On 13 November 2022, crypto analyst Benjamin Cowen shared his technical analysis of the Ethereum ($ETH) price action, and explained why he believes that this bear market could take the $ETH price to as low as $600.

According to a report by the Daily Hodl, Cowen said:

“We’ve talked about this throughout this year and the general expectation is that Ethereum goes through a series of bull runs, but It ultimately just heads home at the end of the day and that’s back to its logarithmic regression band fit to “non-bubble data” and we’re sort of seeing that same trend take place for the fifth time…

“If you remember back to 2018, the drawdown that Ethereum had was about 95% or so. I’m not saying Ethereum is going to go down 95%, but even if it went down, say 87%, which is what Bitcoin went down after its 95% bear market, that would still put Ethereum at $600…

“It takes a long time, I mean it’s taking a really long time for us to get there, but I do think we will get there eventually and it will take us going to those levels in the regression band, in my opinion, before we can actually support another bull run and support a sustained move in the market… Eventually, once we get down to levels that are really deep value, it might be time to sort of flip back to the bullish side…“

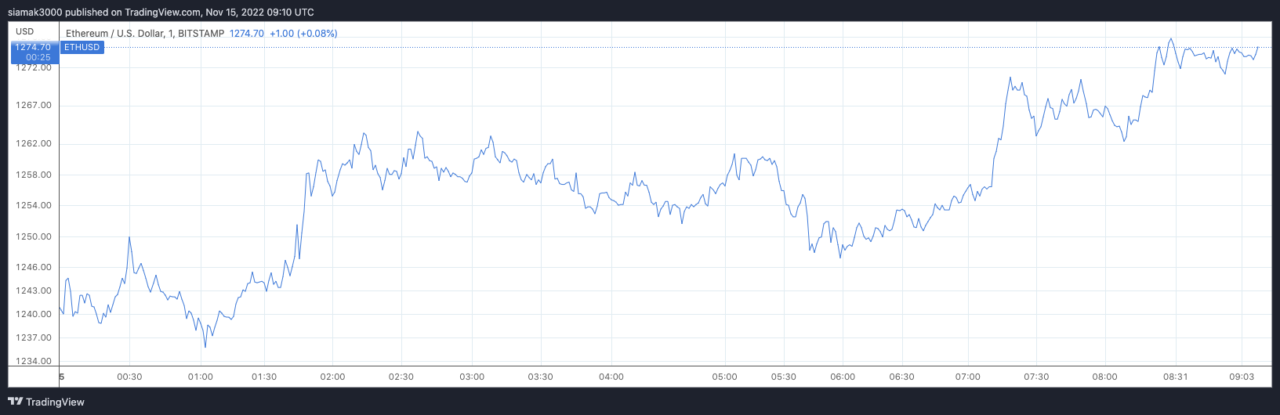

According to TradingView, currently (i.e. as of 9:10 a.m. UTC on 15 November 2022) $ETH is trading around $1,274, up 1.18% in the past 24-hour period. Since $ETH registered its all-time high of $4,878 on 10 November 2021, it has gone down 73.88% (vs USD).

According to a Citi research report released on Monday 31 October 2022, following the Merge, it appears that $ETH is on its way to becoming a deflationary asset. Per a report published by CoinDesk on 2 November 2022, analysts led by Joseph Ayoub had this to say about $ETH in their report:

“Ether looks like it could be moving towards a deflationary future as it exhibits periods of deflation amidst low network activity.“

The CoinDesk report went on to say:

“Citi says the switch to PoS has removed about 564,000 ETH from circulation in the six weeks since the Merge, compared with if PoW issuance was still occurring. In U.S. dollar terms this represents about $870 million. Annualized, it equates to a reduction of about $7.7 billion in active ETH supply following the transition to PoS.“

Image Credit

Featured Image via Pixabay