Last week, American news outlet TIME took a closer look at how Ethereum ($ETH) has performed as an asset since the Merge upgrade, which was completed on September 15.

As you probably already know, on September 15, Ethereum completed its Merge upgrade, which changed its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS).

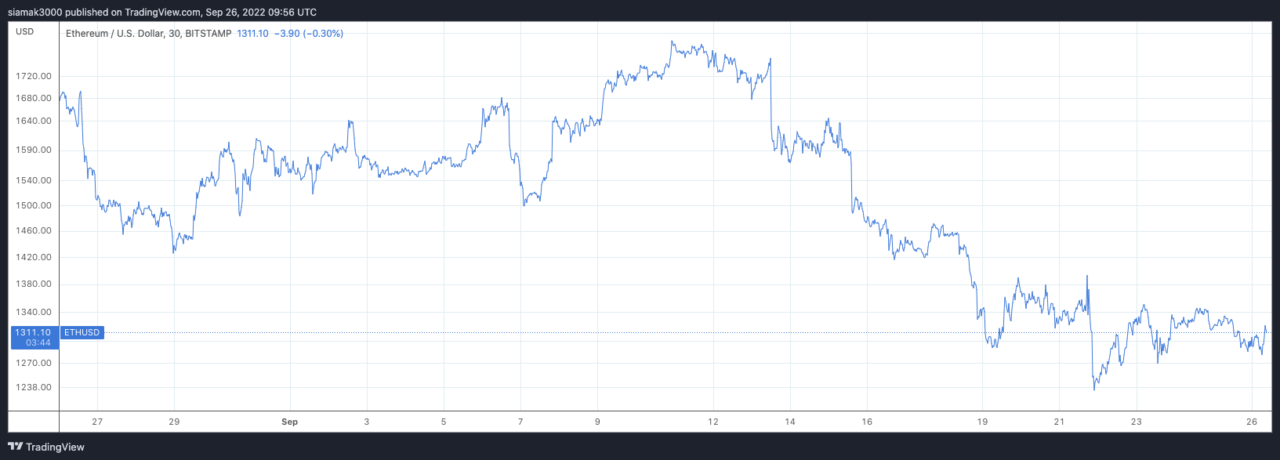

As you can see from the chart below by TradingView, on Bitstamp, $ETH was trading as high as $1,644 on Merge day (September 15), and on September 19, when the TIME article was published, $ETH’s intraday high was $1,376, which is a drop of 16.3% (vs USD). Currently (as of 10:05 a.m. UTC on September 26), $ETH is trading around $1,311.

On September 19, TIME published an article titled “Why Ethereum Is Dropping After the Merge”. Here is how the article explained the drop in the $ETH price:

- “The merge didn’t fix Ethereum’s high fees or congestion. Instead it merely laid the groundwork for further infrastructure that could solve its problems in the years to come. Anyone who hoped that Ethereum would look or run completely differently on Thursday would have been disappointed.“

- “While crypto was designed to hold value independent of the stock market, the two are still very much entwined. Over the last few years, tokens like Bitcoin and Ether have risen and fallen in correlation to larger market trends. This year, Ether prices have been depressed ever since the Federal Reserve announced its intention to institute a series of aggressive interest rate hikes in order to combat inflation.“

- “… last Thursday, SEC Chair Gary Gensler said that a token using Proof of Stake might contribute toward it passing the Howey Test… Given that Ethereum just switched to Proof of Stake, many investors on social media expressed concern that Ethereum might be Gensler’s next target.“

On September 15, Silicon Valley based venture capital firm Andreessen Horowitz (“a16z”), explained why “Ethereum is a far superior blockchain now than it was before.”

In a blog post published on Merge Day, Ali Yaha, a General Partner at a16z, called the Merge “an insane feat” since this upgrade “involved hot-swapping the most important component of Ethereum’s architecture – its consensus mechanism – *while it was running*.” Yaha noted that “all this occurred while maintaining perfect uptime for millions of users, thousands of decentralized applications (dapps), and hundreds of billions of dollars secured.”

Yaha then said that were some of the main advantges of Ethereum’s move to PoS consensus:

- “Post-Merge, Ethereum is now 100x+ more energy-efficient than it was before. Participating in consensus no longer expends the enormous amount of electricity that PoW does. After The Merge, energy usage of ETH will be comparable to the datacenters of web2.“

- “PoS has direct access to each validator’s “stake”, the funds, or skin-in-the-game, that validators deposit to secure the network. That allows PoS incentives to be far more granular, further increasing security.“

- “… anyone with 32 ETH can now participate as a validator on Ethereum.“

- “On a PoS blockchain, transactions that go through consensus are final… Transaction finality on Ethereum will lay the groundwork for future work that will improve Ethereum’s ability to scale (via “layer 2” solutions such as rollups), connect to other blockchains (via cross-chain bridges), and build better abstractions for developers that are easier to use and reason about.“

He also mentioned that the Merge is “a big deal” that “brings us closer to a world that benefits from an efficient and secure layer for decentralized computation that can support the applications we all want to build.”

Image Credit

Featured Image via Pixabay