NEAR Foundation, the Swiss non-profit organization responsible for “contracting protocol maintainers, funding ecosystem development, and shepherding core governance of the NEAR protocol“, has announced the close of $150 million in new funding being raised from several prominent crypto investing firms.

According to a report by CoinDesk, NEAR Foundation held a $150 million funding round led by Su Zhu’s Three Arrows Capital. The report claims NEAR received participation from several major crypto-focused investment funds, including Mechanism Capital, Dragonfly Capital, Andreessen Horowitz (a16z), Jump, Alameda, Zee Prime and Amber Group, among others.

Dragonfly General Partner Ashwin Ramachandran commented on the level of excitement for NEAR, noting that the entire round of funding was completed “end to end” in two weeks.

He said,

Near has done a great job from a technology standpoint, and we want to help them achieve a level of developer, user, ecosystem adoption which reflects their current level of technology innovation.

Ramachandran said that while NEAR has always been an interesting layer 1 network, it was “somewhat slept-on” due to the lack of applications in the ecosystem. He said the growing awareness of projects being built on NEAR, including NEAR Foundation’s announcement of $800 million fund to support development, has led to greater excitement for the DeFi project.

The report claims that the price of the $NEAR tokens from the sale were not disclosed, aside from having been priced at a one-month time-weighted average price (TWAP).

Sources close to the project told CoinDesk that at least two of the firms involved in the latest round of funding made verbal agreements to provide liquidity for emerging DeFi projects on NEAR’s blockchain.

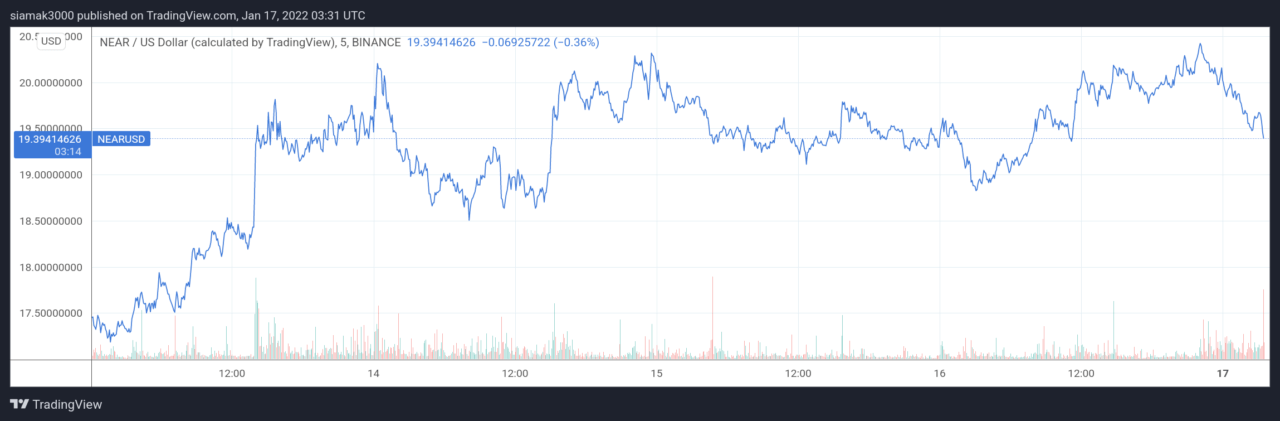

According to data by TradingView, on Sunday (January 16), on crypto exchange Binance, NEAR-USD got as high as $20.42 at 22:05 UTC.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial lo

Featured Image by “b52_Tresa” via Pixabay