On Wednesday (September 1), the Ethereum ($ETH) price went back above the $3,750 level for the first time in nearly four months, seemingly in a hurry to set a new all-time high.

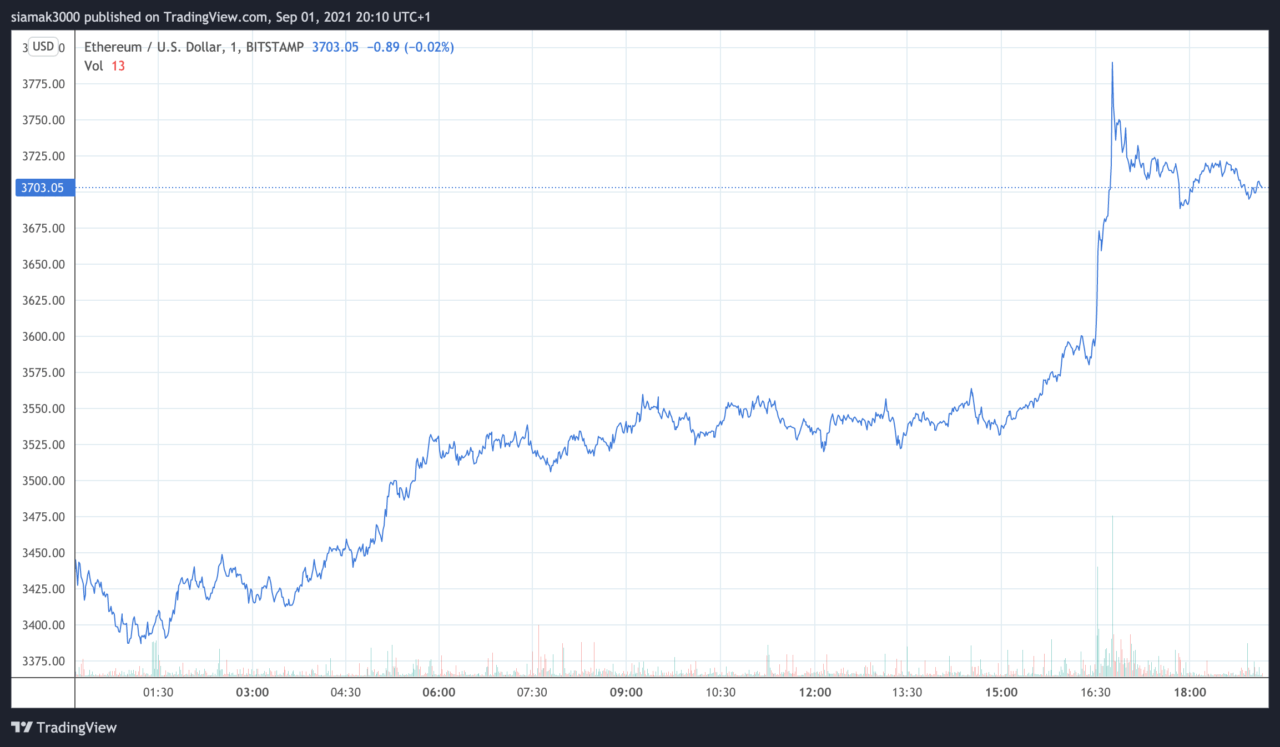

According to data by TradingView, on crypto exchange Bitstamp, around 16:43 UTC on September 1, the $ETH price went above $3,700 for the first time since May 16, and it kept climbing until it reached $3,789.86, which is today’s intraday high, three minutes later.

Currently (as of 19:15 UTC on September 1), ETH-USD is trading around $3,712.90, up 8.68% in the past 24-hour period.

In the past one-month and year-to-date (YTD) periods, $ETH is up approximately 42% and 408% respectively.

With Ethereum’s nearly 9% gain vs USD today making it the highest gainer among the top ten cryptoassets by market cap, popular crypto analyst and influencer Heidi Chakos (who is one of the two co-hosts of the “Crypto Tips” YouTube channel), found a cute way to say that she believes $ETH’s bull ran has real staying power.

Pseudonymous crypto analyst “Altcoins Sherpa” told his over 121K Twitter followers that he thinks — in the short term — Ethereum rather than Bitcoin is the cryptoasset that is going to lead the whole crypto market higher.

Ciaran Murray, Founder of Sumero Finance, which is a decentralised finance (DeFi) application for creating synthetic assets, says that although today is a great day for Ethereum, it is worth keeping an eye on the premium for $ETH futures contracts because if they go over 10%, that could signal that we are in an overheated market and more susceptible to cascading liquidations.

And finally, Crypto-focused behavior analytics startup Santiment says that “the amount of unique coins being circulated on the $ETH network translates well to future price movement.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.