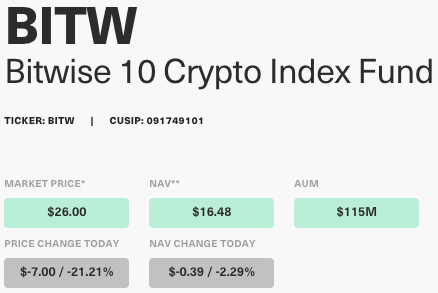

On Wednesday (December 9), Bitwise Asset Management, a leading provider of index and beta funds for the crypto market, announced that shares of the “Bitwise 10 Crypto Index Fund” will start public quotation on OTCQX today under the ticker symbol “BITW”.

There are two ways to buy BITW shares:

- Retail investors can buy BITW shares via brokerages such as Pershing, Charles Schwab, E*TRADE, Fidelity, and TD Ameritrade.

- Accredited investors and entities can purchase BITW shares via private placement.

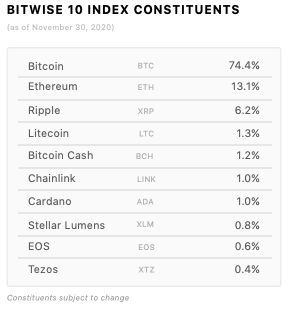

According to the Bitwise 10 Crypto Index Fund’s Fact Sheet, the fund (which was launched in 2017) “employs a research-driven investment approach that seeks to provide market-cap-weighted exposure to the 10 largest cryptoassets, accounting for approximately 80% of the cryptomarket.” It is rebalanced monthly. The fund’s assets are “held in 100% cold storage with a regulated, insured custodian, and are audited annually.”

Bitwise says that the fund “debuts with approximately $120 million in assets under management.”

Hunter Horsley, co-founder and CEO of Bitwise Asset Management, had this to say:

“The unprecedented events of 2020 have motivated many to invest in crypto for the first time. With BITW, investors can now get exposure to Bitcoin, Ethereum, and other cryptocurrencies without trying to pick winners or having to constantly monitor the rapid changes in the space.”

Matt Hougan, Bitwise’s Chief Investment Officer, stated:

“Crypto is the best-performing asset class in the world this year, and the outlook for 2021 is strong. The start of public trading for shares of BITW will make it significantly easier for financial advisers, family offices, individuals, and institutional funds to allocate to the space. We believe the Fund offers a robust, one-stop solution.”

Thomas Lee, Co-Founder, Managing Partner, and Head of Research at independent research boutique Fundstrat Global Advisors, seems to understand what a “huge deal” today’s announcement is: