Former macro hedge fund manager Raoul Pal explained on Thursday (August 27) why the Federal Reserve’s desire for higher inflation (at least for now) is good for both gold and Bitcoin.

Prio to founding macro economic and investment strategy research service GMI in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives.

Also, currently, Pal is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

In the April 2020 issue of the “Global Macro Investor” (GMI) newsletter, Pal explained why he believes that Bitcoin, which he calls “the future”, could have a $10 trillion valuation in the future.

In that issue, Pal said that the idea of a $10 trillion valuation for Bitcoin is not so crazy:

“After all, it isn’t just a currency or even a store of value. It is an entire trusted, verified, secure financial and accounting system of digital value that can never be created outside of the cryptographic algorithm.

“It is nothing short of the future of our entire medium of exchange system, and of money itself and the platform on which it operates.”

Well, on Thursday (August 27), at 09:10 ET (i.e. 13:10 UTC), Fed Chair Jerome Powell gave a speech titled “Challenges and the Fed’s Monetary Policy Review” at this year’s (virtual) Jackson Hole Economic Symposium.

This annual symposium, which is sponsored by the Federal Reserve Bank of Kansas City, had been held in Jackson Hole, Wyoming since 1981, but this year, due to the current COVI-19 pandemic, it took place in the form of a virtual conference.

The Federal Reserve Bank of Kansas City says that typically, around 120 people attend each year, and they come from the following groups: financial organizations (8%), academics (24%), central bankers (45%), media (12%), the federal reserve system (25%), and government (5%).

After Powell’s historic speech ended, both gold and Bitcoin went up a little, but shortly thereafter gave up these gains.

Pal then took to Twitter to comment on the Fed’s new stance on inflation and how he expects this to affect the future of gold and Bitcoin.

He started by saying that the Fed has “no desire to raise rates and a skewed desire to print more”, which “plays to the inherent upside skew in both assets,” and that he expects both of these hard assets to “rise over time” regardless of whether we get higher inflation or deflation.

With regard to the latter, this is how he explains it:

“Powell has shown that there is ZERO tolerance for deflation so they will do ANYTHING to stop it, and that is good for the two hardest assets – Gold and Bitcoin”

As for high gold and Bitcoin could go, Pal says:

“Overall, I think #Bitcoin outperforms gold. Gold can go up 2x or 3x or even 5x while bitcoin can go up 50x or even 100x”

He believes that on a risk-adjusted basis, Bitcoin should vastly outperform gold:

“Gold has maybe 25% downside and Bitcoin 50%, so risk adjusted $BTC kills it.”

Pal says there is only one scenario that is not good for gold or Bitcoin:

“The scenario that this doesn’t work is a persistent 1.5% growth and 1.5% inflation. That is not the sweet spot for Gold or Bitcoin…that is the death of the dollar and EM outperformance. That is a trade for another day.”

In the mean time, Pal offers the following advice:

“HODL, DCA and Stack Sats.”

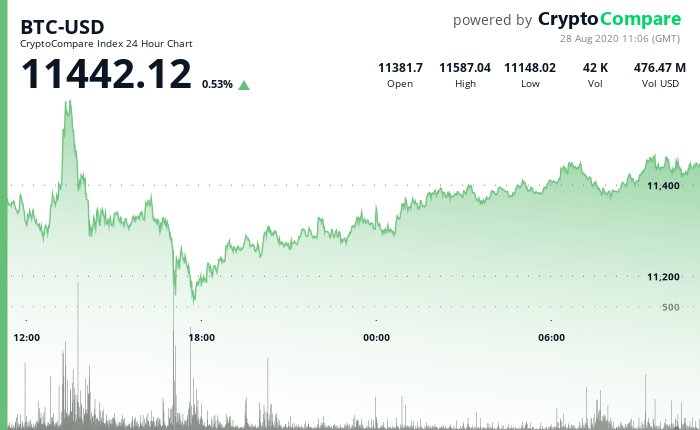

Currently (as of 11:06 UTC on August 28), according to data from CryptoCompare, Bitcoin is trading around $11,442, up 0.53% in the past 24-hour period:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.