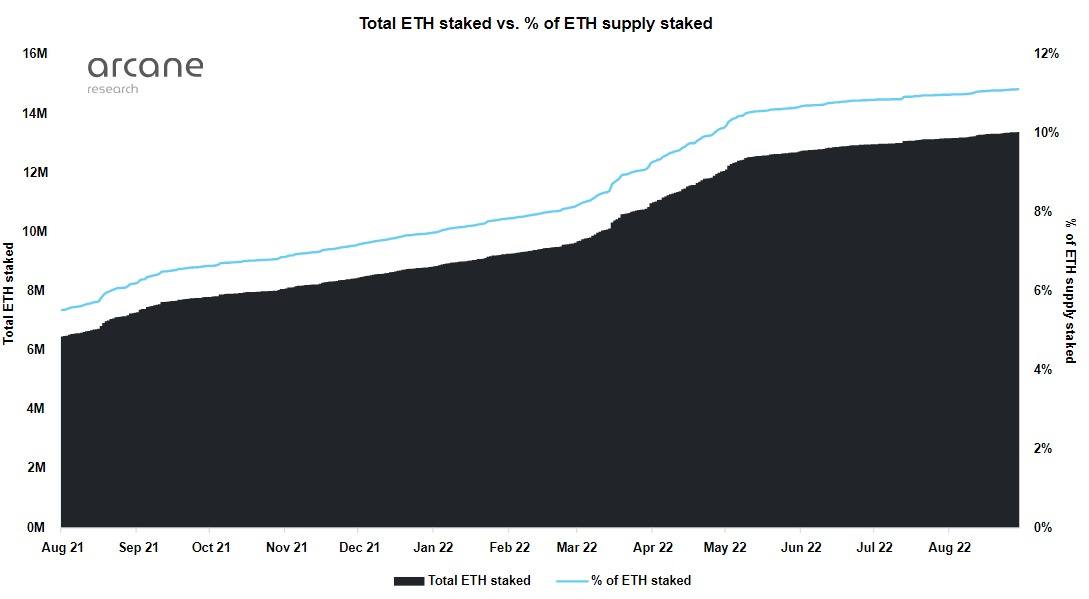

The total amount of Ethereum ($ETH) staked on the network ahead of its major Merge upgrade has more than doubled in a single year, despite the price of ETH declining by 51% year-over-year.

According to a post by Arcane Research, staked Ethereum more than doubled from 6.5 million ETH to 13.4 million ETH in a year, representing around 11% of the cryptocurrency’s circulating supply. It’s worth noting that staked Ethereum cannot currently be withdrawn, with unlocking scheduled to start in 2023 after the Merge.

Per Arcane Research, “yield play” associated with staking Ethereum – as stakers are rewarded for validating transactions and helping secure the network – might be “the safest macro play” when withdrawals are unlocked.

The Ethereum Merge, which describes the network’s current mainnet merging with the Beacon Chain’s PoS system, setting the stage for future scaling upgrades, including sharding, is expected to occur on September 15.

The move is expected to reduce Ethereum’s energy consumption by 99.95% as instead of miners, there will be validators securing the network by staking their ETH holdings. Stakers need at least 32 ETH to run block-producing nodes and earn staking yields. Facilitating access to ETH staking are various services, including exchanges like Kraken and Coinbase, which allow users to stake less than the 32 ETH necessary to become a validator.

While some analysts suggested that after stakers were allowed to unstake their funds there would be a massive sell-off event, the ability to withdraw is a “major de-risking event that should lead to a net increase in the demand for staking” as the firm noted increased liquidity for staking positions would lead to more willingness to stake.

The post adds:

In addition, taxing the unstaked via dilution creates another incentive to stake: Burn can go to zero while stakers market share will continue to increase. The current ETH staking yield is 4% but will decrease as a larger percentage of ETH is staked.

As CryptoGlobe recently reported, a Bloomberg report has suggested Ethereum’s price may “drop to $1,000 for the first time in two months, with volatile price swings in the second-largest cryptocurrency ahead of its much-anticipated Merge upgrade.”

Image Credit

Featured Image via Unsplash