Three months ago, this small Central American nation passed a bill to make Bitcoin legal tender. Today, that law became effective, and President Nayib Bukele announced that his country had taken advantage of the flash crash to buy more Bitcoin.

It all started on June 5 when Zap Solutions (a Bitcoin payments startup that uses the Lightning Network) Founder and CEO Jack Mallers — who helped with drafting the bill — made the announcement at Miami’s Bitcoin 2021 conference.

During his talk, an emotional Mallers presented a recorded video message from President Bukele and read out a small passage from the proposed bill. Mallers went on to say that his firm would be opening an innovations centre in El Salvador with the help of Blockstream.

At approximately 06:05 UTC on June 9, this proposed bill got passed by the Legislative Assembly (with 62 out 84 voting in favor of it).

Then, on June 25, Reuters published a report that said El Salvador President Nayib Bukele had announced during a national address on Thursday (June 24) that “Bitcoin Law” would become effective on September 7.

Here are a few highlights from that speech (as reported by “La Prensa Gráfica”, one of the country’s most popular daily newspapers):

- The English translation of Article 7 of the Bitcoin Law states: “Every economic agent must accept bitcoin as payment when offered to him by whoever acquires a good or service.” However, the president said assured the people of El Salvador that “nobody has to receive bitcoins if they don’t want them”.

- Pensions and salaries will continue to be paid in U.S. dollars.

- Bank account balances will remain in U.S. dollars (i.e. not get converted to Bitcoin).

- The president pointed out that Article 7 of the Bitcoin law that those who do not have the technology to accept Bitcoin do not have to accept it. The English translation of Article 7 states: “Those who, by evident and notorious fact, do not have access to the technologies that allow them to carry out transactions in bitcoin are excluded from the obligation expressed in Art. 7 of this law. The State will promote the necessary training and mechanisms so that the population can access bitcoin transactions.”

- The government is building an electronic wallet called “Chivo” that will be able to hold both USD and BTC. This mobile app will be available for downloading from the iOS and Android app stores from September 7. Any El Salvador citizen who registers the wallet (which will require entering their Unique Identity Document number and cell phone number, as well as submitting to a face scan) can receive $30 worth of Bitcoin from the government (but it seems that they can choose to opt out and receive this amount in USD instead). The president said that “those 30 dollars are to promote the use of bitcoin and to encourage people to download the App”.

- The Chivo wallet will allow withdrawals at ATMs (but it is not known yet what the commission will be).

- The Development Bank of El Salvador (Bandesal) will guarantee automatic convertibility, which means that businesses that get paid in BTC can choose to receive USD.

Yesterday (September 6), President Bukele announced that his country had bought its first 200 bitcoins and they planned to buy “a lot more”.

A few hours later, the president announced that his country had bought another 200 BTC.

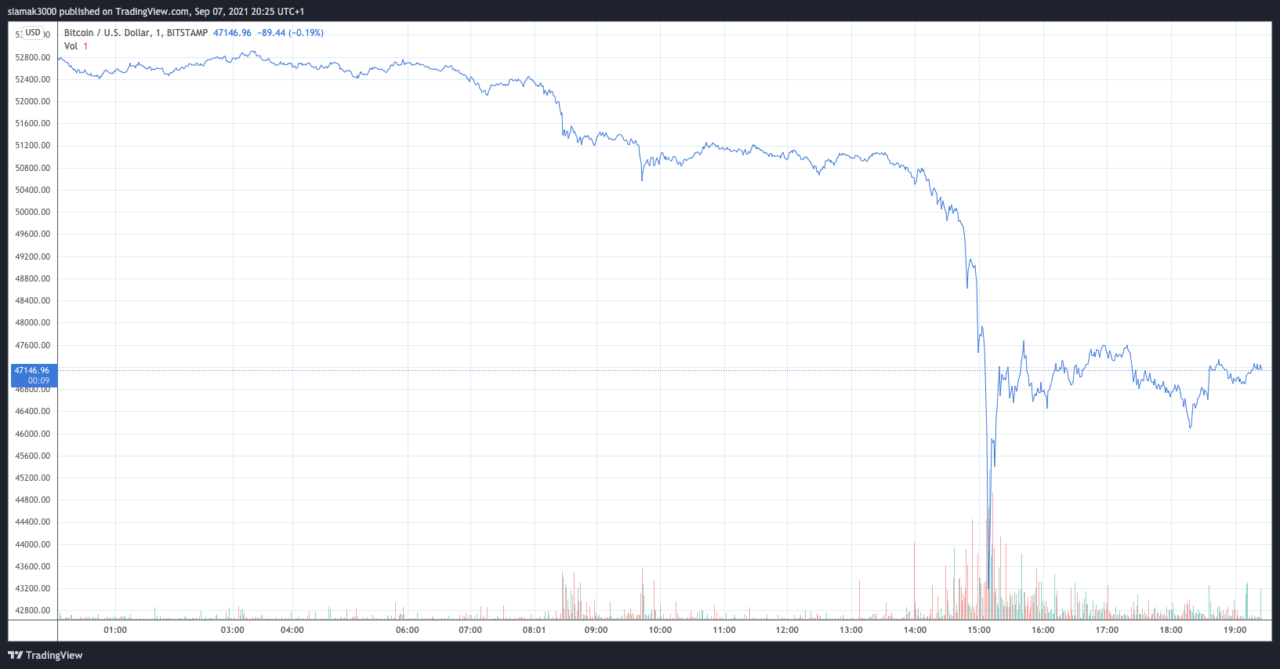

Shortly after the above tweet, Bitcoin was trading around $52,697. According to data by TradingView, on Bitstamp, around 14:09 UTC on September 7, BTC-USD was trading around $50,668. Within one hour, the Bitcoin price had crashed to $43,191 (which is today’s intraday low), i.e. fallen nearly 15%.

At 15:15 UTC, i.e. six minutes after today’s intraday low had been reached, President Bukele tweeted that his country had taken advantage of this Bitcoin flash crash to buy another 150 BTC.

Another interesting piece bit of Bitcoin news out of El Salvador arrived when Aaron van Wirdum, a journalist who works for Bitcoin Magazine, who is currently visiting San Salvador (the capital of El Salvador) reported that earlier today he had paid for his breakfast at McDonald’s with Bitcoin.

Less than two hours later, Bitcoin payment processing startup OpenNode announced that they are partnering with MacDonald’s in El Salvador to allow their branches in that country to accept BTC payments via the Lightning Network.

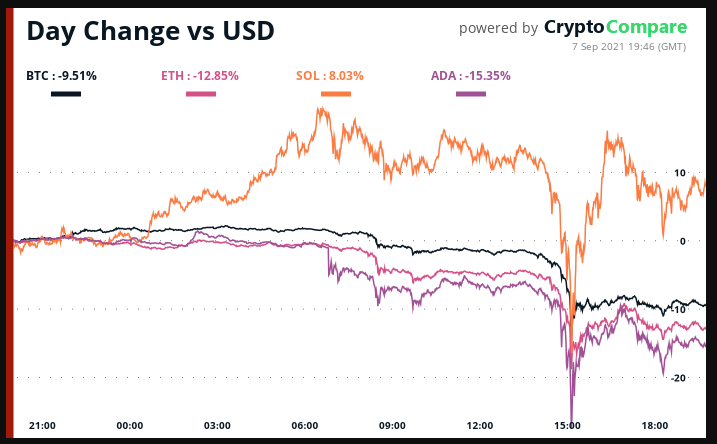

At the time of writing (i.e. as of 19:46 UTC on September 7), as you can see from the chart below by CryptoCompare, while Bitcoin ($BTC), Ethereum ($ETH), and Cardano ($ADA) are down 9.51%, 12.85%, and 15.35% respectively in the past 24-hour period, Solana ($SOL) appears to be quite immune to the virus that has infected almost every non-stablecoin cryptoasset in the top 50, and it is up just over 8% during the same period.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Photo by “petre_barlea” via Pixabay