Last Friday (February 26), another crypto analyst came forward to predict that the Ether price (currently around $1500) is going to $10,000. And today there was more good news for ETH HODLers: we might soon have two Ether ETFs in North America.

Ethereum Price Predictions

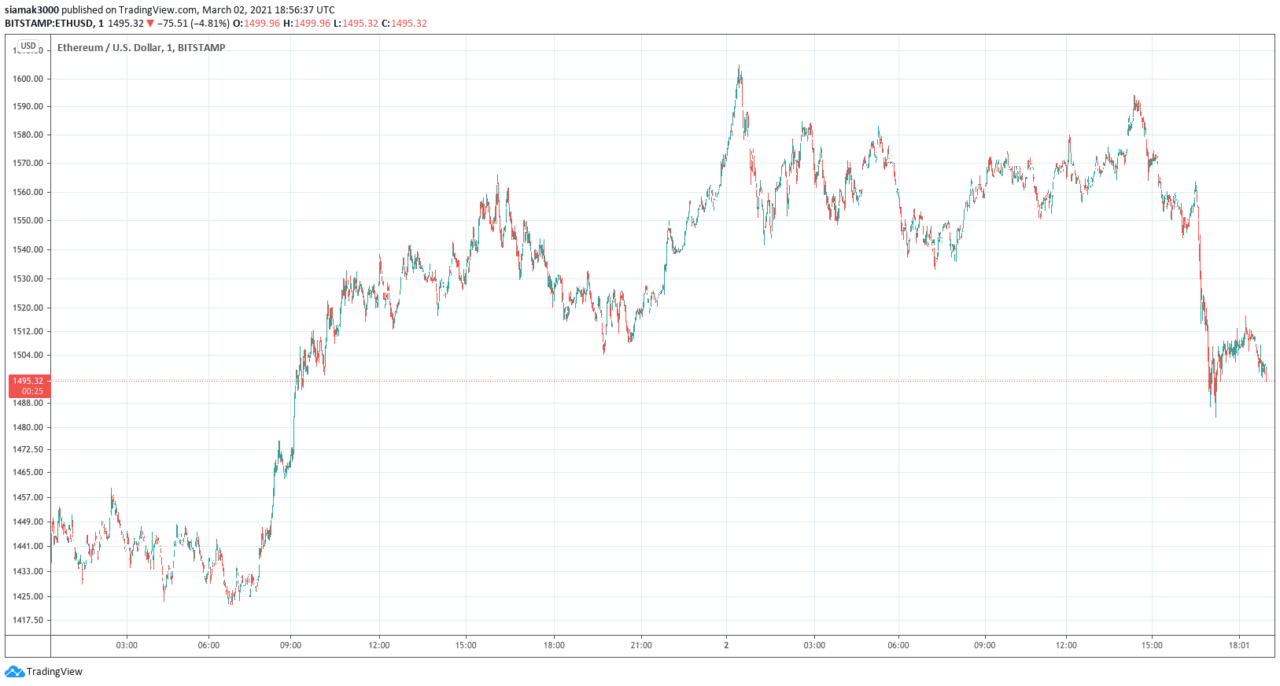

Data from TradingView tells us that on crypto exchange Bitstamp Ethereum price reached today’s intraday high of $1604.99 at 00:25 UTC (which was around the same time that the Bitcoin price reached its intraday high of $50,250).

According to data by CryptoCompare, as of 19:00 UTC on March 2, Ethereum is trading around $1499.23, down 1.7% in the past 24-hour period, but up 103.39% in the year-to-date period.

Although a 100%+ price appreciation in just over two months is pretty impressive, Ethereum reached its all-time high of $2040.62 less than two weeks ago (on February 20). But even $2000 is nothing compared to some of the price targets that we have seen recently from prominent crypto analysts and influencers. Here, we will look at a few of the more well-known predictions that have been made in 2021.

First, on January 7, former hedge fund manager Raoul Pal, who is the CEO of finance and business video channel Real Vision, said that Metcalfe’s Law suggests that “ETH might well go to $20,000 this cycle.”

Second, on January 22, macroeconomist and crypto analyst Alex Saunders, who is Founder and CEO of Nugget’s News, raised his ETH price target to $10,000, and he gave plenty of reasons for such bullishness:

Third, on February 26, popular New Zealand-based crypto analyst Lark Davis came up with the same price target as Saunders:

And finally, Ethereum consultant Ryan Berckmans explained yesterday (March 1) why he expects the ETH price to reach $20,000:

He then went on to say:

- “EIP-1559 redirects ~35% of miner revenue to ETH holders by burning a portion of fees. Note that this fee redirection is secure because ethereum has temporarily overpaid for security. Last year, we paid miners $300M+ more than if EIP-1559 had been live.“

- “Switching to proof of stake redirects ~100% of miner revenue to ETH holders. That’s because proof of stake validators are so cheap that they’re effectively free compared to proof of work miners. Yesterday, proof of stake would have saved ~$30M for ETH holders.“

- “EIP-1559 likely launches in July with the “London” hard fork. Next year, ethereum switches to proof of stake. Ethereum may produce $20b+ in cash for ETH holders during our first year using proof of stake. imo, this cash machine will greatly help us get to ETH at $20k.“

Ethereum ETFs

On Thursday (February 25), CI Global Asset Management (“CI GAM”) announced that it has “filed and obtained a receipt for a preliminary prospectus” in Canada for CI Galaxy Ethereum ETF (“ETHX”). Once it has been launched, it should be the first Ether (ETH) ETF in the world.

Kurt MacAlpine, CEO of CI Financial, the parent company of CI GAM, had this to say:

“Cryptocurrencies are transforming the financial world, and we are excited to launch the world’s first ETF investing directly in Ether, one of the most highly valued cryptocurrencies…

“CI is quickly establishing a leadership position in this space, having launched CI Galaxy Bitcoin Fund and recently filing a preliminary prospectus for CI Galaxy Bitcoin ETF, in partnership with blockchain and cryptocurrency experts Galaxy Digital. With these funds, we are reducing the friction points that investors have traditionally faced in buying and holding cryptocurrencies. CI Galaxy Ethereum ETF is an important addition to that lineup as this emerging asset class gains increasing interest and validation.“

CI Galaxy Ethereum ETF will trade on the Toronto Stock Exchange (STX) under the ETHX ticker. It will “invest directly in Ether with its holdings priced using the Bloomberg Galaxy Ethereum Index (‘ETH Index’), which is designed to measure the performance of a single Ether traded in U.S. dollars.” The ETH Index is owned and managed by Bloomberg Index Services Ltd.

Well, earlier today, another Canadian firm — Toonto-based Evolve Funds Group Inc. (aka “Evolve ETFs”) — announced that it had “filed a preliminary prospectus with the Canadian securities regulators for the Ether ETF.”

Raj Lala, President and CEO at Evolve, had this to say:

“As a leader in disruptive innovation, we look forward to providing Canadian investors with access to another leading cryptocurrency through an ETF structure… Cryptocurrencies are fundamentally transforming digital finance and Evolve is quickly establishing itself as a leading facilitator for investing in this space. Ether is a digital asset that is not issued by any government, bank or central organization and was intended to complement rather than compete with bitcoin.“

Evolve’s press release went on to say:

“The investment objective of ETHR is to provide investors with exposure to the daily price movements of the U.S. dollar price of Ether while experiencing minimal tracking error by utilizing the benefits of the creation and redemption processes offered by the exchange traded fund structure.“

NFT Mania Continues

On Sunday (February 28), Rolling Stone reported that Elon Musk’s girlfriend, Canadian musician Claire Elise Boucher, better known as “Grimes”, was “auctioning off 10 exclusive pieces of digital artwork — in the form of non-fungible tokens (NFTs) — for the next 48 hours.”

Well, yesterday, Tyler Winklevoss, Co-Founder and CEO of Gemini, which acquired NFT art marketplace Nifty Gateway in late 2019, said that Grimes had managed to sell her NFTs for over $5.8 million.

The Verge, which also reported on the results of this auction yesterday, had this to say about NFTs:

“If you’re totally perplexed as to what’s happening here, welcome to the party. After slowly growing in popularity over the past several months, NFTs exploded over the past week or so as the hot new tech thing…

“NFTs allow buyers to support artists, but it also gives buyers a couple things in return. Buyers may not get to hang these digital pieces on their wall, but they might get bragging rights for purchasing a famous work like Nyan Cat or something from a popular artist like Grimes. NFTs are also a speculative asset, and many marketplaces have popped up that offer the ability to resell them — theoretically for a lot more, so long as the hype around NFTs continues.“

ETH 2.0 Beacon Chain Validators

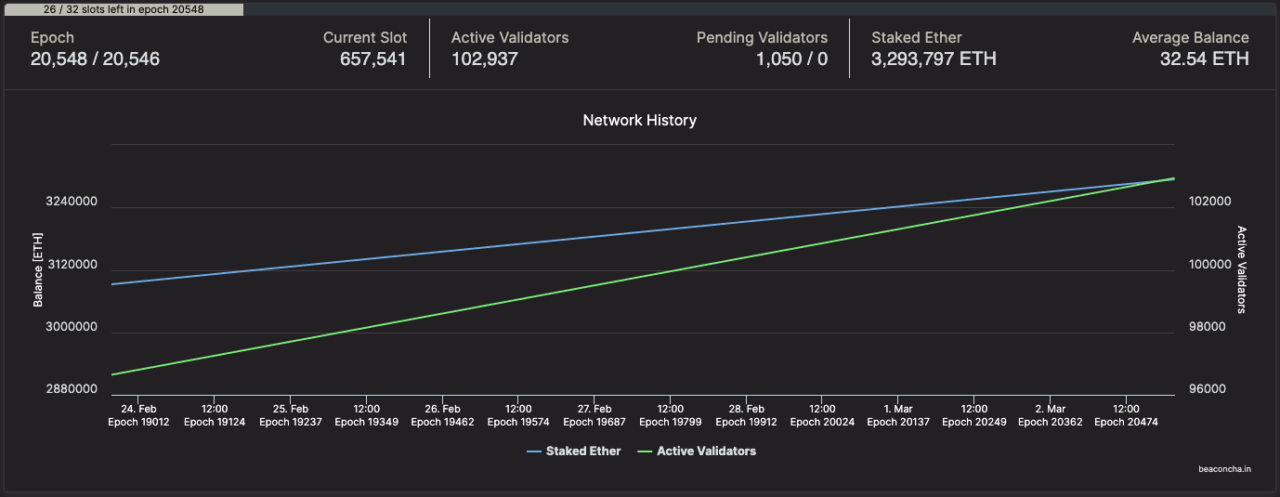

Bitfly’s ETH 2.0 Beacon Chain explorer tool tell us that as of 19:50 UTC on March 2, there are 102,937 active validators, with around 3.29 million ETH (worth roughly $4.92 billion) staked.

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.