It was this day 12 years ago that Satoshi Nakamato, the pseudonymous creator of Bitcoin, released its white paper. However, Bitcoin HODLers have one more reason to celebrate today (and it has nothing to do with Halloween).

It was on 31 October 2008 that Satoshi released Bitcoin’s white paper, which was titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. The original goal for Bitcoin was to be “a purely peer-to-peer version of electronic cash” that “would allow online payments to be sent directly from one party to another without going through a financial institution.”

This is how Satoshi anounced the release of this white paper on the Cryptography Mailing List:

Hal Finney, the person person to receive BTC from satoshi, wrote eight days later that if Bitcoin one day became the “dominant payment system in use throughout the world”, each Bitcoin could be worth $10 million.

On 3 January 2019, the Bitcoin network went live with Satoshi mining the genesis block of bitcoin (block number 0), which had a reward of 50 BTC.

Dr. James Angel, associate professor at Georgetown University’s McDonough School of Business, told Cointelegraph:

It has set in motion a revolution in finance with the rise of DeFi apps, smart contracts, and coin offerings, in addition to a payment revolution that is leading to central bank digital currencies.

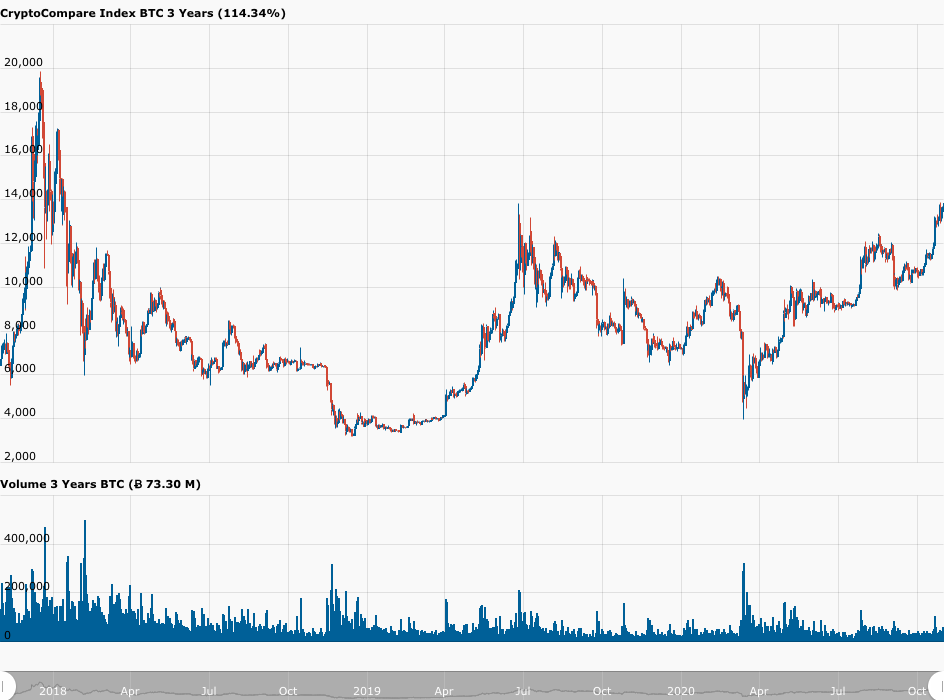

Well, this Saturday, Bitcoin HODLers have not only the 12th anniversary of Bitcoin’s paper to celebrate because, according to data from CryptoCompare, at 10:05 UTC the Bitcoin price reached the intraday high of $14,077. This was the first time that the BTC price has been above the $14,000 level since 15 January 2018, as you can see from the 24-hour and three-year BTC-USD price charts shown below:

Since then, Bitcoin has retraced a bit, and currently (as of 17:05 UTC on October 31), Bitcoin is trading around $13,823, up 2.11% in the past 24-hour period.

Although throughout most of the COVID-19 pandemic Bitcoin has behaved like a risk-on asset, Bitcoin’s performance as an asset during this month has been pretty impressive. Despite all the fear and uncertainty that Bitcoin has faced as the result of concerns over the second/third wave of COVID-19 (and the resulting lockdowns around the world, especially in Europe), fiscal stimulus talks in Washington, the upcoming U.S. presidential election, Bitcoin is currently on track to end this month up 28.24%.

Yesterday, angel investor Qiao Wang, a former Director of Products at Messari, said that Bitcoin’s amazing resilience in the face of all of these challenges suggested that we are in the “early stage” of a Bitcoin bull market:

And earlier today, South Korean blockchain analytics startup CryptoQuant said that on-chain data is telling them that there are fewer people depositing Bitcoin into crypto exchanges, which is of course bullish for Bitcoin since fewer deposits suggests lower selling pressure.

Featured Image by “PublicDomainPictures” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.