Analysts have noted that Bitcoin ($BTC) and other cryptocurrencies are currently undergoing a bear market of “historical proportions” that has seen the digital asset space endure the “largest capital outflow event in history.”

According to analysts from on-chain analytics firm Glassnode, the ongoing cryptocurrency bear market may be the worst one on record, as its analysis has found that after the crypto space’s total market capitalization dropped below the $1 trillion mark, Bitcoin’s price dropped below the 200-day simple moving average.

The indicator is “commonly used” to mark whether BTC is undergoing a bull or bear market, as prices remaining above its 200-day moving average show the cryptocurrency is undergoing a bull market, while prices below that moving average show it is in a bear market. The indicator is also used in Glassnode’s Mayer Multiple (MM), which analysis BTC’s price in a historical context.

Glassnode wrote:

For the first time in history, the 2021-22 cycle has recorded a lower MM value (0.487) than the previous cycle’s low (0.511). Only 84 out of 4160 trading days (2%) have recorded a closing MM value below 0.5.

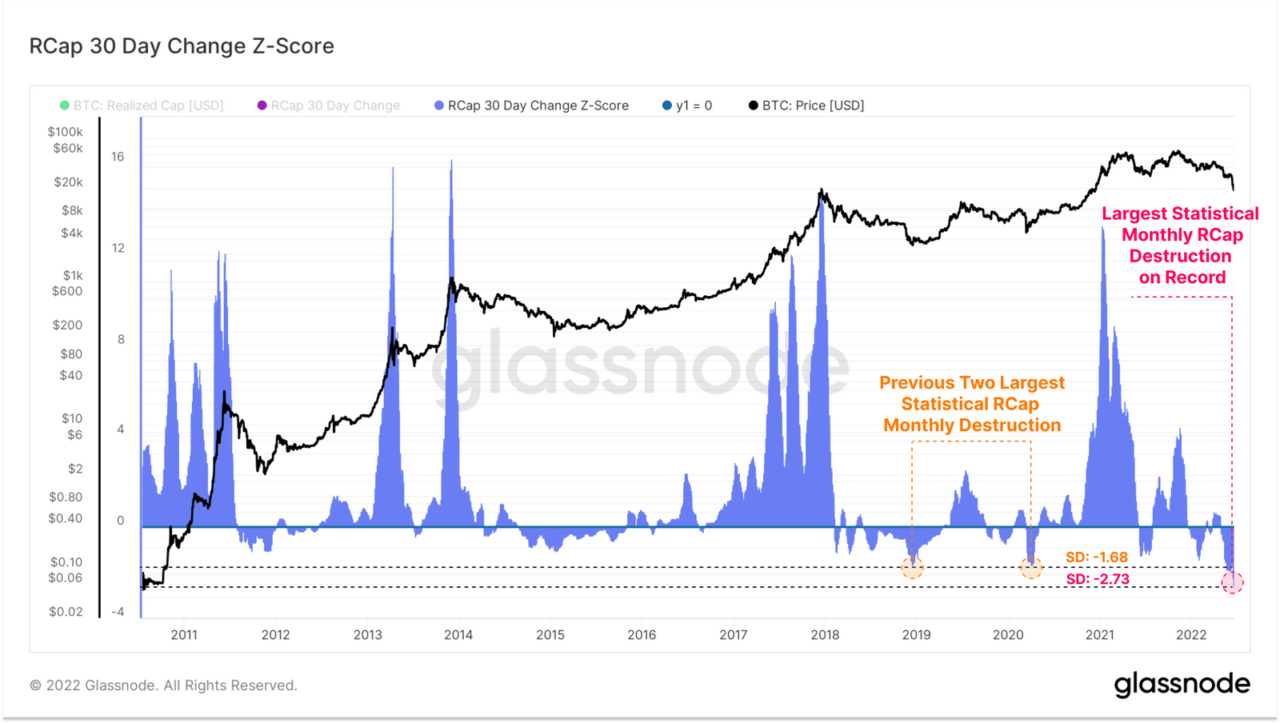

Glassnode also pointed to the 30-Day Position Change of the Realized Capitalization metric, which “is a variation of market capitalization which values each UTXO [unspent transaction output] based on the price when it was last moved” as it “allows us to view the relative monthly capital inflow/outflow into the BTC asset on a statistical basis.”

The firm added that using this measure “Bitcoin is currently experiencing the largest capital outflow event in history, hitting -2.73 standard deviations (SD) from the mean. This is one whole SD larger than the next largest events, occurring at the end of the 2018 Bear Market, and again in the March 2020 sell-off.”

Analysts at Glassnode have been researching the ongoing bear market deeply, and analyzed it in a video published earlier this month as first reported by Bitcoin.com, in which they noted that historically BTC’s price dropped over 80% during bear markets before hitting a bottom.. An 80% drawdown for the cryptocurrency from its $69,000 all-time high would be around $13,800.

The firm’s analysts added that as the BTC market matures and grows, the “magnitude of potential USD denominated losses (or profits) will naturally scale alongside network growth.”

Image Credit

Featured image via Unsplash