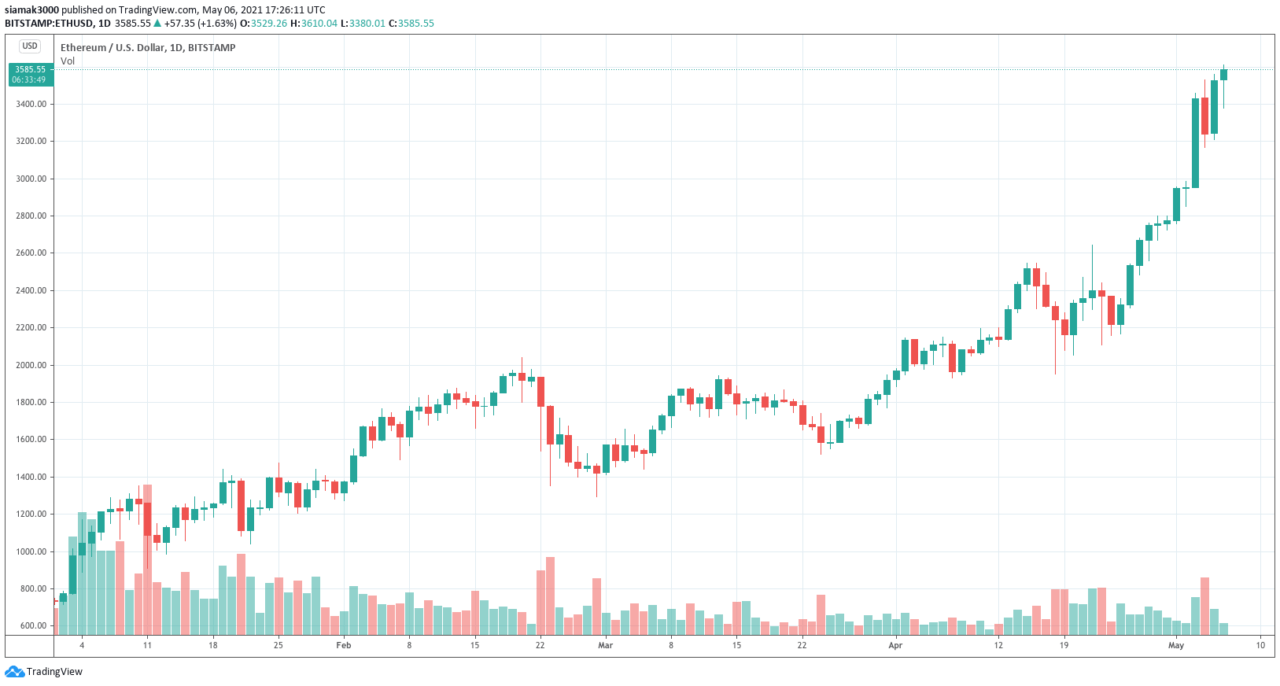

On Thursday (May 6), the Ethereum price broke $3,600 to set a new all-time high.

Data by TradingView indicates that at 16:24 UTC on crypto exchange Bitstamp $ETH broke above the $3,600 level for the first time ever, and five minutes later, it hit $3,610 to record a new all-time high.

Currently (as of 17:32 UTC on May 6), ETH-USD is trading around $3,589, which means that in the past 24-hour period, it is up 5.49%; as for the year-to-date period, ETH-USD is up 386.97%

According to a report by Liam Frost and Daniel Roberts for Decrypt, earlier today, billionaire investor and entrepreneur Mark Cuban, who owns both Bitcoin and Ethereum, had this to say during a panel at Decrypt‘s Ethereal Virtual Summit:

“Between DAI and ETH 2.0, and all the staking that happens to provide liquidity everywhere else, it wouldn’t shock me if we’re getting significant deflation, which is one of the reasons that ETH is skyrocketing so much. So that’s why I think ETH really is uncapped in terms of how high it can go.“

According to another report by Daniel Roberts for Decrypt, Cuban also said:

“I think Bitcoin is the greatest risk of a pullback, simply because there’s so many dollars worth of derivatives, and so people speculate so much, and you don’t have an efficient market in terms of buying and selling it…

“Each global market has its own pricing, and a buyer of Bitcoin, or any crypto for that matter, doesn’t automatically get the best price like you do with a share of stock, for the most part…

“I think Ethereum has greater long term value, period, end of story. Because Ethereum has more utility than Bitcoin does.“

CryptoQuant CEO Ki Young Ju says that it is bullish for Ethereum that outflows of $ETH from crypto exchanges are greater than inflows of $ETH into crypto exchanges:

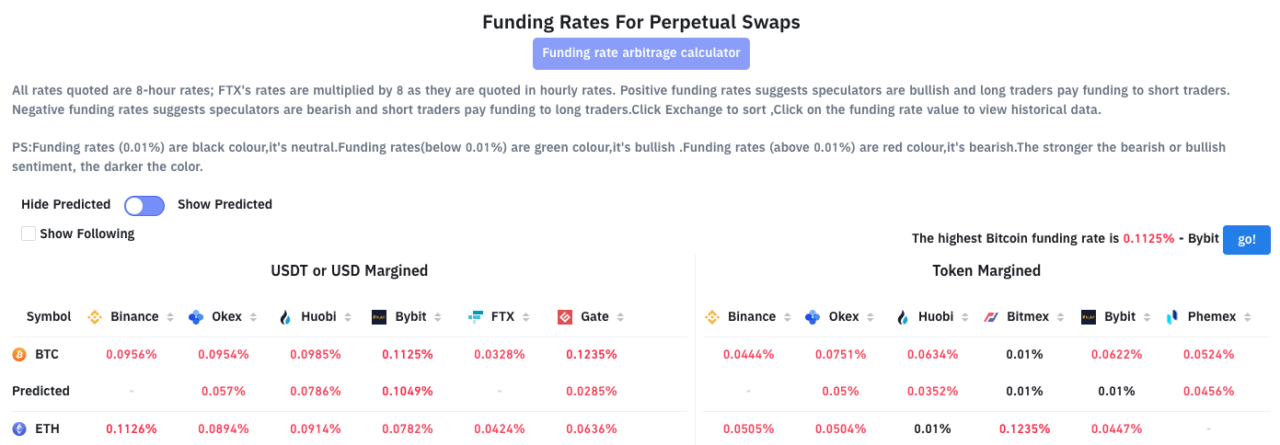

However, it is a bit worrying that funding rates for perpetual swaps are getting a bit too high, which could mean that some of the price increase for $ETH could be due to leveraged long positions, and we all know what would happen if some large $ETH whales decide to sell, or if there is any kind of panic in the crypto market. For example, In the table below from Bybt.com, you can see that on BitMEX the token-margined funding rate for $ETH is much higher than the rate for $BTC.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured Image by “elifxlite” via Pixabay.com