This article provides an update (as of 08:45 UTC on 29 January 2021) on the latest thinking on Bitcoin by influential crypto analysts, investors, and traders, and other thought leaders.

Bitcoin’s Price Action

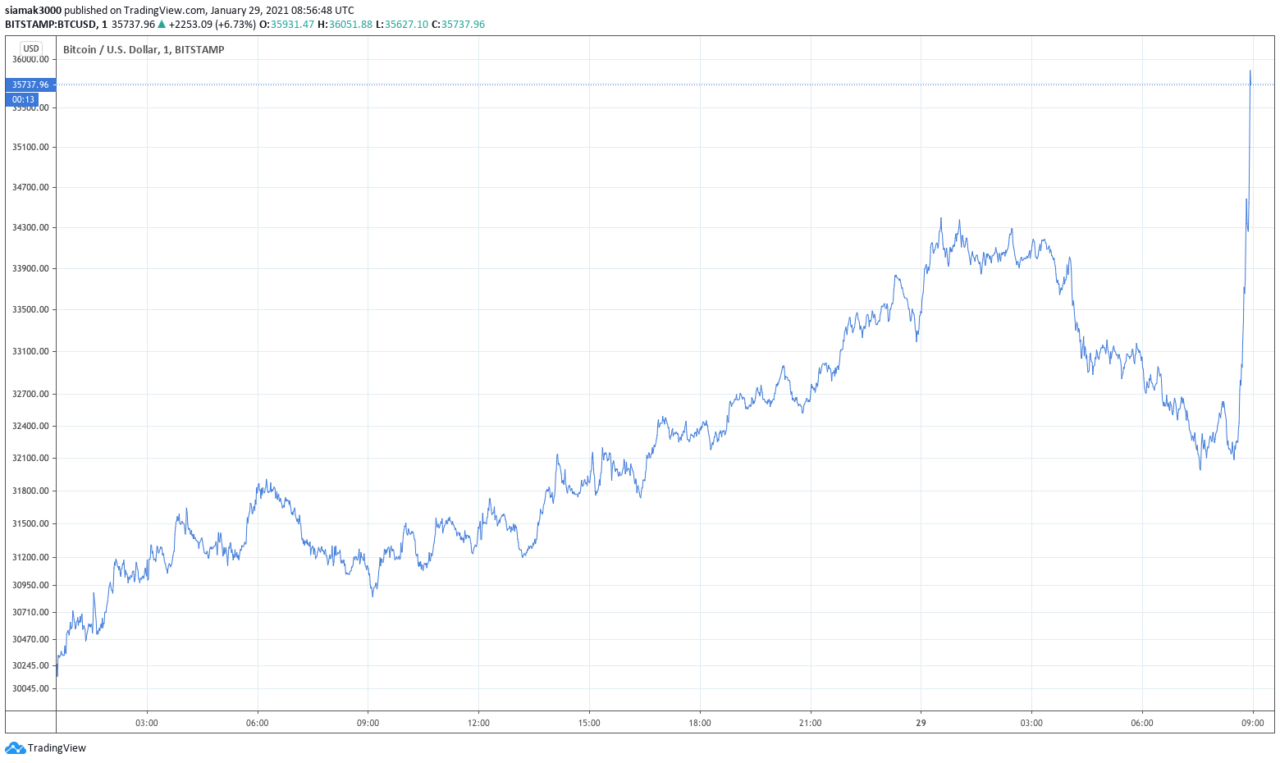

According to data by TradingView, on crypto exchange Bitstamp, Bitcoin traded in the range $29,943 (at 00:222 UTC) – $33,836 (at 23:19 UTC) on Thursday (January 28).

Around 07:34 UTC on January 29, Bitcoin was trading on Bitstamp at $31,990. Less than one hour later (at 08:29 UTC), Bitcoin was trading at $32,086. Then, the Bitcoin price went vertical, and 31 minutes later, it had reached $36,986.

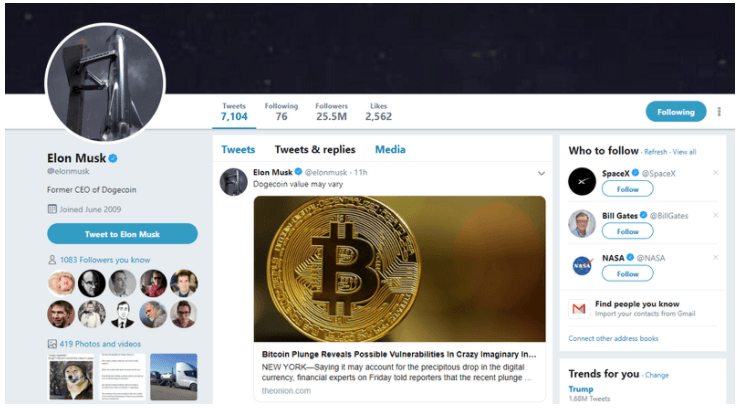

The most likely explanation for this is that Bitcoin’s price surge started around the same time that Tesla CEO Elon Musk updated his Twitter bio to consist of just the hashtag “#bitcoin”.

Many people in the crypto community seem to be considering Elon’s action as very bullish for Bitcoin since they are assuming that it means Tesla is considering using Bitcoin as a Treasury reserve asset in the same way that MicroStrategy is.

However, this is not the first time that Musk has mentioned crypto in his bio. For example, on 2 April 2019, he temporarily changed his Twitter bio to say “CEO of Dogecoin”, and then changed it several hours later to “Former CEO of Dogecoin”.

The more likely explanation might be that Musk knows that Bitcoin is red-hot right now and he is deliberately being cryptic in his mention of Bitcoin to get even more people talking about him and Tesla; if this explanation is correct, then this is another genius marketing move by Musk. It is also worth noting that Musk is well aware that the U.S. SEC does not appreciate CEOs making pre-announcements about their company’s material events via Twitter.

In any case, the Tesla CEO’s endorsement of Bitcoin, even in this form, should help to drive further retail interest toward Bitcoin, which could help to extend Bitcoin’s current rally to a new all-time high above $42,000.

Currently (as of 08:33 UTC on January 28), per data by CryptoCompare, Bitcoin is trading around $37,682, up almost 20% in the past 24-hour period and up 30% in the year-to-date period.

Crypto analyst Alex Krüger had this to say about Bitcoin’s latest price action:

And this is what data Scientist Rafael Schultze-Kraft, Co-Founder and CTO of on-chain market intelligence startup Glassnode, said about the short liquidations that occurred on Binance as a result of Musk’s tweet:

Ray Dalio’s Latest Thoughts on Bitcoin

On 17 November 2020, the day that Bitcoin smashed through the $17,000 level, legendary billionaire hedge fund manager Ray Dalio admitted that his assumptions about Bitcoin might be incorrect.

Dalio is the founder, chairman, and co-chief investment officer of Bridgewater Associates.

The 71-year American whose net worth is estimated to be around $18.7 billion created asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $138 billion in assets under management as of April 2020, and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

Then, yesterday (January 28), in a post (titled: “What I Think of Bitcoin”) published on the Bridgewater website, Dalio shared his latest thoughts on Bitcoin.

He started with praise for Bitcoin:

“I believe Bitcoin is one hell of an invention. To have invented a new type of money via a system that is programmed into a computer and that has worked for around 10 years and is rapidly gaining popularity as both a type of money and a storehold of wealth is an amazing accomplishment...

“It seems to me that Bitcoin has succeeded in crossing the line from being a highly speculative idea that could well not be around in short order to probably being around and probably having some value in the future.“

What he is not sure about is future demand for Bitcoin, since for example there may be regulatory obstacles that make its use more difficult:

“The big questions to me are what can it realistically be used for and what amount of demand will it have. Since the supply is known, one has to estimate the demand to estimate its price... I suspect that Bitcoin’s biggest risk is being successful, because if it’s successful, the government will try to kill it and they have a lot of power to succeed.“

However, he did end on this positive note:

“I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets.“

Kingfisher Capital Invests in Bitcoin

Kingfisher Capital, a North Carolina based privately owned and independently managed financial services firm, informed the U.S. SEC via a filing that appeared on the SEC website yesterday (January 28) that it had purchased 10,667 shares of Grayscale’s Bitcoin Investment Trust (GBTC).

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.