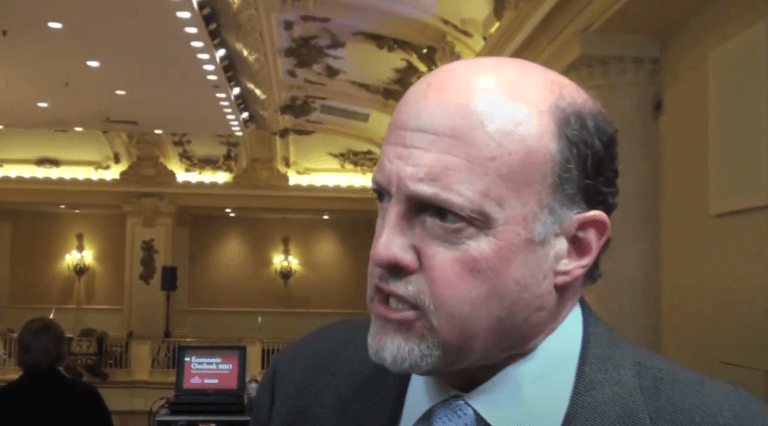

Former hedge fund manager Jim Cramer explained on Wednesday (August) why he viewers of his popular show should consider investing in Coinbase stock (NASDAQ: COIN). He also talked about crypto in general and Ethereum in particular.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

Here’s how Cramer got into crypto.

On 10 September 2020, Anthony Pompliano (aka “Pomp”), who is a co-founder of Morgan Creek Digital as well as the host of “The Pomp Podcast”, told his almost 370K followers on Twitter that he had managed to convince Cramer to buy some Bitcoin (apparently during a recent podcast interview with Cramer).

Then on 11 December 2020, Cramer told Katherine Ross, a correspondent for TheStreet, that he had just bought more Bitcoin.

Three months later, during a second interview appearance on Pomp’s podcast, Cramer said that he had made “a ton of money” from his Bitcoin investment, expressed his disappointment with gold, and mentioned that he was advising people to have 5% of their portfolio in gold, and 5% of it in Bitcoin.

On April 15, Cramer revealed, while talking to CNBC’s “Squawk on the Street” co-host David Faber, that as the Bitcoin price has been going up over the past few months, he had been taking profits by selling some of his BTC holdings.

On June 21, during an appearance on CNBC’s “Squawk on the Street”, Cramer revealed that he had sold most of his remaining Bitcoin holdings due mostly to concerns over the crypto crackdown in China and Bitcoin’s use for ransomeware payments.

Cramer’s latest comments about crypto during the Lightning Round segment of Wednesday’s “Mad Money With Jim Cramer” show; this is when gives quick answers to his viewers’ questions.

When asked about his opinion on Coinbase Global, Cramer said that although he is not a big fan of the company’s management and despite the fact that the direct listing on Nasdaq had not gone that well, he felt that the company’s stock, which had closed the previous day at $259.28, was cheap at current levels:

“I think Coinbase is inexpensive. I don’t really care for management because I think they let out a lot of stock when they started. I was against that. They should’ve been buyers, not sellers. I think the listing went very, very poorly. I think the company is the .. natural repository of crypto.“

Since COIN’s debut on Nasdaq on April 14, its price has gone from $328.28 to $248.54 (its closing price on August 26).

He then went on to share his thoughts on crypto and in the process revealed that he currently holds Ethereum ($ETH):

“I will also say this, though, I own Ethereum directly. I think you should have up to 5% of your portfolio in crypto. I am a believer in crypto.“

According to data by TradingView, $ETH is currently (as of 08:10 UTC on August 27) trading around $3,123.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.