On Thursday (January 21), Tom Jessop, President of Fidelity Digital Assets, talked during an interview about potentially upcoming regulations that the crypto community could expect to see under the Biden administration.

On 15 October 2018, Boston-headquartered American multinational financial services company Fidelity Investments announced via a press release the launch of a new company, Fidelity Digital Asset Services, which would offer “enterprise-quality custody and trade execution services” for cryptocurrencies to institutional investors (such as “hedge funds, family offices and market intermediaries”).

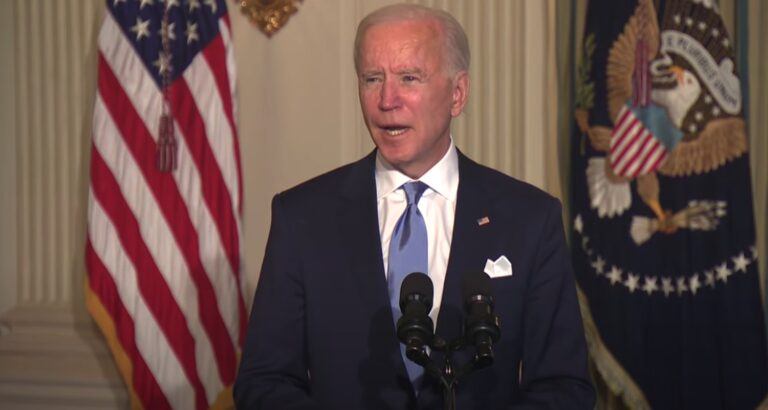

Earlier today, Jessop was asked during an interview on CNBC’s “Squawk Alley” how cryptocurrencies would fare under President Joe Biden’s administration.

Jessop started by saying that the nomination of Gary Gensler as the Chairman of the U.S. Securities and Exchange Commission (“SEC”) “paints some more generally constructive attitude or picture in terms of what we might expect going forward” given Gensler’s experience in the crypto space.

He then went on to add:

“… even predating this news, we started to see more constructive engagement with the regulators, and we think that will persist into the new year just given what we’re seeing in terms of institutional and as well as retail demand, which was alluded to in the prior session.“

Jessop then commented on the negative comments about cryptocurrencies that were made by Janet Yellen (Biden’s nominee for Treasury Secretary) at a Senate hearing on Tuesday (January 19).

Jessop replied:

“I think there’s an interesting report that will be issued by one of the companies that does forensic blockchain analysis, which is a tool that we rely on in terms of operating our business, and they do an annual report on illegal or illicit activity on the Bitcoin blockchain by actually looking at network activity and the preview of this report is that on an absolute basis they estimate the illegal activity on the blockchain dropped…to $10 billion last year and just given the overall transactions volume increases on the Bitcoin blockchain as a percentage of total activity, it’s something like 3/10 of one percent.

“So, I think when we think about this concern, it is a valid concern, but I think that there are perhaps other places to look in call it the non-digital economy where this activity is occurring with greater frequency and greater size. So, I would not diminish the risk, but I think the risk is potentially smaller than people might suggest it to be, and it’s diminishing or declining on year-on-year basis, which again is positive in terms of further development of this ecosystem.“