The cryptocurrency market’s recovery in July, which has seen the price of Bitcoin ($BTC) rise 18.4% and of Ethereum ($ETH) rise 64.7% respectively, has seen trading volume for the flagship cryptocurrency against BinanceUSD ($BUSD) explode upwards.

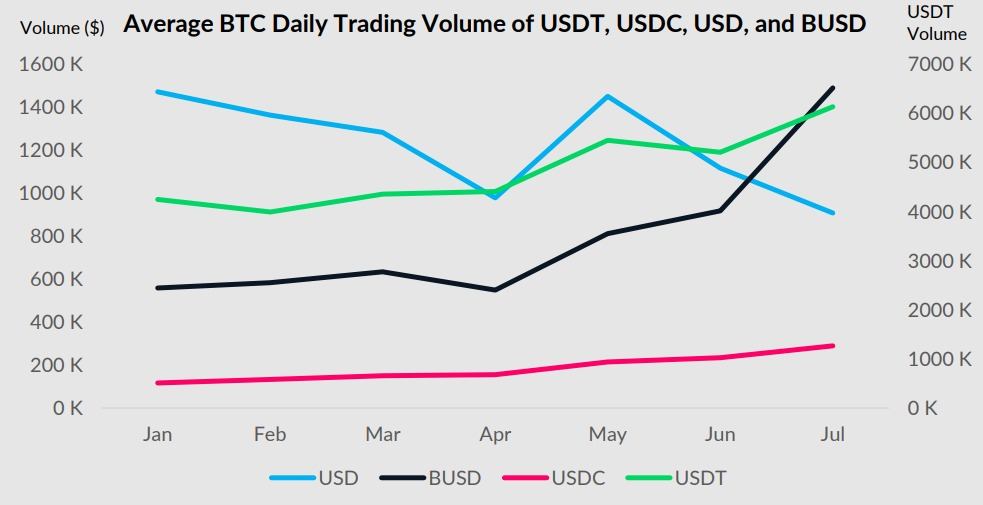

According to CryptoCompare’s July 2022 Exchange Review, the average daily volume of the BTC/BUSD pair rose 62.1% to 1.49 billion in July, surpassing the daily volume of the BTC/USD pair for the first time in history, with that pair seeing an 18.7% decline to $909 million a day.

BUSD, it’s worth noting, is a stablecoin backed by the New York State Department of Financial Services (NYDFS), with each BUSD being backed by one dollar held in traditional bank accounts. BUSD is available on a number of blockchains and has been launched in collaboration with Paxos and Binance.

The report details that other BTC stablecoin pairs also experienced an “increase in trading volume as the cryptocurrency markets rebounded in July after the distressing price action of the last couple of months.

It adds that the average daily volume for BTC/USDT and BTC/USDC rose 17.8% and 23.7% to $6.13 billion and $290 million respectively, while the volume for BTC/BUSD rose 67.8% to $46.2 billion, an all-time high for the pair. Year-to-date, the pair’s volume has grown 166%.

CryptoCompare’s report also details that spot trading volumes across centralized exchanges declined 1.34% to $1.39 trillion, the lowest trading volume since December 2020. Derivatives trading volume has, meanwhile, risen to 13.4% to $3.12 trillion.

The data means that the derivatives market “now represents 69.1% of the total crypto market (vs 66.1% in June).” In July, the largest cryptocurrency exchange by volume was Binance, and it was followed by the Atom Asset Exchange (AAX), which saw its volume rise 26.5% to $57.2 billion.

The report adds:

Binance, FTX, OKX and Coinbase have all recorded a decline in volume since the start of the year, falling 12.9%, 15.5%, 57.6% and 57.2% respectively. AAX is the only exchange in the top 15 that has seen its trading volumes grow since the start of the year.

As CryptoGlobe reported BlackRock, which is the world’s top asset management firm by total AUM, launched a new spot Bitcoin trust aimed at U.S. institutional clients. The move comes shortly after the firm partnered with Coinbase to “ create new access points for institutional crypto adoption by connecting Coinbase Prime and Aladdin.”

Apparently, Coinbase Prime will “provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.”

BlackRock’s new trust product, the “BlackRock Bitcoin Private Trust,” seeks to “rack the performance of bitcoin, less expenses and liabilities of the trust.”

Image Credit

Featured Image via Pixabay