2021, and sworn into office on 17 April 17 2021.

According to his SEC bio, “before joining the SEC, Gensler was professor of the Practice of Global Economics and Management at the MIT Sloan School of Management, co-director of MIT’s Fintech@CSAIL, and senior advisor to the MIT Media Lab Digital Currency Initiative.” From 2017 to 2019, he “served as chair of the Maryland Financial Consumer Protection Commission.”

Gensler was “formerly chair of the U.S. Commodity Futures Trading Commission, leading the Obama Administration’s reform of the $400 trillion swaps market.” He was also “senior advisor to U.S. Senator Paul Sarbanes in writing the Sarbanes-Oxley Act (2002), and was undersecretary of the Treasury for Domestic Finance and assistant secretary of the Treasury from 1997-2001.”

Gensler “earned his undergraduate degree in economics in 1978 and his MBA from The Wharton School, University of Pennsylvania, in 1979.”

He started his keynote speech by saying that he was “invited me to talk about the roughly $2 trillion crypto markets” and that in this speech he would be simply expressing his own views and “not speaking on behalf of the Commission or SEC staff.” Gensler believes that “there’s no reason to treat the crypto market differently just because different technology is used,” and the bulk of his speech was focused on explaining what the SEC is doing to fulfil its remit in three areas: “platforms, stablecoins, and crypto tokens.”

Platforms

Here, Gensler is referring to “crypto trading and lending platforms, whether they call themselves centralized or decentralized (DeFi).”

Gensler is not happy that most of the tokens being traded on these (unregistered) platforms are likely to be securities

“… these platforms likely are trading securities. A typical trading platform has dozens of tokens on it, at least. In fact, many have well in excess of 100 tokens. As I’ll address later, many of the tokens trading on these platforms may well meet the definition of “securities.” While each token’s legal status depends on its own facts and circumstances, given the Commission’s experience with various tokens that are securities, and with so many tokens trading, the probability is quite remote that any given platform has zero securities.“

Therefore, he has asked SEC staff to work on the following platform-related projects:

- “… getting the platforms themselves registered and regulated much like exchanges.“

- considering “how best to register and regulate platforms where the trading of securities and non-securities is intertwined“

- determining “whether it would be appropriate to segregate out custody“

- considering “whether it would be appropriate to segregate out market making functions“

Stablecoins

The SEC chairman says that “outside of use on crypto platforms, stablecoins generally are not used for commerce.” They are “not issued by a central government and are not legal tender.” However, they “raise three important sets of policy issues” by “offering features similar to and potentially competing with bank deposits and money market funds.”

These three issues are as follows:

- “First, stablecoins raise public policy considerations around financial stability and monetary policy.“

- “Second, stablecoins raise issues on how they potentially can be used for illicit activity.“

- “Third, stablecoins raise issues for investor protection.“

(Non-Stablecoin) Crypto Tokens

Gensler thinks that most of these crypto tokens are securities under the U.S. Supreme Court’s 1946 Howey Test, which says that “an investment contract exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others.”

“The fact is, most crypto tokens involve a group of entrepreneurs raising money from the public in anticipation of profits — the hallmark of an investment contract or a security under our jurisdiction. Some, probably only a few, are like digital gold; they may not be securities. Even fewer, if any, are actually operating like money.“

According to him, currently “many entrepreneurs are raising money from the public by selling crypto tokens, with the expectation that the managers will build an ecosystem where the token is useful and which will draw more users to the project,” which means that it is vital that the SEC works gets those “crypto tokens that are securities to be registered with the SEC.”

The SEC chairman concluded by saying:

“We already have robust ways to protect investors trading on platforms. And we have robust ways to protect investors when entrepreneurs want to raise money from the public.

“We ought to apply these same protections in the crypto markets. Let’s not risk undermining 90 years of securities laws and create some regulatory arbitrage or loopholes.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.