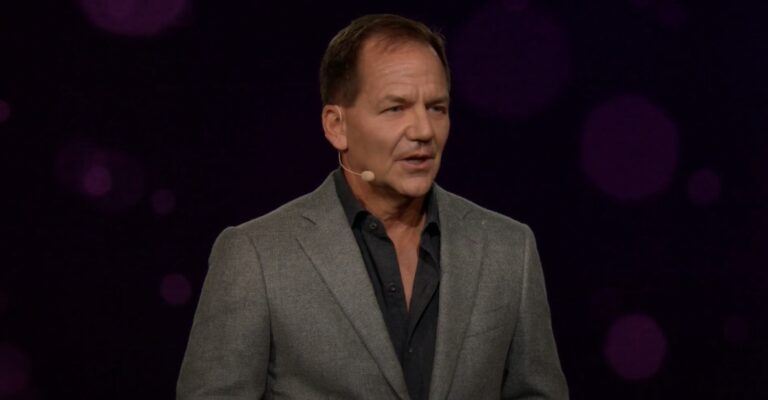

On Tuesday (May 3), legendary billionaire macro investor Paul Tudor Jones II (aka “PTJ”) talked about crypto during an interview with CNBC.

As you may remember, in May 2020, PTJ made some very bullish comments about Bitcoin (as an inflation hedge) in the investment letter (“Market Outlook — Macro Perspective”) sent out to clients of the $22 billion macro hedge fund “BVI Global Fund”, which is managed by his asset management firm Tudor Investment.

Bloomberg was the first to report (on 7 May 2020) that according to this investment letter, the offering memoranda for the Tudor BVI Global Fund had been updated to disclose that Tudor Investment Corporation “may trade Bitcoin futures” for the fund and that the “initial maximum exposure guideline for purchasing Bitcoin futures” had been set to “a low single digit exposure.”

PTJ made his most recent comments about U.S. inflation, the Fed’s upcoming rate hikes, and how he feels crypto vs other asset classes during an interview with Andrew Ross Sorkin on CNBC’s “Squawk Box”.

According to a report by The Daily Hodl, the billionaire investor had this to say about the Fed:

“I think this is one of the most challenging periods ahead for the Federal Reserve Board in its history. I don’t know if we’ve ever navigated something like this… we’ve just never seen anything like this since the ’70s. It’s really uncharted waters. I like to think of it as a cross-hatch ocean…“

And when Sorkin asked how PTJ is adjusting his portfolio, the reply was:

“It’s really hard.. You can’t think of a worse environment than where we are right now for financial assets… Clearly, you don’t want to own bonds and stocks. I think we’re in one of those very difficult periods where simple capital preservation is… the most important thing we can strive for… I don’t know if it’s going to be one of those periods where you’re actually trying to make money.“

As for crypto, PTJ said:

“It’s hard to not want to be long [on] crypto because of the intellectual capital, just the sheer amount that’s going into that space… It’s a borderless internet where all of a sudden you have blockchain as the verification code to allow anyone on the internet to instantly connect… and then that opens up huge possibilities… Clearly central banks and central governments are not going to necessarily be huge fans of that, particularly when it comes to using crypto as a means of exchange.“

And regarding his investing in and trading of cryptoassets, he said:

“I’ve got my modest allocation to crypto. I have a trading position on top of that goes from fully invested to zero. Right now I’m modestly invested and I would think that it’s going to have a bright future as we roll through these rate hikes. A lot of it depends on what our central bank does… and how serious we are about fighting inflation.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.