A recent research report by crypto exchange Kraken highlighted the highly impressive growth in Cardano’s on-chain activity.

In February, Kraken Intelligence, the research arm of crypto exchange Kraken, released a 42-page research report titled “Cardano: A new generation in smart contract platform design”. After the introduction, the report examines Technology, Web3 Ecosystem, and Network Growth & Adoption.

Here are some key highlights from that report:

- “Cardano initially took on notoriety among a class of ICO-craze-driven projects in 2017 following the network’s launch. While the ICO-wave gained infamy from the number of overpriced assets that ultimately disappeared into crypto dust, Cardano finds itself among a subset of ICO Warriors that persisted the treacherous perils of a dark and quiet crypto winter — bloody, beaten, yet hungry for more.“

- “Importantly, Cardano is very much a value-driven project, emphasizing community governance, academic peer-review, and the importance of high assurance programming.“

- “Cardano’s values have noticeably directed the project’s developments and design decisions, and as a result, the blockchain looks like it has been designed with the purpose and standards of providing decentralized, global, financial infrastructure rather than only focusing on providing a Web experience.“

- “With ambitious goals, Cardano recognizes the necessity for their infrastructure to run correctly the first time it runs. This is in contrast to a ‘launch now, fix as we go’ philosophy employed by many Silicon Valley development teams.”

- “Ironically, despite the ‘Ethereum Killer’ label, Cardano is actually far more reminiscent of Bitcoin, particularly with respect to its tokenomics, consensus protocol, and accounting style.“

- “Cardano’s design is fundamentally unique among most of its peers particularly as its design closely reflects a PoS-based, smart contract-enabled version of Bitcoin, due to the design of its base protocol and accounting model, rather than an iteration on Ethereum.“

- “Key technical features that distinguish Cardano from its L1 peers are its base protocol Ouroboros and its secure delegator-friendly design, the Extended Unspent Transaction Output (EUTXO) accounting model, the project’s Haskell base, unique Layer-2 (L2) solutions, and community focus.“

- “… Cardano adopted Haskell in an effort to build a product with unmatched advantages in reliability and security and to position itself as a viable solution for institutional-grade, global financial infrastructure.“

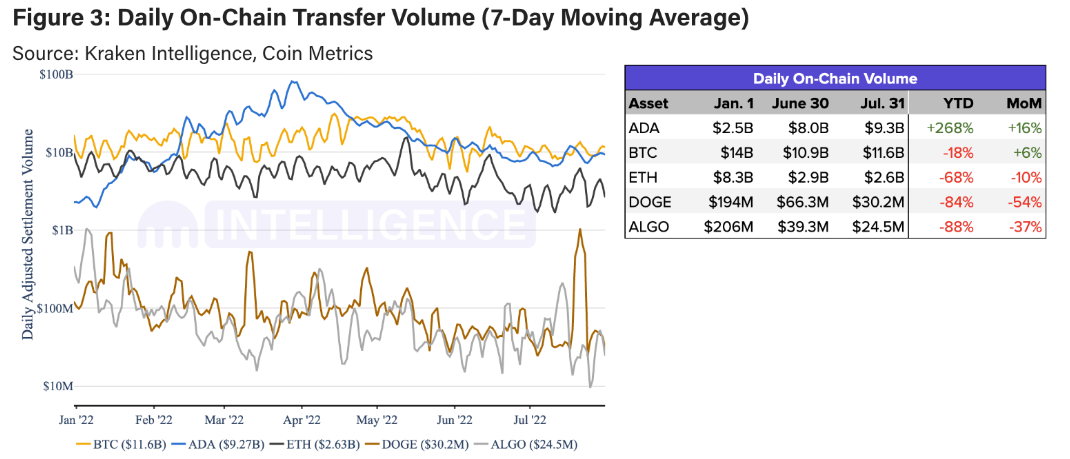

Well, recently, Kraken Intelligence published a research report titled “July 2022 crypto on-chain digest: All eyes on ETH”. From the point of the Cardano community, one of the most interesting sections of the report was the one that looked at the metric “Daily On-Chain Transfer Volume (7-Day Moving Average”).

The reported stated:

“ADA on-chain activity continued its tear in volume with a +268% rise YTD and +16% MoM. Though there is no single driver for the growth in ADA on-chain volume, several notable developments have occurred on the Cardano blockchain in recent months. Namely, the platform saw increased volume likely due to the launch of its first DeFi exchange SundaeSwap, its first metaverse gaming application Pavia.

“Developers increased the blockchain’s block size limit by 10%, Cardano’s ecosystem expanded to surpass over 1,000 projects last month, and expectations of an imminent hard fork likely contributed to ADA’s volume growth, to name a few other developments. However, the Vasil hard fork on ADA was initially slated for June but has since seen multi-week delays.“

Image Credit

Featured Image via Unsplash