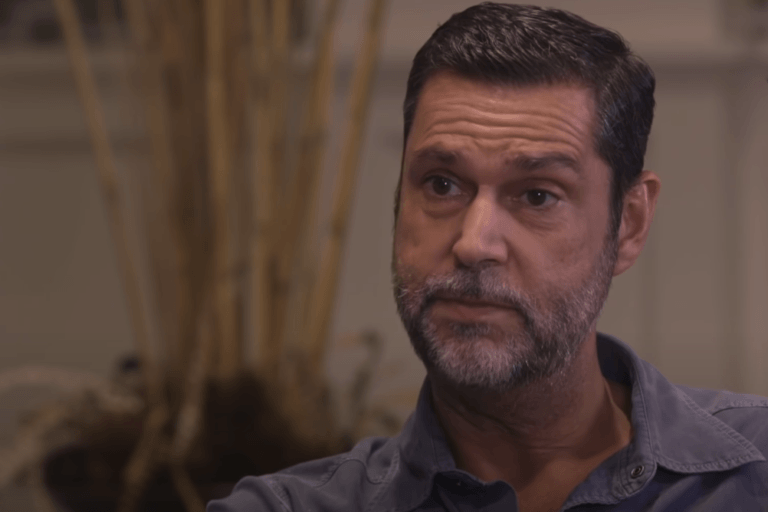

In a recent interview, former Goldman Sachs executive Raoul Pal talked about Ethereum and two of its (currently) faster and cheaper to use competitors.

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

Pal’s comments about the crypto market were made on November 30 during an interview with the host of the “InvestAnswers” YouTube channel.

With regard to the outlook for the price of Ethereum, Pal said:

“I’m using base case probabilities. No certainties. I still think ETH finishes this year closer to $15,000 than to $10,000… Just by the nature of what is actually going on right now and the chart patterns and, you know, the people who are coming into the space. I actually still see ETH… the small probability upside is that it hits $40,000 by the summer. That’s because [of] the staking cycle and how the charts look. And using the log chart, extending it forwards, and a number of things give me that. It’s not my base case; my base case would be $20,000 ETH by March at the latest.“

And when asked if he was concerned that Ethereum had so many good competitors, Pal replied:

“I don’t care. Of course, they were ETH’s dominance like Bitcoin’s dominance will fall over time because new technology comes into the space and they solve different problems and they have different orders of centralisation … and that’s absolutely fine. So the Bitcoin dominance is going to diminish over time. ETH dominance will diminish over time. SOL’s dominance versus others will diminish over time because this space is changing in structure. So I don’t have an issue with that. I’m not an ETH person. I’m just like this is the best horse to back, best risk adjusted return. I’m a crypto maximalist.“

Then, later, when asked why he is invested so heavily in $ETH if he believes that Ethereum’s dominance over other L1 blockchains will fall in time, Pal answered:

“I think that Solana will outperform ETH in the cycle and I think that Terra will outperform ETH. So, why don’t I have all my money in those? Because I have less certainty, because the network effects are less pronounced. So, therefore, I have to have a smaller bet, but I don’t think ETH stops going up. The whole space is going up 100Xover the next 10 years. So you can back a lot of different horses and still make money.“

Later in the interview, Pal was asked if he had to hold one cryptoasset for seven years, what would it be. He answered — after a brief pause — “Ethereum”.

Lastly, with regard to the question of how high the price of $SOL could go, Pal said that “it just exactly mirrors ETH [in] 2017”, which he confirmed would mean the price of $SOL reaching $2000 in this cycle.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.