Celsius Network’s withdrawal freeze earlier this month created an Ethereum ($ETH) arbitrage opportunity for patient traders, according to Cathie Wood’s Ark Investment Management, as staked Ethereum tokens started trading at a discount.

Ark analyst Frank Downing noted in a newsletter that the cryptocurrency lender generated yield through institutional lending, mining, and decentralized finance (DeFi) lending. Part of that yield, the analyst noted, is generated through Lido Finance’s staked ether token, stETH, which is backed 1:1 by Ethereum staked on the Beacon Chain.

Around 41% of Celsius’ DeFi deployments, were in stETH, while 30% were in Ethereum’s Proof-of-Stake deposit contract. The latter will remain illiquid until Ethereum transitions to a Proof-of-Stake consensus algorithm on the mainnet, a move that is expected to occur later this year. stETH can nevertheless be freely traded on the market, as the token allows ETH stakers to maintain liquidity.

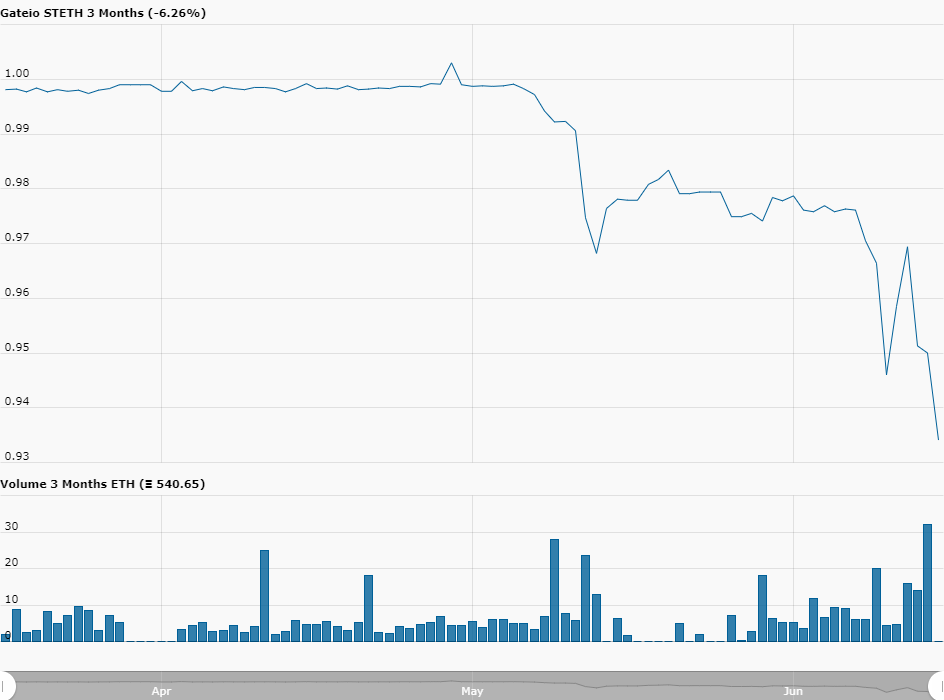

According to the analyst, as first reported by Benzinga, Celsius is likely moving stETH from its main wallet to wallets belonging to cryptocurrency exchange FTX to fund withdrawal demands from their customers. The move affected stETH’s price, which is now down to 0.934 ETH while being backed 1:1 by the cryptocurrency.

The analyst noted that the discount presents an arbitrage opportunity for patient investors willing to hold onto their stETH until withdrawals from Ethereum are available after the merge.

Per Downing, Celsius paused withdrawals in a bid to buy time to move out of its risky positions. Its move could lead to worsening market sentiment and further add downward pressure to cryptocurrency prices, which would lead to more regulatory scrutiny.

Speaking to the Financial Times Marcus Sotiriou, an analyst at GlobalBlock, noted that the stETH-ETH peg being broken “raises concerns that if clients try to redeem positions, Celsius will run out of liquid funds to pay them back.”

Sotiriou noted that the firm is “taking massive loans against their illiquid positions to pay out their customer redemptions” and as such could run out of funds in as little as five weeks.

In announcing the freeze, Celsius wrote it is “taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.” It added users will keep accruing rewards on their holdings.

There have been questions surrounding Celsius’ high yields and its exposure to Terra’s ecosystem ahead of its collapse, as well as questions surrounding its losses after the BadgerDAO hack.

Image Credit

Featured image via Unsplash