Microsoft Co-Founder Bill Gates, who is — according to Forbes — currently the world’s fourth richest person with an estimated fortune (as of 20 June 2022) of $121 billion, does not seem to be able to see the attraction of non-fungible tokens (NFTs), such as the very popular Bored Ape Yacht Club (BAYC), and he does not seem to have changed his opinion of cryptocurrencies.

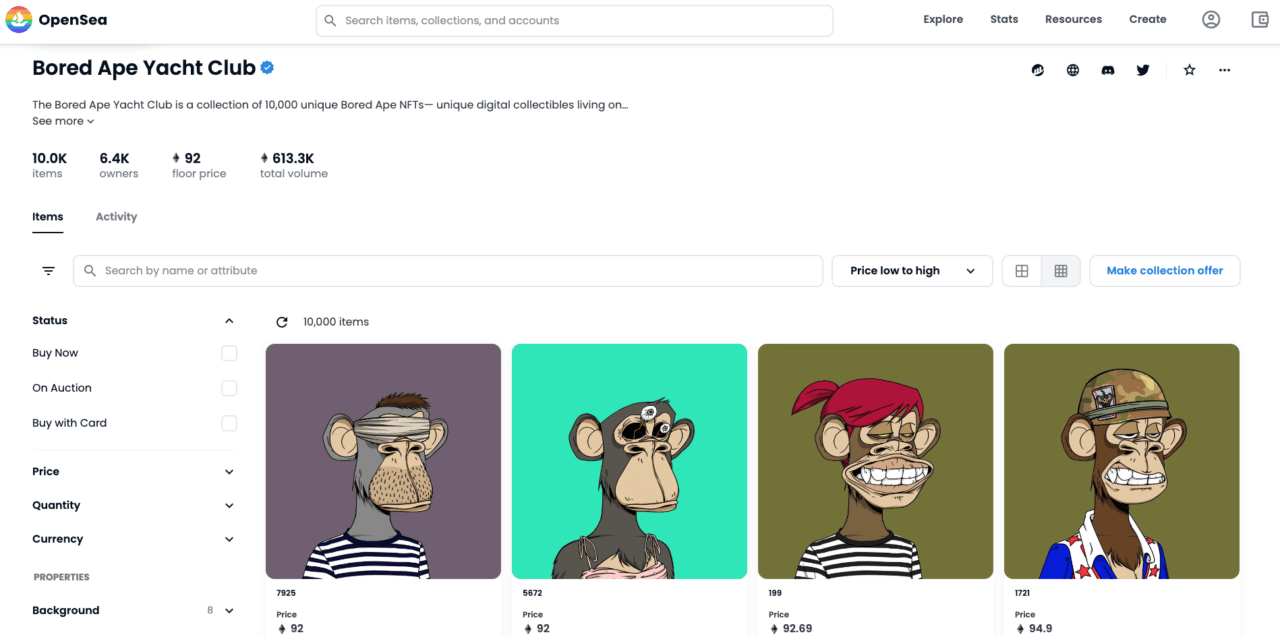

Here is how Yuga Labs, the team behind BAYC, describes this NFT collection:

“BAYC is a collection of 10,000 Bored Ape NFTs—unique digital collectibles living on the Ethereum blockchain. Your Bored Ape doubles as your Yacht Club membership card, and grants access to members-only benefits, the first of which is access to THE BATHROOM, a collaborative graffiti board. Future areas and perks can be unlocked by the community through roadmap activation...

“Each Bored Ape is unique and programmatically generated from over 170 possible traits, including expression, headwear, clothing, and more. All apes are dope, but some are rarer than others. The apes are stored as ERC-721 tokens on the Ethereum blockchain and hosted on IPFS. (See Record and Proof.) Purchasing an ape costs 0.08 ETH.“

According to a report by CNBC, Gates made his comments at a TechCrunch talk on climate change. Microsoft’s co-founder described crypto as being “100% based on greater fool theory.”

As Wikipedia explains, in finance, the Greater Fool Theory “suggests that one can sometimes make money through the purchase of overvalued assets — items with a purchase price drastically exceeding the intrinsic value — if those assets can later be resold at an even higher price.”

Gates also took a jab at the NFT market, saying sarcastically that “expensive digital images of monkeys,” would serve to “improve the world immensely.” His comments were in reference to the BAYC NFT collection, which has found a customer base among athletes, celebrities and other wealthy individuals.

Gates claimed he was more accustomed to dealing in markets that have tangible output.

He said,

I’m used to asset classes … like a farm where they have output, or like a company where they make products.

The billionaire also claimed that he was “not involved in [crypto],” and that he was not “long or short” on digital assets.