On Saturday (July 8), popular pseudonymous analyst and trader “Crypto Capo” (“@CryptoCapo_” on Twitter) explained why he believes that altcoins could fall another 45-50% from current price levels.

The “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

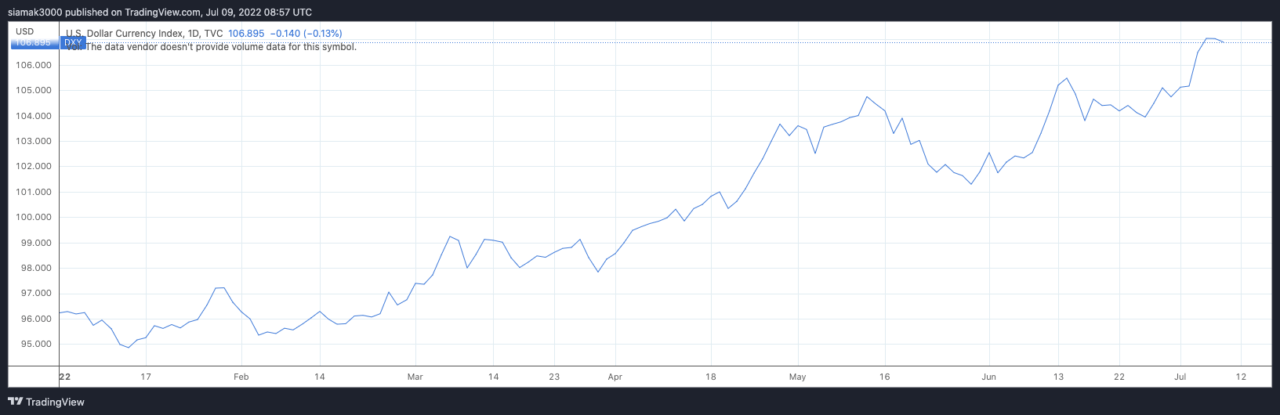

According to data from TradingView, the U.S. dollar index is currently (as of 8:57 a.m. UTC on July 9) around 106.89. And yesterday, DXY reached 107.77, which is the highest it has been this year. In fact, since the start of 2022, DXY has gone up 12%.

In contrast, since the beginning of the year, BTC-USD is down over 54%.

Anyway, on July 8, the crypto analyst told his over 436K followers on Twitter:

“DXY going parabolic. Bitcoin going up a bit and people getting euphoric and calling for 40k. Not a single bullish sign to support this move up and price is still at 21k-22k (resistance)…

“Rejection will be strong. Altcoins could drop 45-50%. There will be no mercy.“

However, two other crypto analysts disagreed with Crypto Capo’s comments about DXY pumping being bad for crypto.

Ran Neuner had this to say:

“Ser, I think you are not seeing this correctly. A strong DXY is the only thing that will bring down inflation. Strong DXY means lower energy and that means less aggressive FED. This is why growth stock and Bitcoin are pumping.“

And Miles Deutscher said:

“Although historically inversely correlated, the DXY pumping actually isn’t a bad thing given the current macro environment. Strong dollar = lower commodity/energy prices (as they’re denominated in $USD) > lower inflation > Increases likelihood of an *earlier* FED pivot.“

And later in the day, Crypto Capo explained why he is expecting the crypto market to reach new lows in the near future:

Image Credit

Featured Image by ‘WorldSpectrum‘ via Pixabay.com