Goldman Sachs are reportedly planning to offer a custody service for crypto funds.

According to a report in Bloomberg, the leading Investment Bank is considering a plan that would see them holding crypto-securities on behalf of funds – with the goal of reducing client-risk in holding the investments and protecting funds from attacks.

Although the sources behind the news (who remain unidentified) emphasised that there has been no timeline put in place for the new services, they did suggest that a new custody set-up could precede other services such as prime brokerage.

A spokesperson for Goldman Sachs addressed the rumours:

In response to client interest in various digital products we are exploring how best to serve them in this space. At this point we have not reached a conclusion on the scope of our digital asset offering.

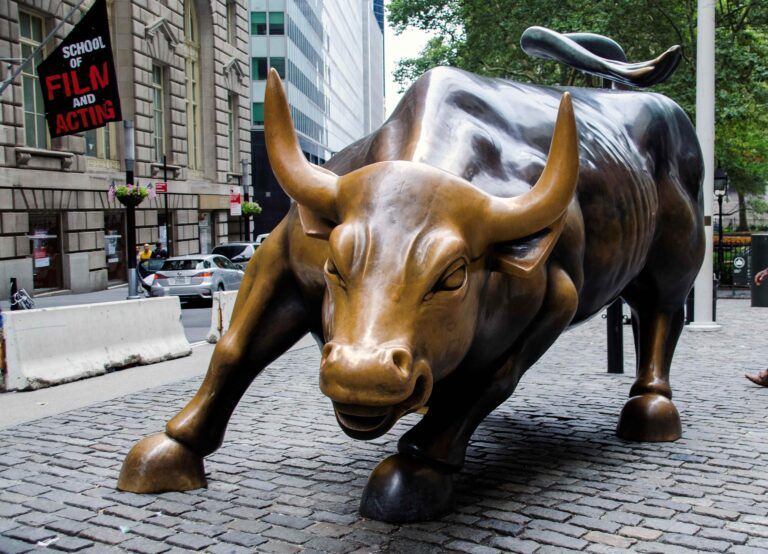

Bullish?

With many inside the cryptocurrency industry looking for increasing signs of institutional investment, the news will come as welcome relief.

If confirmed, these plans would be a significant endorsement of cryptocurrency markets as other Wall Street heavyweights such as JP Morgan Chase and Bank of New York Mellon also explore crypto-custody options.

With the recent announcement by ICE (Intercontinental Exchange) the New York Stock Exchange’s (NYSE) parent company, of a new Microsoft-backed digital assets platform, CoinShares Chief Strategy Officer, Meltem Demirors, however, took a more cynical approach to the news:

nicely played, Goldman marketing team! they’ve been trying to plant the flag since early 2017 but ICE just steamrolled them.https://t.co/dhWwPQWc7s

— Meltem Demirors (@Melt_Dem) August 6, 2018