According to Tesla’s latest annual report (on Form 10-K), which has been filed with the U.S. Securities and Exchange Commission (SEC), the electric car maker has already invested $1.5 billion in Bitcoin.

The relevant section of the annual report reads:

“We hold and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.

“The prices of digital assets have been in the past and may continue to be highly volatile, including as a result of various associated risks and uncertainties. For example, the prevalence of such assets is a relatively recent trend, and their long-term adoption by investors, consumers and businesses is unpredictable. Moreover, their lack of a physical form, their reliance on technology for their creation, existence and transactional validation and their decentralization may subject their integrity to the threat of malicious attacks and technological obsolescence. Finally, the extent to which securities laws or other regulations apply or may apply in the future to such assets is unclear and may change in the future. If we hold digital assets and their values decrease relative to our purchase prices, our financial condition may be harmed.

“Moreover, digital assets are currently considered indefinite-lived intangible assets under applicable accounting rules, meaning that any decrease in their fair values below our carrying values for such assets at any time subsequent to their acquisition will require us to recognize impairment charges, whereas we may make no upward revisions for any market price increases until a sale, which may adversely affect our operating results in any period in which such impairment occurs. Moreover, there is no guarantee that future changes in GAAP will not require us to change the way we account for digital assets held by us.

“Finally, as intangible assets without centralized issuers or governing bodies, digital assets have been, and may in the future be, subject to security breaches, cyberattacks or other malicious activities, as well as human errors or computer malfunctions that may result in the loss or destruction of private keys needed to access such assets. While we intend to take all reasonable measures to secure any digital assets, if such threats are realized or the measures or controls we create or implement to secure our digital assets fail, it could result in a partial or total misappropriation or loss of our digital assets, and our financial condition and operating results may be harmed.“

Of course, the two main takeaways are:

- In January 2021, Tesla invested “an aggregate $1.50 billion in bitcoin” and “may acquire and hold digital assets from time to time or long-term.”

- Tesla is expecting to “begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.”

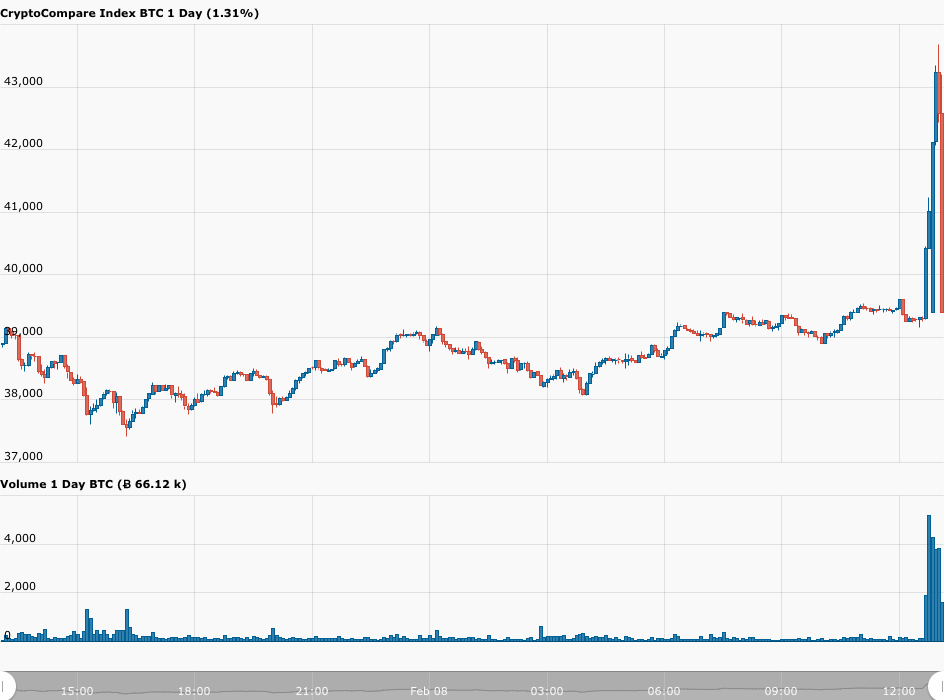

Shortly after this news came out, the Bitcoin price start surging toward new new all-time highs. According to data by CryptoCompare, currently (as of 13:05 UTC on February 8), Bitcoin is trading at $42,893, up 10.86% in the past 24-hour period.