On Monday (August 29), New Zealand based crypto analyst Lark Davis commented on Ethereum’s recent price action.

Around 8:29 a.m. UTC, when ETH-YSD was trading around $1,446 on Coinbase, Davis tweeted:

Meanwhile, South Korea based blockchain analytics startup CryptoQuant highlighted the bearish investor sentiment by pointing out that $ETH funding rates had reached a 14-month low.

Here is how CryptoQuant defines funding rates:

“Funding rates make the perpetual futures contract price close to the index price. It is made be closer to the spot prices and cover some of the gap generated by the perpetual period of time.All cryptocurrency derivatives exchanges use funding rates for perpetual contracts and the standard unit is a percentage.

“Funding Rate is a result of market behaviors and could be used to maker some interpretation in the derivative market which also is a dominant price maker in the market. However, correlating high funding rates with inevitable price drop could be a wrong interpretation. In the bull market, it have a tendency to naturally bring high funding rates with price rise.“

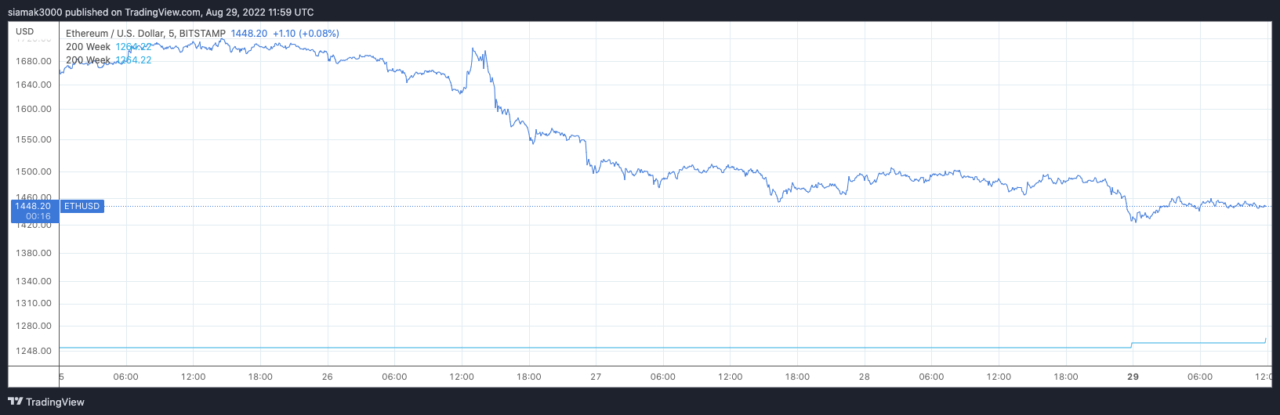

According to data by TradingView, on Bitstamp, ETH-USD is currently (as of 12:00 p.m. UTC on August 29), trading around $1,448, down 2.75% in the past 24-hour period.

On Sunday (August 28), Davis took to Twitter to highlights the followings about the Merge:

- “It will reduce Ethereum’s energy consumption by around 99.9%”

- “There will be a 90% reduction in annual creation of new Ethereum coins”

- “The fees are not going to go down immediately, likely not till late 2023.”

- “Ethereum will become deflationary thanks to its perpetual burn mechanism.”

- “The merge will mark about the halfway point towards the final version of Ethereum on the Ethereum roadmap.”

As for his final verdict on the Merge, he said “basically HODL and chill.”

In the August 2022 issue of Pantera’s monthly newsletter (which is called “Pantera Blockchain Letter”), Erik Lowe, Head Of Content at Pantera Capital, he first explained why Ethereum’s next major protocol upgrade is called the Merge and then went on to explain the effect of the Merge on $ETH issuance and supply:

“If you were wondering why the event is called ‘The Merge’, it is in reference to the ‘merging’ of the Ethereum Mainnet (execution layer) with the Beacon Chain (consensus layer) that has been running in parallel since December 2020. The Ethereum that facilitates our DeFi transactions today is the execution layer, which runs on Proof-of-Work. The Beacon Chain utilizes Proof-of-Stake. The merging of the two is when Ethereum transitions to Proof-of-Stake. So how does this relate to issuance and supply?

“Currently, the issuance of new Ethereum is about 14,600 ETH/day, which is the aggregate of 13,000 ETH from mining rewards on Mainnet and 1,600 ETH from staking rewards on the Beacon Chain. After ‘The Merge’, there will be no Proof-of-Work and thus no mining rewards, leaving just 1,600 ETH/day in staking rewards.

“A year ago, the London upgrade went live, which introduced a minimum fee (known as a base fee) for every transaction to be considered valid. That fee is then burned, resulting in approximately 1,600 ETH removed from the total supply each day based on an average gas price of 16 gwei, according to the Ethereum website. (A gwei is one-billionth of one ETH.)

“After ‘The Merge’, Ethereum’s issuance rate of 1,600 ETH/day in staking rewards minus the fees burned nets out to zero. Subtracting penalties incurred by validators (e.g. getting slashed for misbehaving) and ETH that is lost over time, this would make Ethereum issuance net negative. In the context of today’s inflationary environment, Ethereum’s shift towards a potentially deflationary asset is an exciting prospect.“

Image Credit

Featured Image via Pixabay