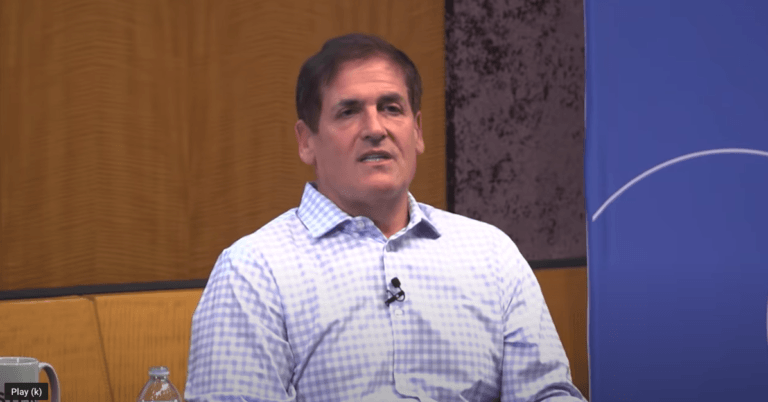

In a recent interview, billionaire investor and entrepreneur Mark Cuban criticized the U.S. Securities and Exchange Commission (SEC) for the way it deals with crypto.

Cuban is the majority owner of the professional basketball team Dallas Mavericks, as well as one of the “sharks” on the highly popular reality show “Shark Tank” (which is aired on the ABC television network).

Cuban’s comments were made during an interview (released on August 7) with “Altcoin Daily”.

The Shark Tank star said:

“The SEC is incredibly hypocritical. You know, they talk about trying to protect investors. You guys know what Pink Sheets are?… I just looked at this yesterday because two days ago because someone asked me. There are 16,750 Pink Sheet stocks… probably about [the same as] the number of tokens. There is no protection for anybody anywhere coming from the SEC, and that already falls under their purview.

“They’re supposed to be protecting you. There are funds — ETFs and others — that incorporate stocks from countries that have no SEC-like protections at all. They don’t care. You can still buy them and sell them. There are companies that are bought and sold on big exchanges that have no audit rights whatsoever. You don’t have any idea if the numbers are accurate.

“And so when the SEC comes in and says they want to protect investors from crypto, they’re not even doing their job with the area they’re supposed to do their job, and then you’ve got the issue of their approach to trying to figure it out. The SEC does this thing called ‘regulation through litigation’, meaning they don’t come out and say ‘here’s the rules that we want everybody to follow, give us your comments’. They do what they did with Coinbase. They sue. And they’ll sue you and their hope is that the result of the lawsuit then turns into precedent that they’re able to use to enforce the way they want to enforce it.

“It’s not like someone today could just call the SEC and say ‘OK, we want to issue a token… we have this crypto business, tell us what we need to do’… As a result, there’s all this uncertainty, which is why you’ve seen more crypto companies in Singapore, the Bahamas, and the British Virgin Islands, the Caymans, all these different places, and people are afraid to do anything here.

“And now you look at the big companies like Coinbase [that] create jobs, and they’re trying to do it right… they’re getting f***ed… There was — I forget — which politician that said we should do it through the CFTC instead of the SEC, and they’re right because the SEC they care more about hiring more lawyers than getting it done the right way.“