Recently, Jurrien Timmer, Director of Global Macro at Fidelity Investments, looked at various metrics to determine if Bitcoin is “attractively valued” at current price levels.

In March 2021 Timmer published a 12-page research paper on Bitcoin (title: “Understanding Bitcoin: Does bitcoin belong in asset allocation considerations?”).

Timmer started by saying that he intended his paper to serve as “a brief plain-English primer, but also to assess, in a meaningful way, the value proposition of bitcoin as it relates to asset allocation.”

After his study of Bitcoin, here were some of the conclusions he came to:

- “… bitcoin has gone mainstream, already considered a legitimate asset class by more and more investors.“

- “… bitcoin has both a compelling supply dynamic (S2F) and demand dynamic (Metcalfe’s Law).“

- “… bitcoin is gaining credibility, and as a digital analog of gold but with greater convexity… bitcoin will, over time, take more market share from gold.“

Timmer said that “if gold is now competitive with bonds, and bond yields are near zero (or negative), perhaps it makes sense to “to replace some of a portfolio’s nominal bond exposure with gold and assets that behave like gold.”

He finished by saying:

“If bitcoin is a legitimate store of value, is scarcer than gold, and comes complete with a potentially exponential demand dynamic, then is it now worth considering for inclusion in a portfolio (at some prudent level and at least alongside other alternatives, such as real estate, commodities, and certain index-linked securities)?

“Despite the many risks discussed—including such factors as volatility, competitors, and policy intervention for some the answer may well be ‘yes,’ at least insofar as that ‘yes’ applies only to components on the 40 side of 60/40. For those investors, the question of bitcoin may no longer be ‘whether’ but ‘how much?’.“

Well, on May 16, Timmer took to Twitter to determine how “attractively valued” Bitcoin is after the recent sell-off in the crypto market.

Timmer said:

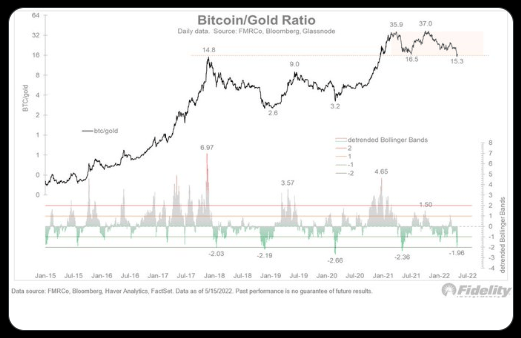

“First up is the bitcoin/gold ratio, which I see as a barometer for how this aspiring digital store of value is faring relative to that “original” store of value. The BTC/gold ratio is now resting on major support, in the form of the 2017 high as well as the 2021 low. At the same time, the detrended Bollinger Band shows that the ratio is now at 2 standard deviations below trend, which is a level that has contained the last 3 declines...

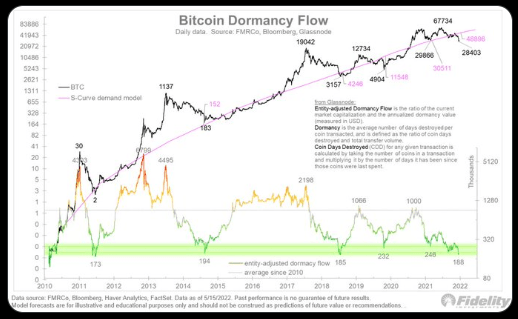

“Next up is the dormancy flow, which roughly speaking is a measure of strong vs weak hands. The entity-adjusted dormancy flow from Glassnode is now at the lowest level since the 2014 and 2018 lows.

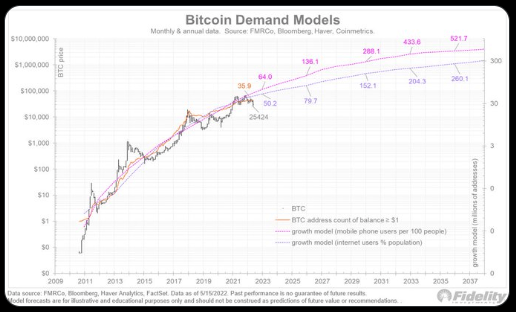

“Next up is valuation. With the current swoon to $25k, Bitcoin is now below the price currently suggested by both my mobile phone-based S-curve model and the more conservative internet adoption model.“

He went on to look at two other of is “favorite metrics” before concluding:

“All of the above tells me that Bitcoin is not only at solid support but also attractively valued. The one caveat is that the Bitcoin sensitive equities need to confirm any recovery for Bitcoin.“

To make sure you receive a FREE weekly newsletter that features highlights from our most popular stories, click here.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

Image Credit

Featured Image by “SnapLaunch” via Pixabay.com