On Thursday, American privately and publicly funded non-profit media organization National Public Radio (NPR) talked about the Bitcoin revolution that is taking place in El Salvador.

As you may remember, the bill to make Bitcoin legal tender in El Salvador got passed by the Legislative Assembly on June 9 and the Bitcoin Law became effective on 7 September 2021.

On 24 June 2021, Salvadoran President Nayib Bukele announced during a national address that the Bitcoin Law would become effective on 7 September 7 2021.

According to a report by Slate that was published on 16 June 2001, here is how the village of El Zonte became one of the first places in El Salvador to make Bitcoin “de facto” legal tender:

“El Zonte is a village on the Pacific coast that has a population of about 3,000 people and is popular for surfing and fishing. While a beach town might sound affluent, El Zonte is not: According to Reuters, ‘El Zonte is visibly poor, with dirt roads and a faulty drainage system.’ In 2019, an anonymous donor in the U.S. reportedly began sending Bitcoin to nonprofits in the area with the aim of finding ways to build a sustainable cryptocurrency ecosystem in the community.

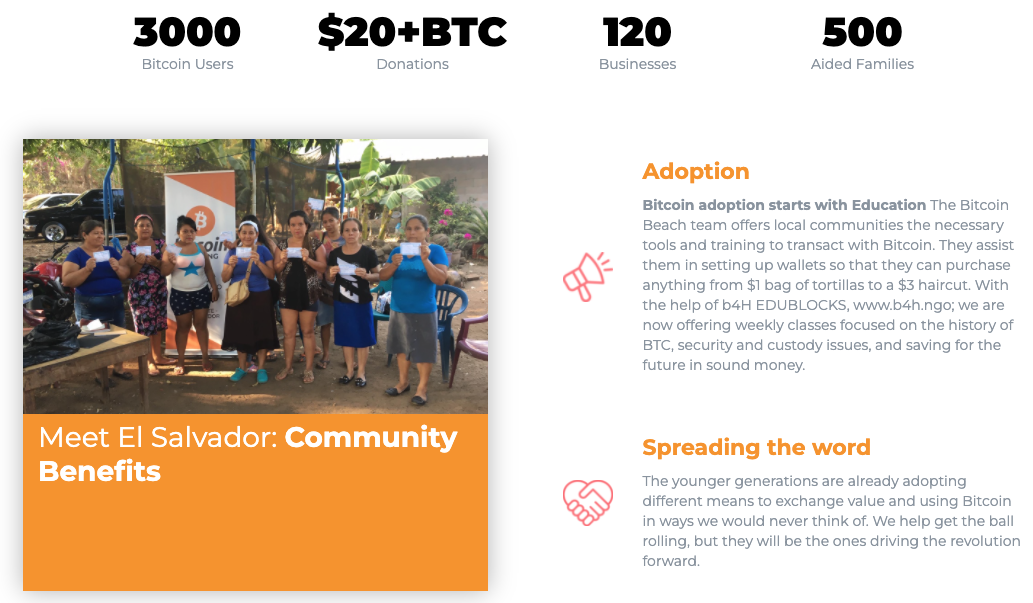

“Then nonprofit workers in El Zonte, in consultation with the donor, launched Bitcoin Beach, an initiative that injected the cryptocurrency into the local economy, set people up with digital wallets, and helped businesses set up systems to accept Bitcoin payments.

“Residents use a Venmo-like app payment system for exchanging Bitcoin, which was developed by a tech company in California called Galoy Money. Using the app, people can see which businesses accept Bitcoin and look one another up by username. ‘This was just the perfect laboratory,’ said Chris Hunter, co-founder of Galoy, of El Zonte. Hunter says El Zonte was a prime location for test-driving a Bitcoin payment system because of the lack of regulatory and tax burdens, the fact that most merchants and people don’t have credit cards, and dollarization of El Salvador’s economy.“

Yesterday, Carrie Kahn, an NPR International Correspondent based in Mexico City, Mexico, published a report on her recent visit to El Zonte.

Kahn started her report by saying that “the president of El Salvador is making a huge bet on bitcoin with his country’s treasury,” hoping to ” borrow a billion dollars to stock up on bitcoin and to build a bitcoin trade zone near a dormant volcano,” a plan that has “made him a hero in the crypto community.”

When Kahn interviewed Maria del Carmen Aguirre, a 51-year-old Salvadoran grandmother who owns a small store — a few blocks from the beach — that accepts Bitcoin, she was told:

“Thanks to my bitcoin earnings, I was able to buy a lot for my little store… If I’d gotten in before, I would have been able to buy a car with my earnings.“

Kahn also met Dutch brothers Jaap-Jaan and Martin Vanhangel, who are both in their early 20s and were on vacation over there. They told her that they had been able to pay for nearly everything with Bitcoin:

As CoinDesk reported on February 9, Salvadoran Finance Minister Alejandro Zelaya has confirmed that his country’s initial $1 billion bitcoin bond issue would take place between March 15 and March 20. When President Bukele introduced the Bitcoin bond on 20 November 2021 during a presentation at an event called Bitcoin Week in the coastal town of Mizata, he said that he would use $500 million of the proceeds to build “Bitcoin City” and the other $500 million to buy even more Bitcoin and lock it up for five years.

Jaime Reusche, a vice president and senior analyst in Moody’s sovereign risk group, told Kahn that he remains skeptical of President Bukele’s plans:

“It’s a heck of a gamble. This would be the first of its kind throughout the world… However, the president seems to be emboldened by the fact that his popularity remains sky-high inside the country.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.