Bitcoin has been on somewhat of a mini-bull run in the last two weeks – this week managing to break $8,000 for the first time since May.

Often in times of market movement, it can be instructive to look at what Google trends show about sentiments that might be driving a surge in the price of a cryptocurrency.

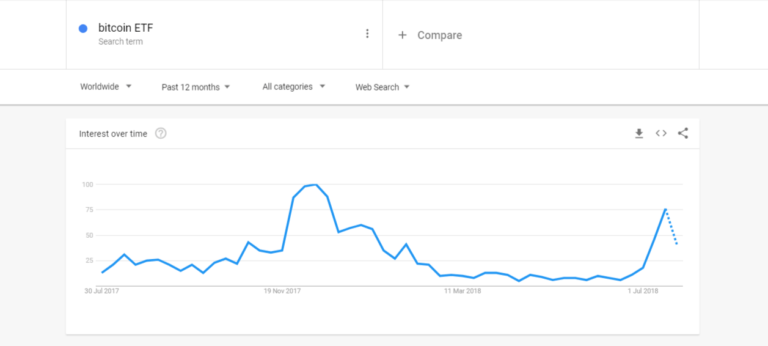

With many suspecting that anticipation of the SEC decision regarding bitcoin ETFs (Exchange Traded Funds) is driving much of the current bullish price movement, it is interesting to compare Google trends data for related search terms.

First and foremost, search interest in “bitcoin ETFs” has surged dramatically in July – almost approaching the numbers of last November and December’s enormous bull run – as can be seen in the title graph.

This while by no means proving a causal link – nicely correlates with the change in bitcoin’s price recently – suggesting that anticipation of the SEC’s ETF decision might be playing a part.

By comparison – the search term “bitcoin futures” – widely believed to be a factor in the bull-run of late 2017, has remained very low this year – relative to its enormous December heights:

“Buy the Rumour, Sell the News”

As researchers from the San Francisco Federal Reserve and many have argued – the sudden fall in price following the introduction of bitcoin futures in December was unlikely a coincidence, with the Fed paper explaining it to be “consistent with trading behavior that typically accompanies the introduction of futures markets for an asset.”

Source: CryptoCompare

Source: CryptoCompare

Often colloquially known as “buy the rumour, sell the news” it’s not hard to argue that this type of phenomenon was a significant part of bitcoin’s stellar bull-run. Known to have a recursive effect whereby investors buy even more once they realise that a surge is related to anticipation, it seems likely that the arrival of futures – as well as the idea that this spelt greater instutional acceptance of crypto – was at play.

What is interesting for traders, investors and the industry as a whole therefore, is whether a similar phenomenon is on the cards if and when the SEC approves bitcoin-related ETFs.

With the decision expected some time in mid-August, popular crypto-twitter figure ArminVanBitcoin urged the community to instead look to the long-term:

ETF scenarios…

Not approved: Price crashes. 📉

Approved: Price pumps, then crashes hard from whales selling the news. 📉Invest long term, ignore the noise. 🍻#bitcoin

— A v B ⚡ (@ArminVanBitcoin) July 24, 2018