Two of the leading companies in the crypto space — CryptoCompare and Blockdaemon — announced on Wednesday (September 28) that they have joined forces to deliver a groundbreaking family of institutional-grade staking yield indices for five of the most popular proof-of-stake (PoS) assets, thereby enabling institutions to gain off-chain exposure to staking yield.

The CryptoCompare Blockdaemon Staking Yield Index Family is designed to measure the annualized daily staking yield generated by a particular PoS digital asset, allowing institutional investors to create total return and yield swap products, benchmark portfolios, conduct research, and more.

What Is Staking?

Here is how Binance Academy explains staking:

“You can think of staking crypto as a less resource-intensive alternative to mining. It involves holding funds in a cryptocurrency wallet to support the security and operations of a blockchain network. Simply put, staking is the act of locking up cryptocurrencies to receive rewards.

“In most cases, you’ll be able to stake your coins directly from your crypto wallet, such as Trust Wallet. On the other hand, many exchanges offer staking services to their users…

“PoS allows blockchains to operate more energy-efficiently while maintaining a solid degree of decentralization, at least in theory…

“Enter proof of stake. The main idea is that participants can lock coins (their “stake”), and at particular intervals, the protocol randomly assigns the right to one of them to validate the next block. Typically, the probability of being chosen is proportional to the amount of coins – the more coins locked up, the higher the chances.

“This way, what determines which participants create a block isn’t based on their ability to solve hash challenges, as it is the case with proof of work. Instead, it’s determined by how many coins they are holding.“

Who Are the People Behind This Family of Staking Yield Indices?

According to the press release shared with CryptoGlobe, the CryptoCompare Blockdaemon Staking Yield Index Family is the result of a collaboration between CryptoCompare and Blockdaemon.

London-headquartered and FCA-authorized CryptoCompare, which was founded in 2014 by Charles Hayter (CEO) and Vlad Cealicu, is the leading global cryptocurrency market data provider, giving institutional and retail investors access to real-time, high-quality, reliable market and pricing data on 5,300+ coins and 240,000+ currency pairs, as well as institutional-grade digital asset real-time and settlement indices.

By aggregating and analysing tick data from globally recognised exchanges, and seamlessly integrating different datasets in the cryptocurrency price, CryptoCompare provides a comprehensive, holistic overview of the market. To ensure the integrity of its data, CryptoCompare regularly reviews crypto exchanges, monitors for market abuse, and takes regional anomalies and geographical movements into consideration.

Blockdaemon, which was founded in 2017, is the leading independent blockchain node infrastructure to stake, scale, and deploy nodes with institutional-grade security and monitoring. Supporting 50+ cutting edge blockchain networks in the cloud and on bare metal servers globally, Blockdaemon is used by exchanges, custodians, crypto platforms, financial institutions and developers to connect commercial stakeholders to blockchains. It powers the blockchain economy by simplifying the process of deploying nodes and creating scalable enterprise blockchain solutions via APIs, high availability clusters, auto-decentralization and auto-healing of nodes.

Blockdaemon is backed by some of the biggest names in the venture capital space, including SoftBank Investment Advisors, CoinShares, Sapphire Ventures, Kenetic Capital, and Citi Ventures.

What Is Special About These Staking Yield Indices?

The CryptoCompare Blockdaemon Staking Yield Index Family is designed to measure the annualized daily staking yield generated by a particular PoS digital asset, allowing institutional investors to create total return and yield swap products, benchmark portfolios, conduct research, and more. The Index Family will initially feature five regulated indices that capture the annualized daily staking yield of the top-performing PoS digital assets: Avalanche ($AVAX), Cardano ($ADA), Cosmos ($ATOM), Polkadot ($DOT), and Solana ($SOL).

Charles Hayter, CEO and Co-Founder of CryptoCompare, had this to say:

“The CryptoCompare Blockdaemon Staking Yield Indices have created a new standard for digital asset investment products, overcoming the limitations faced by traditional indices, which do not capture any staking rewards, generated by the underlying cryptocurrency. These new innovative indices remove this hurdle, opening the door for new market participants while giving investors a vehicle by which they can easily gain exposure to the opportunities provided by staking.”

And Konstantin Richter, CEO and Founder of Blockdaemon, stated:

“These indices further exemplify our ability to deliver new and innovative institutional solutions using our proven, widely adopted staking infrastructure. By utilizing the CryptoCompare Blockdaemon Staking Yield Indices, pivotal real-time and historical data allows institutional investors and network participants to have access to crucial insights to make key performance-driven decisions.”

ETC Group, which is Europe’s leading specialist provider of institutional-grade digital asset-backed securities, was a key driver of the development of this suite of independent benchmarks, and it will be the first crypto ETP issuer to license the Staking Yield Index Family for a series of products planned for launch in Q4 2022.

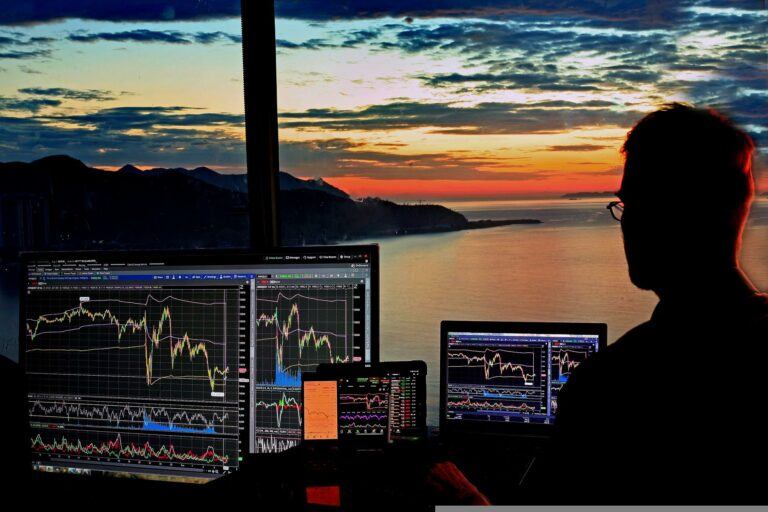

Image Credit

Featured Image via Pixabay