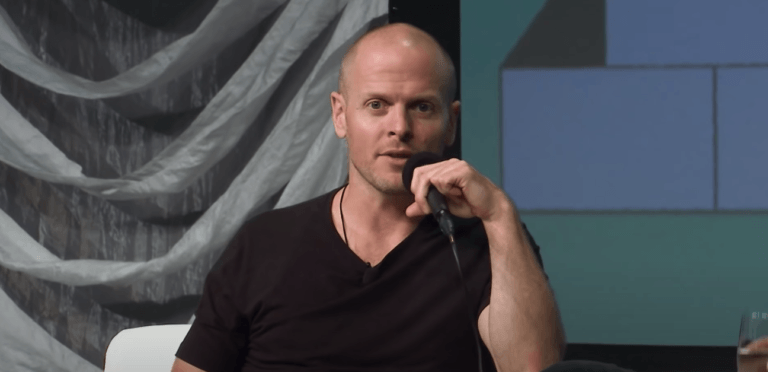

Recently, highly successful investor and author Tim Ferriss talked about his experience with Bitcoin during a chat with serial entrepreneur and angel investor Kevin Rose.

Ferriss has an impressive bio. Ferriss has been listed as one of Fast Company’s “Most Innovative Business People” and one of Fortune’s “40 under 40.” He is an early-stage technology investor/advisor (Uber, Facebook, Shopify, Duolingo, Alibaba, and 50+ others) and the author of five #1 New York Times and Wall Street Journal bestsellers, including The 4-Hour Workweek and Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers.

As for Rose, he is a partner at early-stage venture capital firm True Ventures. Previously, he was a General Partner at Google Ventures.

On January 7, the day that the price of Bitcoin went above $40,000 for the first time — and four days after Bitcoin’s 12th birthday — Ferriss asked his followers on Instagram “which developing country will be the first to embrace BTC (or other crypto) as a reserve currency.”

Ferriss’ Instagram post featured a photo of his Zimbabwean one-hundred trillion dollar note.

In this post, Ferriss wrote:

“Zimbabwean dollars in 2008 = US dollars in 2040? Probably not, but looking at examples of ultra-inflation, the position of ‘that can’t happen to a reserve currency’ is wishful thinking.

“Reserve currencies have changed throughout history and will continue to change. Hell hath no fury like holders of a debased currency.”

He then posed the following question to fans of cryptocurrencies:

“Which developing country will be the first to embrace BTC (or other crypto) as a reserve currency, and when do you think it will happen?“

Well, yesterday, Ferriss released episode #493 (title: “The Random Show — Bitcoin Pros and Cons, 2021 Resolutions, Fave Books, Lucid Dreaming, Couples Therapy, and More”) of “The Tim Ferriss Show” podcast. This episode featured a conversation with Rose that took place on January 8.

During this conversation, Ferriss made a number of interesting comments about crypto in general and Bitcoin in particular.

When Ferriss Got Into Crypto

“I got into crypto in a meaningful way right before that crash in 2017. So if I had consequently sold all of it, I would have done so at a pretty massive loss, and I was like, well, look I’m playing with house money in the sense that I can afford to lose whatever I am putting into crypto, so I’ll just hold on to it...”

Why Ferriss Got Into Crypto

“The premise that I used, or the set of assumptions I used to get into crypto, ended up being totally wrong in a lot of ways, at least in the sense that I was investing in crypto as a hedge specifically against, say, a huge drop in the stock market since I had a few different pending IPOs…“

“I decided to become involved with crypto also because if you’re in certain social circles with certain very smart people… it’s easy to get intoxicated and it’s easy to kind of walk into this reality distortion field where you’re like ‘the world is going to Mad Max in the next 48 hours and crypto will be all that survives’…“

The Crypto Market Crash in March 2020

“With Covid, a lot of Bitcoin bulls and so on were expecting that Bitcoin would be inversely correlated with these crashes… but that’s not what happened, not what happened with gold either, and I think what was underestimated was how many people would need cash.

“When you need cash, you sell whatever you happen to have… For instance, a lot of people got themselves into trouble by borrowing against assets. So, they took out, say, lines of credit based on the value of their stocks and then when the stocks cratered, those all got called… and they had to sell anything they could sell that was liquid and that would include a lot of crypto. So, it took a few months for crypto to recover to pre-Covid…“

What Made It Easier for Ferriss to HODL Bitcoin

“I just happened to have this combination of ignorance and laziness which led me to hold on to the Bitcoin that I had.“

How the Current Bitcoin Rally Is Different From the One in 2017

“There are differences — huge differences — between right now and 2017, namely the entry of institutional investors, and yes just a few months ago, Paul Tudor Jones and some other legends kind of dipping their toe in the water and beginning to make some allocations in their portfolios…“

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.