On Monday (November 1), $DOT, the native token of smart contracts platform Polkadot, surged 20% to set a new all-time high.

What Is Polkadot?

Here is an overview of Polkadot using information from the Polkadot website:

“Polkadot is a network protocol that allows arbitrary data—not just tokens—to be transferred across blockchains. This means Polkadot is a true multi-chain application environment where things like cross-chain registries and cross-chain computation are possible. Polkadot can transfer this data across public, open, permissionless blockchains as well as private, permissioned blockchains.

“This makes it possible to build applications that get permissioned data from a private blockchain and use it on a public blockchain. For instance, a school’s private, permissioned academic records chain could send a proof to a degree-verification smart contract on a public chain.“

Polkadot “unites a network of heterogeneous blockchains called parachains and parathreads.” These chains “connect to and are secured by the Polkadot Relay Chain” and they can “also connect with external networks via bridges.”

And here is what Binance Academy says about Polkadot’s parachains and Relay Chain:

“An individual blockchain in the Polkadot ecosystem is called a parachain (parallel blockchain), while the main chain is called the Relay Chain. The idea is that parachains and the Relay Chain can easily exchange information at all times. You could think of parachains as being similar to individual shards in the planned implementation of ETH 2.0.

“Any developer, company, or individual can spin up their custom parachain through Substrate, a framework for creating cryptocurrencies and decentralized systems. Once the custom chain is connected to the Polkadot network, it becomes interoperable with all other parachains on the network.“

As for the use cases for the $DOT token, Binance Academy has this to say:

“Similar to most other blockchain infrastructure projects, Polkadot has its own native token. Known as DOT, it serves as the network token, jused t like ETH is the token for Ethereum and BTC is the token of Bitcoin.

“Several use cases exist for this token. First of all, it grants token holders with governance rights of the entire Polkadot platform. This includes determining network fees, voting on overall network upgrades, and the deployment or removal of parachains.

“DOT is also designed to facilitate network consensus through staking. Similar to other networks that involve staking, all DOT holders are incentivized to play by the rules at all times. How come? Well, if they don’t, they could lose their stake.

“The third option is to use DOT for bonding. This is required when new parachains are added to the Polkadot ecosystem. During a bonding period, the bonded DOT is locked. It’s released once the bond duration has ended and the parachain is removed from the ecosystem.“

$DOT’s Price Action

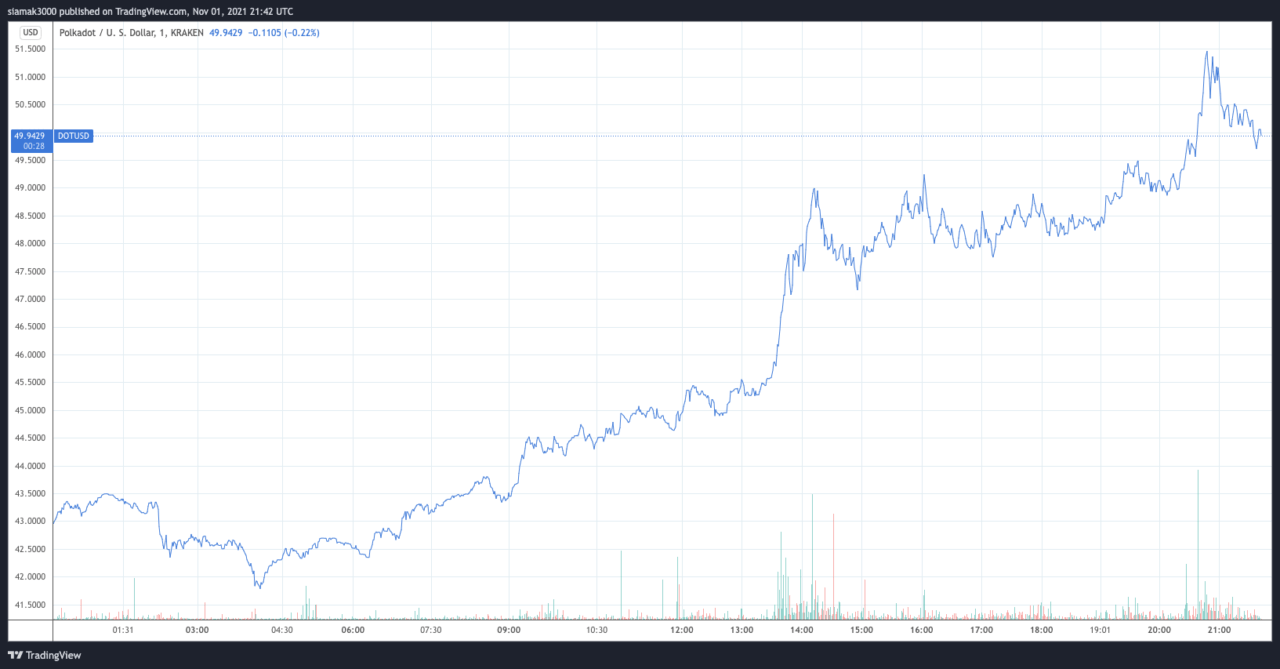

According to data by TradingView, on crypto exchange Kraken, at 20:48 UTC, the $DOT price got as high as $51.46, which is a new all-time high.

Currently (as of 21:50 UTC), $DOT is trading at $50.13, which means it is up 16.66% in the past 24-hour period.

One popular crypto influencer reiterated his prediction that in this bull cycle $DOT will outperform $SOL, $BNB, $ADA, $ETH, and $BTC.

Polkadot’s highly impressive price action does not come as a surprise to most $DOT HODLers since they expected “face melting season” as soon as the start date for Polkadot’s parachain slot auctions got announced.

As you may remember, on October 13, Polkadot co-founders Gavin Wood and Robert Habermeier announced the news that Polkadot is now technically ready to support its first parachains on day one of the two-day substrate developer conference “sub0 Online” (held October 13-14). And shortly afterwards, there was a motion (#118) submitted by governance member Joe Petrowski to Polkadot Council to start the first set of parachain slot auctions on November 11.

Earlier today, the Polkadot team announced the following bullish news:

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.